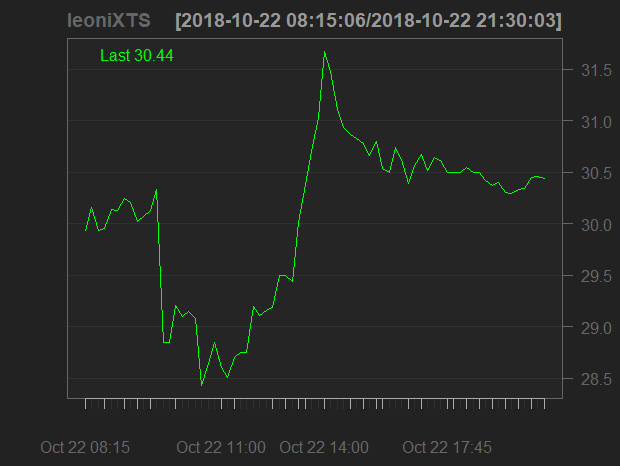

Leoni AG is a German company, specializing in production of high-quality cables for cars. Its shares are traded in sDAX (index of the best German smallcaps). From the beginning of the year Leoni's stock has lost more than 50%. Today, as Leoni has issued a profit warning, its stocks first fell about -6% but then quickly turned around to +5%, ending up by +1.5%. It may mean that the market is tired of the negative news. And even if not yet, German automotive is already fundamentally cheap. Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

Category: Opportunity

What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance

Two months ago we suggested you to buy a list of stocks, carefully selected from SP500 index on both fundamental and technical criteria. One month later we have published the results: though our stocklist has clearly beaten SPY there were no evidences of formal statistical significance. Now there are. Moreover, you have an opportunity to buy our next stockpicking report just for $10. Continue reading "What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance"

What You Have Missed by Not Buying Our Stocklist for just $5

One month ago we screened all stocks from SP 500 index and suggested busy investors to get rid of information overload and purchase our stock list just for 5 USD. Only a few investors considered our offer, which has brought about 3% return within a month, whereas SP 500 return stagnated around zero. Continue reading "What You Have Missed by Not Buying Our Stocklist for just $5"

Investor, get rid of information overload!

Retail investors are overwhelmed with information. Meanwhile the payload of these numerous analytics and market reviews is zero or even negative. Is a passive investment in an index ETF a solution to this problem? Yes, but not necessarily the best one. We provide a short list of S&P 500 stocks with good fundamentals, low volatilities and correlations and nice charts from technical point of view. Continue reading "Investor, get rid of information overload!"

DeGiro hat die Liste der kostenfreien ETFs aktualisiert – Stand 31.03.2018

DeGiro ist der günstigste Broker in Deutschland, der nicht nur die kleinsten Gebühren hat, sondern auch bietet viele ETFs quasi kostenlos an. Leider sind viele davon wegen PRIIPs für EU-Privatinvestoren unzugänglich geworden. DeGiro hat die Liste aktualisiert. Zwar sind von 700 nur 200 geworden, ist es nach wie vor für Privatanleger mehr als genug.

Continue reading "DeGiro hat die Liste der kostenfreien ETFs aktualisiert – Stand 31.03.2018"

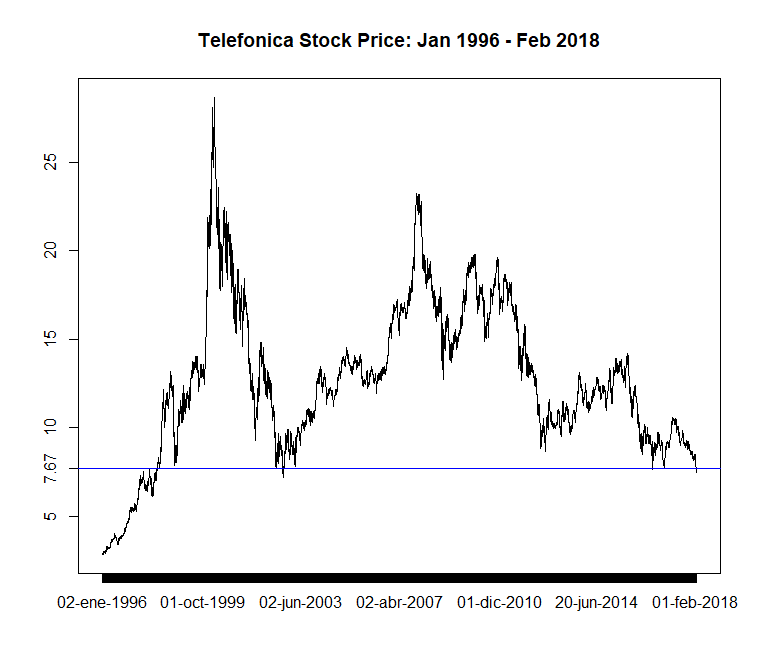

Telefonica (ES0178430E18) – A Trading Chance From Spain

Telefonica a Spanish telecommunication company, one of the largest in the world. It is also very active in Germany (with o2 brand). Telefonica's stock is a component of the Euro Stoxx 50 and currently looks promising both from technical and fundamental points of view. Telefonica always was a good dividend payer, however, there is a pitfall with the Spanish tax at source (Quellensteuer).  Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

Screening DeGiro free ETFs – 5 months later

On 3rd September 2017 we published a gallery of 21 ETFs and ETCs, which can/could* be traded (one a month) free of charge by our broker DeGiro. We always encourage you not to forget the past, so we publish current charts of these ETFs and you can see how things went on. Continue reading "Screening DeGiro free ETFs – 5 months later"

JuniorDepot I – Eröffnung bei DeGiro – Basic oder Custody?

Finanzieller Analphabetismus in Deutschland ist – unserer Erfahrung nach - wirklich schrecklich. Leute wollen keine Steuererstattung beantragen (lassen), lehnen jegliche Alternativen zur Hausbank ab und zahlen (zu) hohen Zinsen, und so weiter und so fort. Heute aber berichten wir um einen erfreulichem Fall: einer von unseren Stammleser will für seine siebenjährige Tochter das Depot eröffnen und €100/mo. investieren, so dass die Mädle sich zur Volljährigkeit ein Auto leisten kann.

Da es ein wirklich vorbildliches Vorhaben ist, werden wir dieses Projekt während der nächsten 11 Jahre ausführlich erläutern. Wir fangen mit der Brokerwahl und die organisatorischen Nuancen an. Continue reading "JuniorDepot I – Eröffnung bei DeGiro – Basic oder Custody?"

Screening DeGiro free ETFs

Yesterday we celebrated our first anniversary and mentioned that we are going to make the asset screening as automatic as possible. But it is a long (or at least mid) term project but time and tide wait for no man. Thus we made for you a manual pre-screening of about 600 ETFs that can be traded on NYSE or NASDAQ via DeGiro without broker fees (except the so-called modality payments, which are though negligible).

Continue reading "Screening DeGiro free ETFs"

Contango and Cash: the rollover costs are not always prohibitive

As we published our recommendation to invest in commodities, we got a remark that we should not neglect the contango effect and rollover costs. So we analyzed them and came to a conclusion that although the costs of futures rolling (and ETF fees) are not negligible, they are also not so important, compared to the recent movements of commodity prices.

There were ten futures for the nearest months

Roll over, roll over.

And the January futures was to expire

Nine!

Continue reading "Contango and Cash: the rollover costs are not always prohibitive"