Elle, a 8-years old girl, who learns to manage her wealth, got started to trade more and more intensively. During the current market turbulence it actually makes sense. This time we speculate with an oil-ETC and learn the nuances of commodity trading.

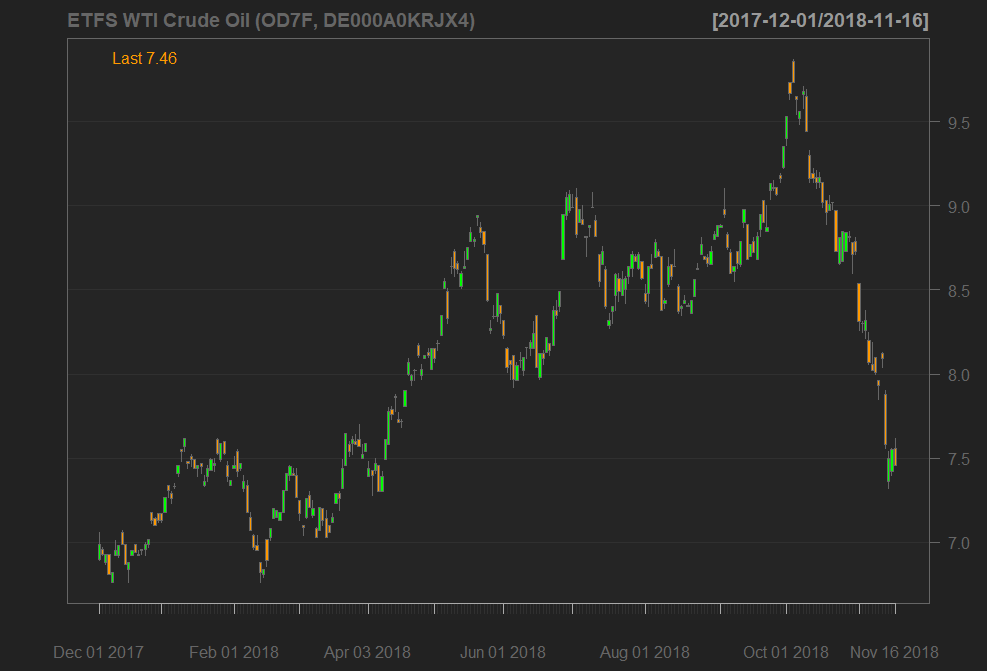

Elle, a 8-years old girl, gets €100 each months and usually invest this money in one of DeGIRO ETFs that may be traded once per month free of charge. Normally she buys stock ETFs and sometimes precious metals ETCs. But this time we recommended her to buy ETFS WTI Crude Oil (OD7F, DE000A0KRJX4) since we see a good chance (although the risks are also high).

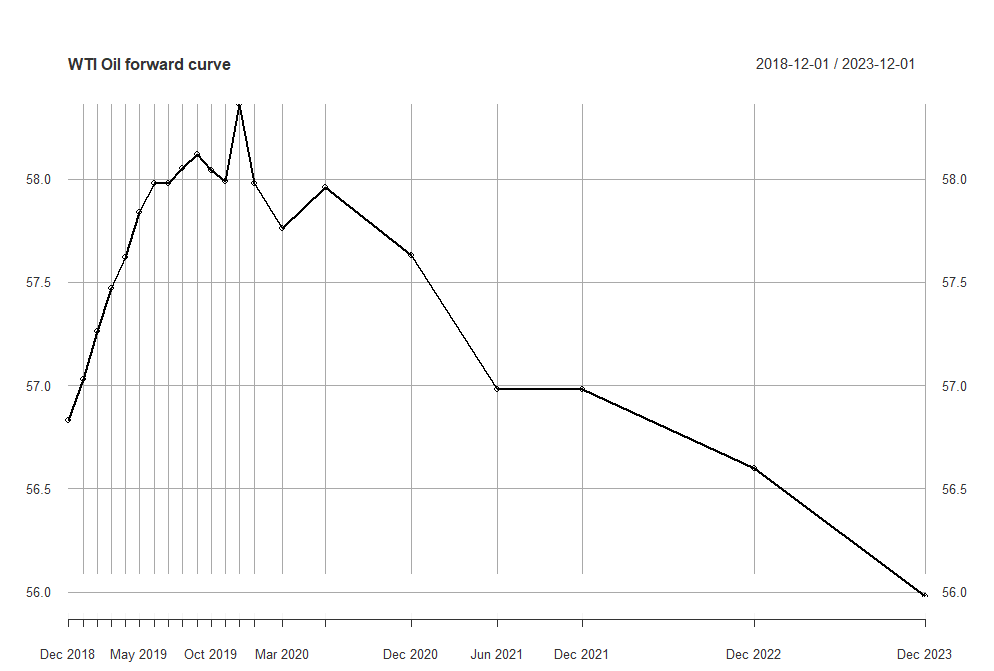

You might ask why WTI and not Brent? The answer is straightforward: Brent price is ca. $10 higher and we hold this spread for an anomaly (in spite of the fact that suchlike high spreads sustain on the market for several quarters).

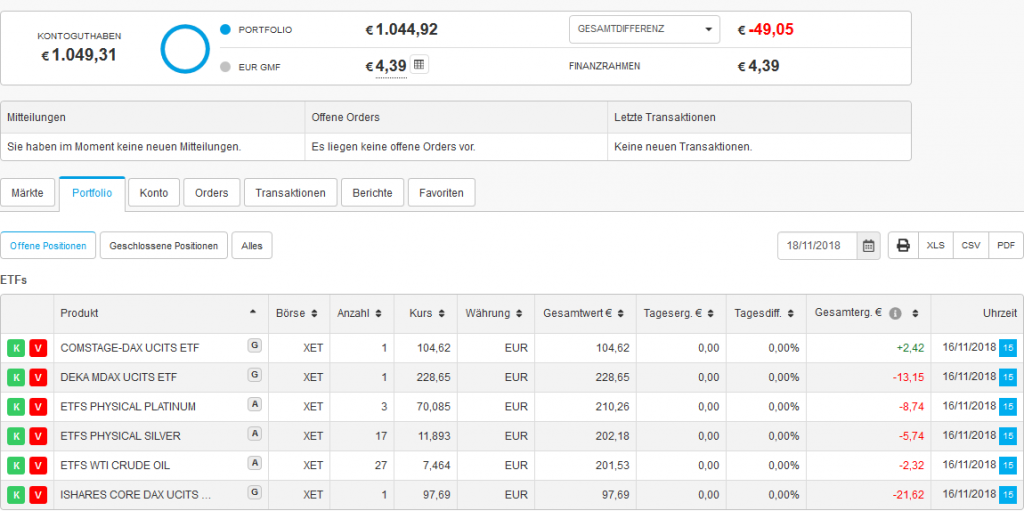

This time she has a first bought a DAX ETF (COMSTAGE-DAX UCITS ETF, LU0378438732) and it was nearly a perfect timing, at least in short term.

But as the oil has recently encountered a record fall, we patiently awaited some price stabilization and then decided to purchase it. In order to do this, we needed cash and had to partially sell another DAX ETF: ISHS CORE DAX UCITS ETF (EXS1, DE0005933931).

We warned Elle that she will have to bear the rollover costs. However, the current contango in the short end at not so strong. Moreover, since there is a backwordation at the long end, we somehow have an intuition that the curve soon becomes monotonically decreasing (there is now economic justification behind this intuition, the deep neural net in my brain, trained on daily observation of oil forward curves simply tells me this :)). In this case the rolls of monthly futures will be even profitable for us!

Anyway, the lesson we would like to teach Elle is that it may make sense to actively trade when Mr. Market moved so significantly. But such trading is risky: although we have already learned not to catch a falling knife, we are also aware that the oil price - as it reaches the bottom - can start to drill 🙂

Our current portfolio snapshot looks as follows, stay tuned!

FinViz - an advanced stock screener (both for technical and fundamental traders)