ggplot2 and plotly are very advanced charting libraries but sometimes it may be preferable to use base graphics, e.g. if one needs to fine-tune the chart layout.

A [not so] well-known R package DescTools draws nice ohlc plots and allows parsing arguments to plot() command. Continue reading "CandleStick Plots with R base graphics (withOUT ggplot2 and plotly)"

Author: letYourMoneyGrow.com

Setting up Python-Env – mamba [b]eats conda

Mamba aka Miniforge was a package for (and now a spin-off of) Anaconda, intended for a faster environment resolution. In general mamba is [currently] more efficient than conda, esp. if you rely on conda-forge, a community-led anaconda channel Continue reading "Setting up Python-Env – mamba eats conda"

Howto Setup SoS Jupyter in Conda – R4 and Python38 with Tensorflow and Spyder

Anaconda is a very practical tool to manage the virtual environments... when it properly works. In theory, a desired configuration shall be setup seamlessly. In practice Conda may need hours to resolve the configuration and finally do it wrong. In this manual I explain how to setup a SoS Jupyter Notebook with R4 and Python38 with a TensorFlow and Spyder. This worked on 01.01.2024 Continue reading "Howto Setup SoS Jupyter in Conda – R4 and Python38 with Tensorflow and Spyder"

Bye-bye Software AG and BBBY

Today - on 24.04.2023 - Software AG stock jumped +50% due to a takeover offer from private equity firm Silver Lake, whereas Bed Bath & Beyond filed for bankruptcy. Continue reading "Bye-bye Software AG and BBBY"

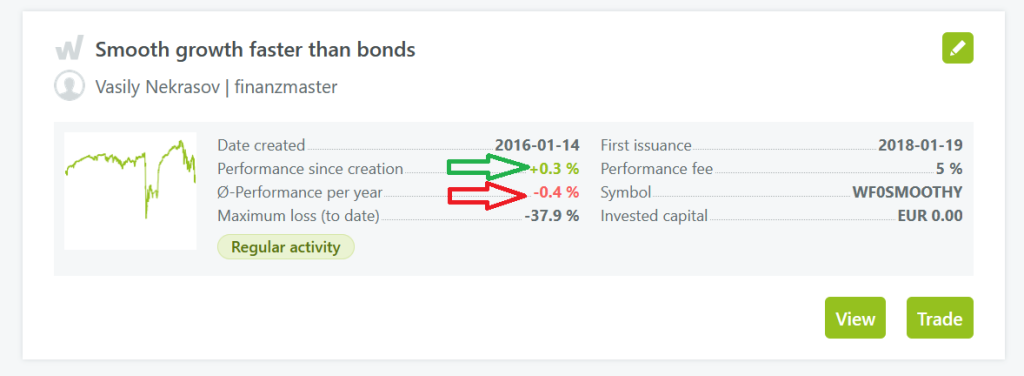

Wikifolio – Yet another fuckup – They cannot even a school math

Just had a look at one of my Wikifolios: the overall performance is positive but the annualized one is negative. Sorry guys (and gals): it is impossible, since the total performance is calculated according to , where

is the annual[ized] return, an

is the [fractional] number of years (and the latter is obviously positive). Even if you use the formula of continuous rate

(which you definitely do not understand since it is slightly beyond the school math), it still cannot be so that

is negative but the overall performance is positive.

Continue reading "Wikifolio – Yet another fuckup – They cannot even a school math"

Continue reading "Wikifolio – Yet another fuckup – They cannot even a school math"

GiGo Analysis Case – even Google might deliver Garbage Data

Surprisingly, German real estate market is quite intransparent, since prices may (like German dialects) strongly vary even in two neighbor villages. But even the summary statistics is often misleading.

In this short study we demonstrate how one can detect an inconsistency and how it might be explained. Continue reading "GiGo Analysis Case – even Google might deliver Garbage Data"

AI Stock Picking Dashboard via mwShiny in Docker behind Apache ReverseProxy

In this post I demonstrate [the performance of] a multi-window interactive graphical dashboard, which visualizes the stock-picking signals from an ensemble of deep neural networks.

Further I describe the online deployment of this dashboard by means of Docker and Apache ReverseProxy.

Everybody, who invests quantitatively and significantly contributed to the engaged software: in partucular R, [mw]Shiny, LAMP-stack, Docker (and of course TF/keras) are encouraged to claim their free access to this dashboard (others are also encouraged to request a paid subscription :)). Continue reading "AI Stock Picking Dashboard via mwShiny in Docker behind Apache ReverseProxy"

JuniorDepot31 – Experiment Termination

Since DeGiro announced closure of Elle's depot on May 15, 2022 she had to optimally close her positions before this date. Unfortunately, the announcement of depot termination coincided with market correction and further macroeconomic risks due to Russian invasion of Ukraine.

Thus the achieved CAGR is just 2.06%, not 6% as pursued. Still it is much better than a bank deposit with zero (or even negative) rate and given the permanent deterioration of DeGiro the result is not that bad. Continue reading "JuniorDepot31 – Experiment Termination"

JuniorDepot30 – The Final Degradation of DeGiro

On 10.02.2022 DeGiro notified Elle that her Depot is going to be closed due to inability to run a bank account for an underage person.

This is a very illustrative case of the operational risk.

Continue reading "JuniorDepot30 – The Final Degradation of DeGiro"

(Снежная) Королева Этери Тутберидзе и причем тут Трейдинг и Инвестиции

Напряжение, надрывы и колоссальная ошибка выжившего роднят фигурное катание и финансовую отрасль. Но возраст, в котором приходит успех - в пользу финансов. Continue reading "(Снежная) Королева Этери Тутберидзе и причем тут Трейдинг и Инвестиции"