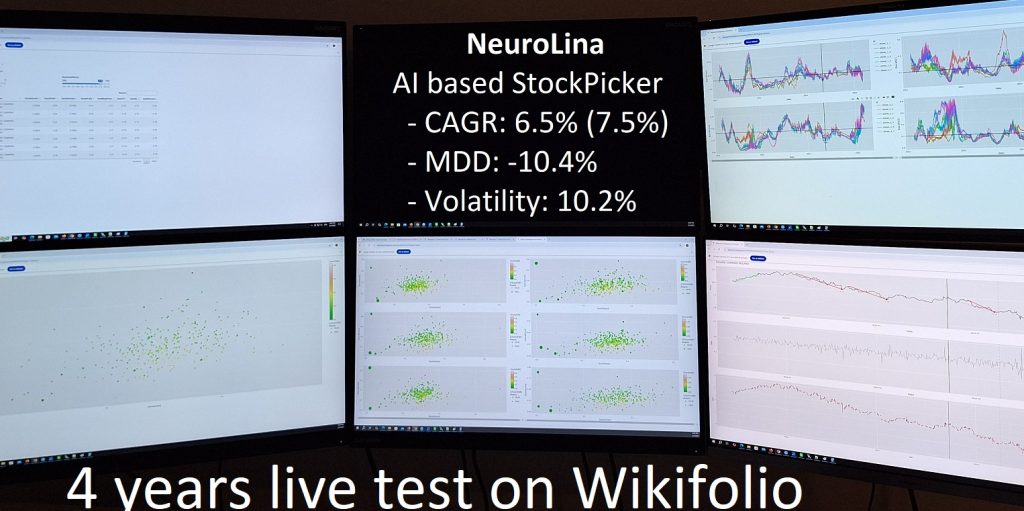

After 4 years of a live test of my AI-based stock picker Neurolina on a 3rd party service I publish (and close) NeuroLina Wikifolio and summarize the performance.

NeuroLina is an AI based stock picker assistant, developed by me, Vasily Nekrasov. NeuroLina is enriched with a multiscreen interactive visual cockpit. It may be used in fully automatic mode but actually intended to assist (rather than to replace) a human portfolio manager.

You can have a look at a (two-years old) pitch presentation. However, a presentation can promise virtually everything but only performance counts.

Well, there is the complete trade and account history for the 4 years live test on Wikifolio (a third party social trading service). You can download it here or directly by Wikifolio (registration required).

In theory, NeuroLina works with single stocks (from EuroStoxx600 and RUSSELL1000) and can go both long and short. But Wikifolio does not allow any short selling. Thus, when I got a lot of short-selling signals for many stocks, I just engages the DBPD (2x inverse DAX ETF).

Why inverse DAX and not an inverse Euro Stoxx 600? Well, because (to my knowledge) there is no (known to me) liquid inverse EuroStoxx600 ETF on Wikifolio. I also tried to use the PUT Optionsscheins (Optionshein is a mangy analog of an option) but their bid-ask spreads are simply too high.

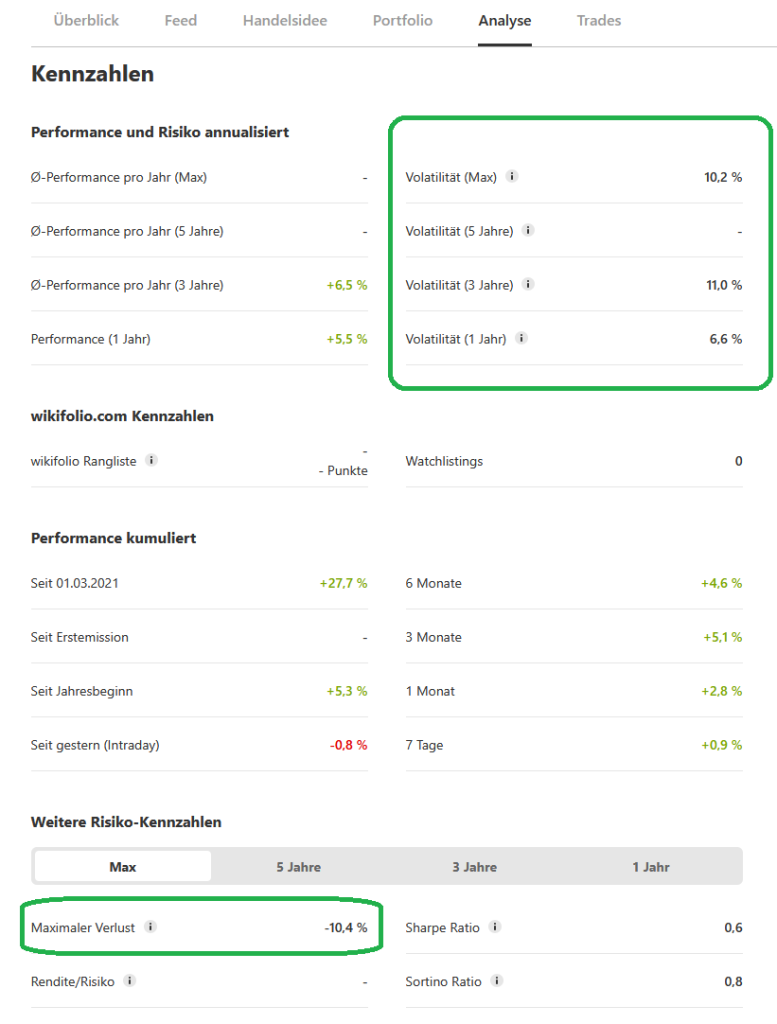

The CAGR was 6.5% (), whereas both volatility and the maximal drawdown were about 10%. This is not conform to my personal risk preference and the pitch presi (in which I assume 10% of annual return by the 20% of MDD) but the risk and performance reduction was fully deliberate, since I have tried to sell the NeuroLina to a risk-averse institutional investor.

Moreover, as you can check by means of the historical data, the cash-quote rarely fell below 33%, so the annual return can be scaled to 10% (virtually) without any leverage!

And last but not least note, that the Wikifolio takes 1% fee each year (0.95% management fee + 5% performance fee, to be precise), so the genuine return is 7.5% p.a. (and maybe even higher, since the bid-ask spread for American stocks is often VERY high on Wikifolio).

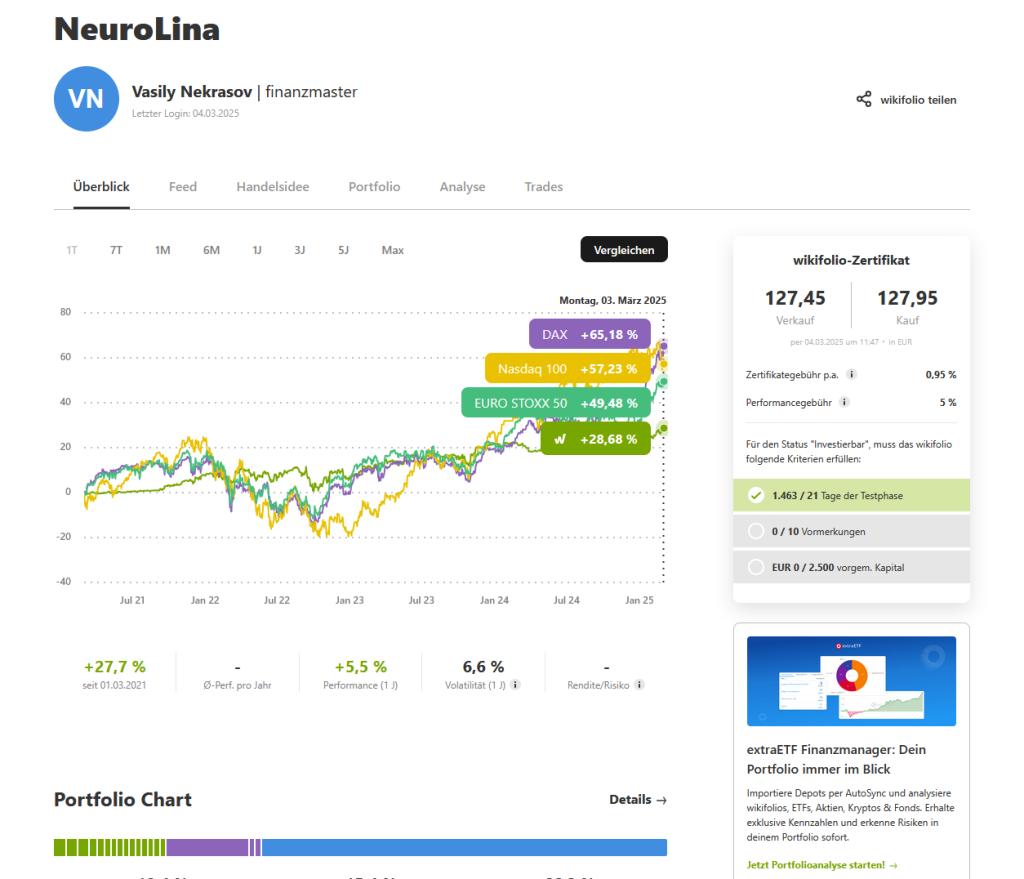

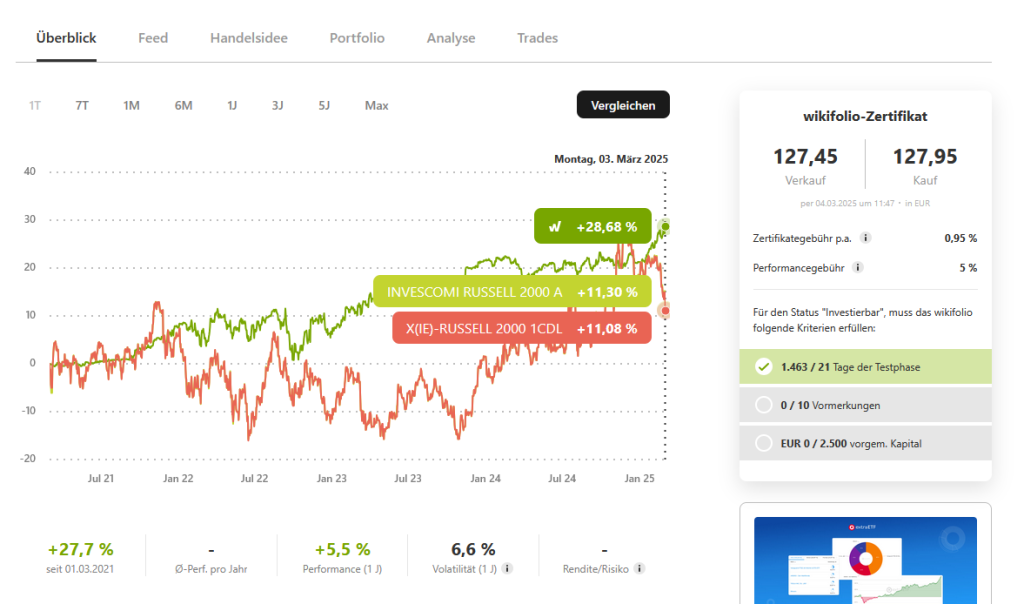

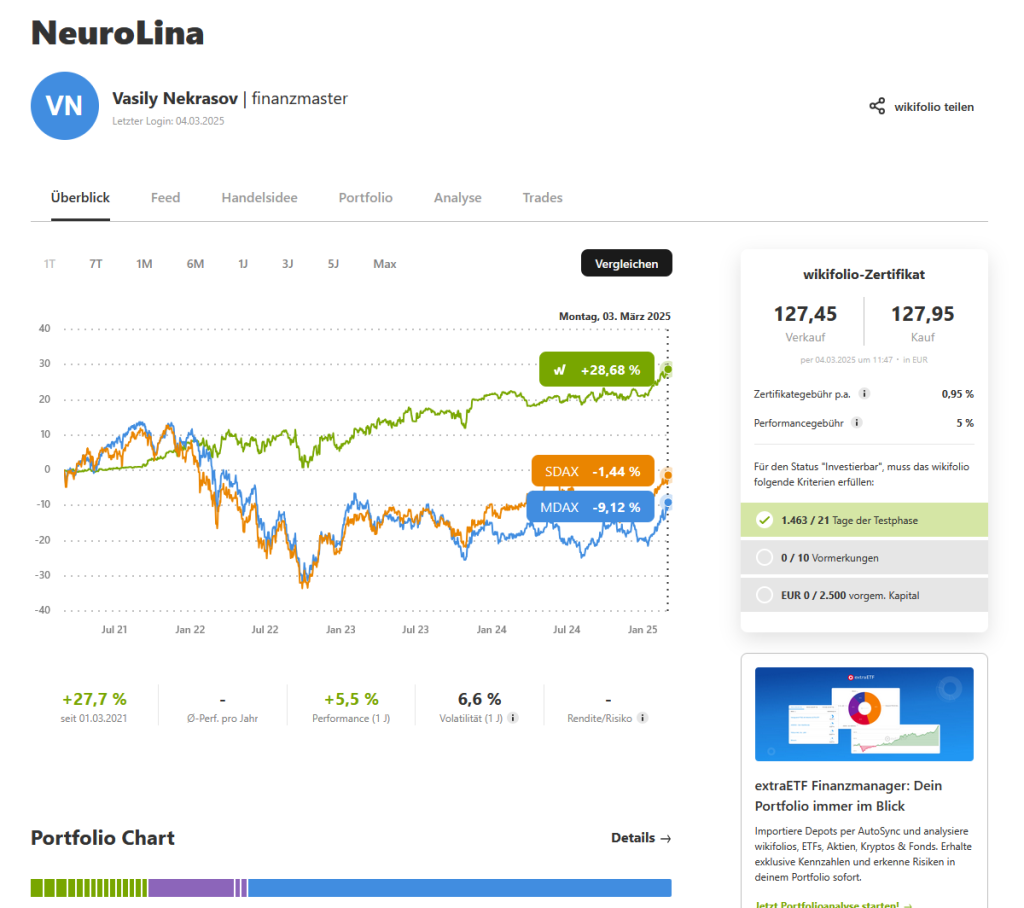

Below, there are some screenshots with respective benchmarks. As you can readily see, the NeuroLina has beaten the small caps both in the sense of return and risk and lost to the big caps in the sense of return (but not in the sense of risk-adjusted return)!

Note, that Wikifolio does not provide (an ETF on) RUSSELL1000 as a benchmark!

FinViz - an advanced stock screener (both for technical and fundamental traders)