Recently we made an ex-post analysis of our ETF screening efficiency and detected the price data inconsistency for 4 of 21 ETFs in question. Having a closer look at these ETFs, we explain the causes of inconsistency and emphasize that your trading strategy is only as good as your data (quality controls) are!

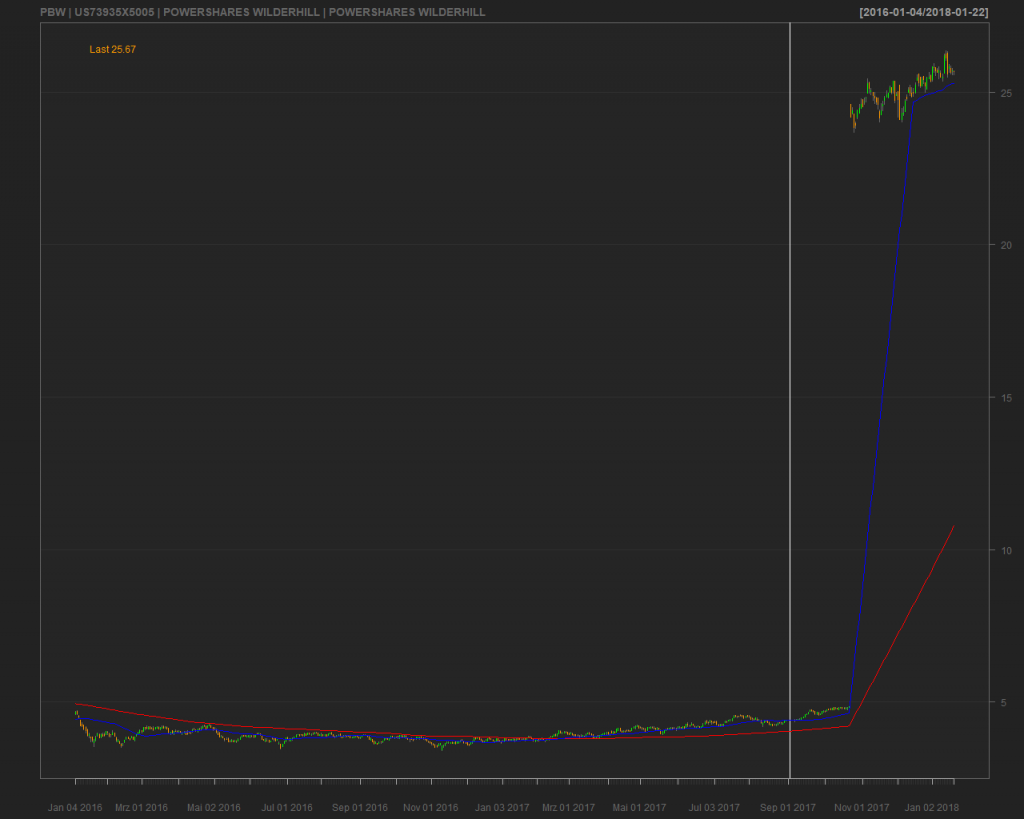

In our recent study we found out that the recent prices of (IBB - US4642875565 - ISHARES NASDAQ BIOTECH), (PBW - US73935X5005 - POWERSHARES WILDERHILL), (QLD - US74347R2067 - PROSHARES ULTRA QQQ and UNG) - (US9123182019 - UNITED STATES NATURAL GAS FUND LP UNIT) looked highly implausible.

|

|

|

|

Since our investment decisions highly depend on the price data (quality), we have a closer look at these ETFs and ETCs.

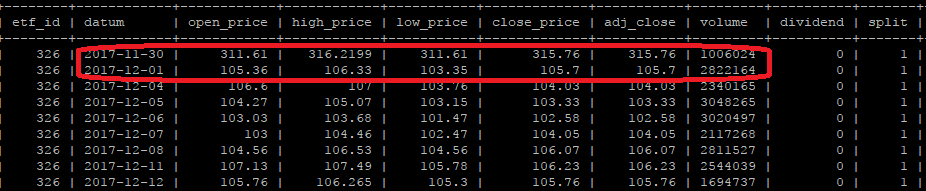

As to QLD and IBB, in our experienced eyes it looks like splits. Querying our price database for IBB, we get  and readily see where the problem occurs.

and readily see where the problem occurs.

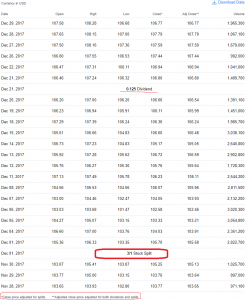

Note that the column split is set to 1 everywhere. The data came from AlphaVantage, so let us have a look at alternative data source, e.g. at yahoo finance

We readily see the information about 3/1 stock split, which is missing in our snapshot of Alpha Vantage data. BTW, the dividend information for Dec 21, 2017 is also missing.

Fortunately, as we queried Alpha Vantage today for IBB, we were able to see the information both on splits and dividends.

Note that Yahoo adjust the prices retroactively,

which means that if you locally store the data from yahoo finance, it is pretty difficult to consistently update your database; rather it might be easier and more reliable to erase your snapshot (make a backup first, of course) and fetch the new data from Yahoo.

Contrary, the update in case of AlphaVantage is easy: just correct the info on dividends and splits and calculate the adjusted prices backwards.

This means that these data came to alpha vantage with a lag, which creates a certain challenge. Before we just sent the data requests twice a day to Alpha Vantage in order not to abuse their generosity and not to overload their servers. Now we have to introduce additional requests that will compare the stored data with retroactive updates by Alpha Vantage. Note that it would be a bad idea just to overwrite the old values in our database with updated values from the data provider. Rather we need to introduce an additional table in database to store the reconciliation information. Moreover, we actually should distinguish with which data snapshot our scrutinizes were done (well, for our purposes it would likely be a bit overfastidious but e.g. for reporting by financial institutions it is a must). Additionally, we need to introduce a statistical data quality control; a kind of Artificial Intelligence, if you prefer a buzzword :). This is a big but very interesting challenge and we will keep you posted on the progress.

Getting back to our ETFs: in case of QLD there is indeed a 2/1 split on 2017-07-17 (and also on 2015-05-20 and 2012-05-11, which we didn't notice before.) And for UNG there is a 1/4 reverse split (or better to say a merge) on Jan 05, 2018. Finally, PBW shares were merged 5 to 1 on Oct 23, 2017.

P.S. In Germany, besides splits and dividends, a so-called Bezugsrechte-Emission (pre-emption rights) occasionally takes places. Such warrant is like a call option, which is generated by an old stock (but then detached from it and is traded separately). It gives a right to buy a newly-issued stock at fixed price. The lifetime of such warrants is normally very short and it is a really big challenge to adjust historical prices for them.

Fortunately, the issue of pre-emption rights is really a rare case and hardly relevant for ETFs.

FinViz - an advanced stock screener (both for technical and fundamental traders)