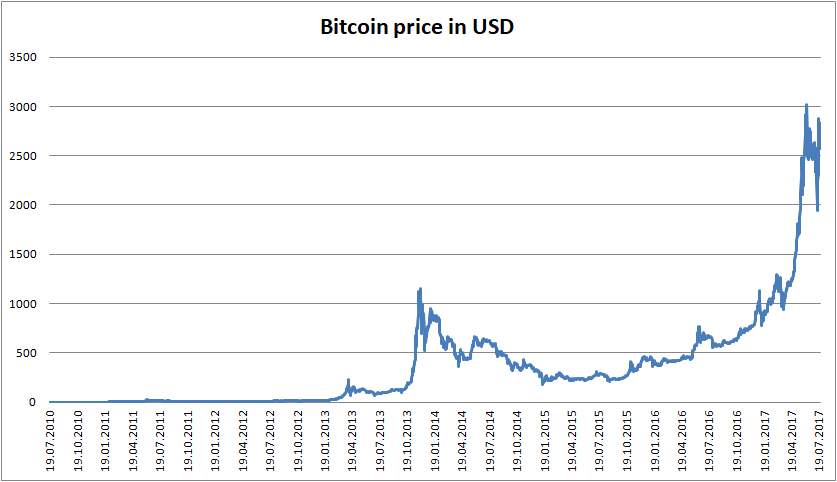

Friends of mine ask me why I don't trade the Bitcoin and other cryptocurrencies. Finally, it does not matter what to trade as long as one can make a return. The reason is that indeed I hardly can, since:

1. Contrary to [German] stocks, I don't have such a deep knowledge of cryptocurrencies.

2. Enormous volatility of Bitcoin makes the re-investment of winnings virtually impossible, so one can achieve only linear, not an exponential growth by active trading.

3. I have a strong allergy when something clearly resembles a tulipmania or a Ponzi scheme.

4. Theoretically a blockchain cannot be forged but in practice there are implementation bugs. And technical limitations (which recently might have caused the split of Bitcoin in two currencies).

As to the first issue, one might say it is my personal problem. In a sense yes, whereas I do know what a blockchain is and even read the original paper by Satoshi Nakamoto. The problem is that, besides rarity, I see no value behind Bitcoin (do you see any?). But even the rarity is questionable: more and more cryptocurrencies are introduced to the market and (temporarily) get some (non-negligible) dollar value. This process can continue only as long as there is a continuous dollar inflow. A Ponzi scheme?!

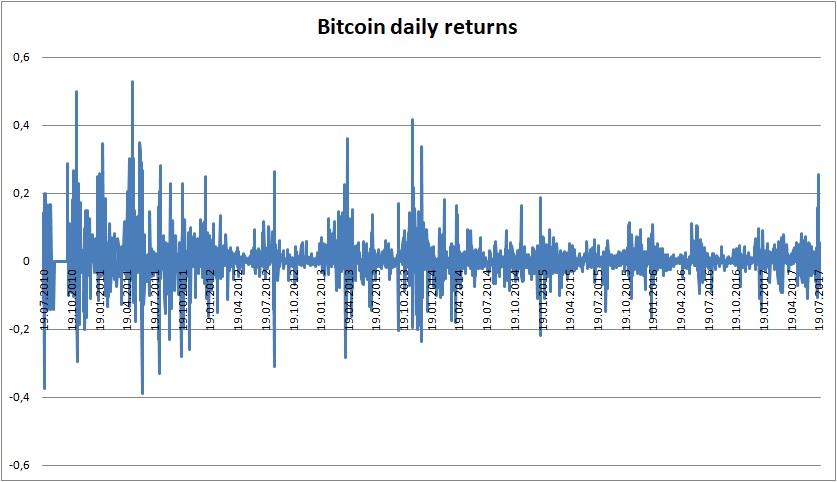

Another issue is the enormous volatility. As you readily see, the returns of and even

are not uncommon. But recall, if an asset fell by -20%, it has to grow by +25% in order just to recover the loss. Indeed:

. And if an asset fell by -50% it needs to grow by +100% in order to recover!

For a gambler it does not matter much, all he need is positive expectation. But gambling a fixed stake (i.e. without the reinvestment of winnings) one can achieve only a linear growth. Not interesting in the long term, if the exponential growth is achievable. However, the exponential growth means the re-investment of winnings. And the volatility (recall that for -20% we need +25% and for -50% we need +100%) will kill our re-investment!!!

Well, to tell the whole truth: we can (and should) re-adjust our investment dynamically, partially selling if we got profit and adding a position if the asset drops. Your may read more about it in my paper on Kelly criterion. The problem is, however, how to estimate the parameters. Whereas the estimation of the historical volatility is more or less reliable, the historical mean return is not very meaningful, since the past demand and supply of the Bitcoin is not representative for the future.

Last but not least, cryptocurrencies are glorified to be safe.

Well:

1. Hackers Stole $32 Million in Ethereum; 3rd Heist in 20 Days

2. Note claiming to be from cryptocurrency hacker says stolen $53 million is legally his

And there are not only risks of hacking. E.g. Bitcoin has so far averted a split in two currencies but imagine what would happen if not!

FinViz - an advanced stock screener (both for technical and fundamental traders)