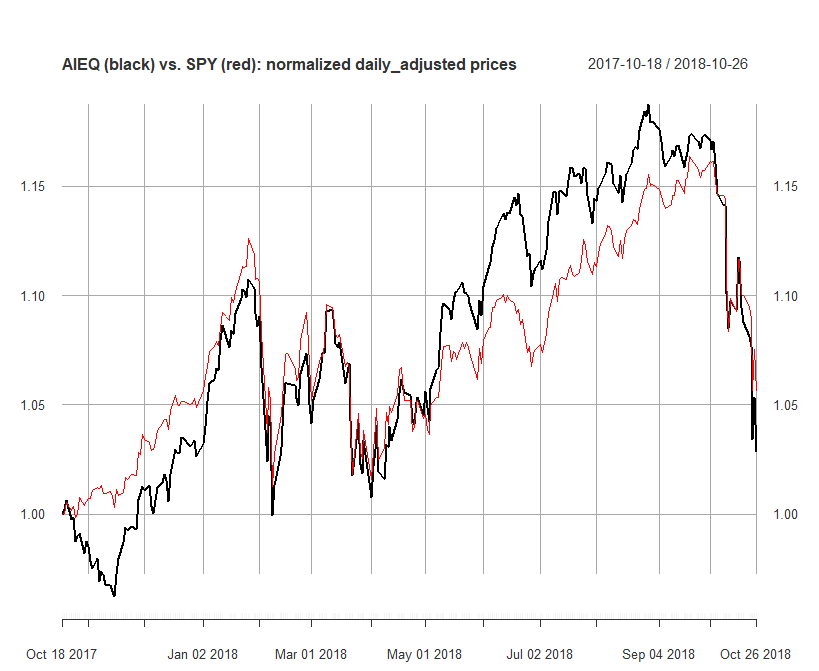

A year ago the Business Insider reported about the "the stocks market's robot revolution". Whereas the title was crying, a summary was more reserved: The fund has outperformed the S&P 500 so far, but a much longer trading period is needed to assess whether it can truly offer market-beating returns. I scheduled in my calendar to have a look at this fund in a year, telling a colleague, who pointed me on AIEQ that I would bet a bottle of whisky (bot not a farm!) that this ETF will perform worse than its benchmark. I turned out to be right.

Continue reading "AIEQ the AI Powered Equity ETF: Artificial Intelligence is Still Losing to a Natural Stupidity"

Continue reading "AIEQ the AI Powered Equity ETF: Artificial Intelligence is Still Losing to a Natural Stupidity"

Month: October 2018

Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?

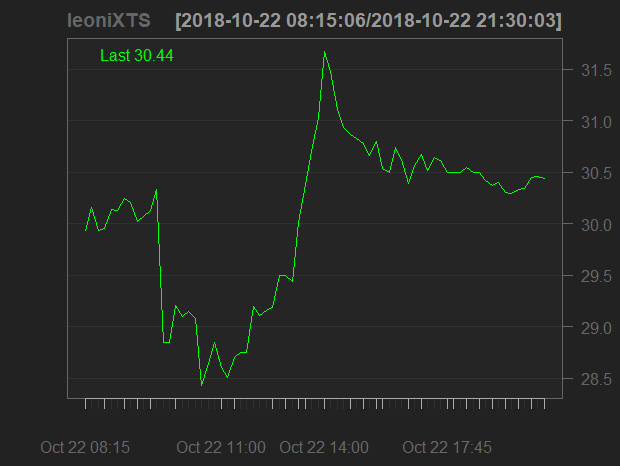

Leoni AG is a German company, specializing in production of high-quality cables for cars. Its shares are traded in sDAX (index of the best German smallcaps). From the beginning of the year Leoni's stock has lost more than 50%. Today, as Leoni has issued a profit warning, its stocks first fell about -6% but then quickly turned around to +5%, ending up by +1.5%. It may mean that the market is tired of the negative news. And even if not yet, German automotive is already fundamentally cheap. Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

JuniorDepot10 – Speculating Gold and Getting Benefits of Diversification

This time Elle, a 7-year old girl, first bought a physical gold ETC but then quickly sold it and bought an ETF on DAX. Concretely this trade was a bit premature but the portfolio diversification (in particular by means of precious metals) still brought benefits. Continue reading "JuniorDepot10 – Speculating Gold and Getting Benefits of Diversification"

Tom and Gerry 3: a dead mouse bounce?

Whereas Tom Tailor continues to decline, Gerry Weber has recently bounced +40% as the founder Gerhard Weber resigned from CEO position. Yet we bought Tom Tailor stock, although we usually do not trade against a strong trend. We explain why it was plausible to make an exception this time. Continue reading "Tom and Gerry 3: a dead mouse bounce?"

The Highest Volatility in October? Don’t trust a Superficial Statistics!

A recent post "Fasten your seat belt for stocks: October is almost here" on MarketWatch, repeated by Morningstar and shared in my social networks may make an illusion that it is likely to expect high(est) volatility in October. A little bit more detailed statistical analysis shows that such expectation is superficial.

A more general (and very old) lesson from this case: the statistical analysis is much more than a primitive consideration of the mean values in groups. And of course: don't trust provoking titles.  Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

Коммуникация с клиентами ДУ – на примере диалога с квалифицированной клиенткой

В доверительном управлении капиталом (wealth management, Vermögensverwaltung) решающее значение имеет, конечно, же доходность (адекватно соотнесенная с риском). Но коммуникация тоже очень важна. Поэтому особенное удовольствие мне доставляет работать с клиентами, которые сами неплохо разбираются в финансовых рынках. Более того, такие клиенты обычно более терпеливы в периоды просадок, кои бывают у всех. Continue reading "Коммуникация с клиентами ДУ – на примере диалога с квалифицированной клиенткой"