Michael Shackleford, a who has made a career of analyzing casino games, designed Australian Reels Slot Machine in 2009. In modeling the casino's risk of ruin he (blindly) relied on the normal distribution. We show that this drastically undervalues the tail risk. Continue reading "A Fairy Tail or The Magic of Extreme Casino Wins"

Month: July 2018

JuniorDepot8 – Buying Silver ETC and DAX ETF

Elle, a 7-year old girl, continues to grow her wealth. Recently she has bought a silver ETC and a DAX ETF (the former a little bit prematurely, the latter pretty optimally). Continue reading "JuniorDepot8 – Buying Silver ETC and DAX ETF"

Lukas Spang ist weder Warren Buffett noch ein Glückspilz, sondern…

Vor einem Jahr haben wir eine ausführliche Analyse vom Lukas Spangs Wikifolio "Chancen suchen und finden" veröffentlicht und vor Stagnationsrisiko vorgewarnt. Unsere Prognose stellte sich als richtig heraus!

Continue reading "Lukas Spang ist weder Warren Buffett noch ein Glückspilz, sondern…"

GEZ Urteil und seine wirtschaftliche Folgen für DICH, Mitbürger

Gestern (am 18.07.2018) hat das Verfassungsgericht entschieden, dass GEZ Zwangsgebühr im Großen und Ganzen mit dem Grundgesetz vereinbar ist. Lediglich wurde die Zahlungsplicht für Zweitwohnungen gekippt. Zwar kann €17,50/mo. noch erträglich scheinen, zeigen wir, dass dadurch ein ganzes Vermögen - z.B. die auskömmliche Altersvorsorge – geklaut wird.

Continue reading "GEZ Urteil und seine wirtschaftliche Folgen für DICH, Mitbürger"

Rentenarmut kommt! Auch die Betriebstrenten sind in Gefahr!

Viele Deutschen haben es wohl gedanklich akzeptiert: die gesetzliche Rente wird es kaum geben. Aber sie hoffen immer noch auf Betriebsrenten. Bekehrter Schwabe muss enttäuschen: wegen Nullzinspolitik sind auch die Betriebsrenten in Gefahr. Rentenkürzungen passierten schon und werden noch vorkommen!

Continue reading "Rentenarmut kommt! Auch die Betriebstrenten sind in Gefahr!"

PropellerAds delivers Bullshit and Malware – avoid it!

By letYourMoneyGrow.com we also want to grow our own money, thus we tried to put Propeller Ads on our pages. But we pursue a win-win collaboration with our readers and never grow our money at their costs. Had Propeller Ads "merely" delivered a bullshit, we would just silently abandon it. But it also supplies malware, thus we feel obliged to apologize to our readers. Fortunately, there is virtually no danger since we promptly removed all PropellerAds content from our website.

Continue reading "PropellerAds delivers Bullshit and Malware – avoid it!"

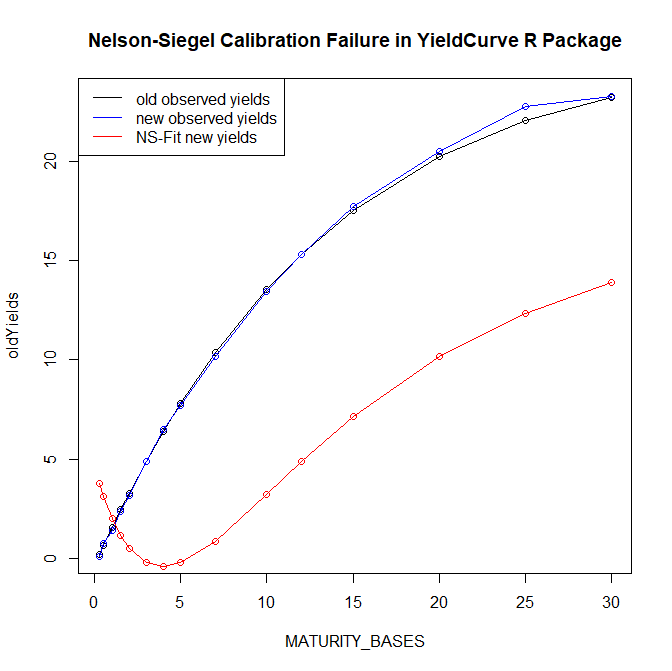

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do

In our previous post on Nelson-Siegel model we have shown some pitfalls of it. In this follow-up we will discuss how to circumvent them and how machine learning and artificial intelligence can[not] help. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do"

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I

The Nelson-Siegel-[Svensson] Model is a common approach to fit a yield curve. Its popularity might be explained with economic interpretability of its parameters but most likely it is because the European Central Bank uses it. However, what may do for ECB will not necessarily work in all cases: the model parameters are sometimes extremely unstable and fail to converge. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

JuniorDepot7c – Lots of Actions and Calculations

Market were really turbulent during the last weeks. We committed a lot of trades with Elle and did some important calculations of our trading costs. Continue reading "JuniorDepot7c – Lots of Actions and Calculations"

What You Have Missed by Not Buying Our Stocklist for just $5

One month ago we screened all stocks from SP 500 index and suggested busy investors to get rid of information overload and purchase our stock list just for 5 USD. Only a few investors considered our offer, which has brought about 3% return within a month, whereas SP 500 return stagnated around zero. Continue reading "What You Have Missed by Not Buying Our Stocklist for just $5"