In this post I demonstrate [the performance of] a multi-window interactive graphical dashboard, which visualizes the stock-picking signals from an ensemble of deep neural networks.

Further I describe the online deployment of this dashboard by means of Docker and Apache ReverseProxy.

Everybody, who invests quantitatively and significantly contributed to the engaged software: in partucular R, [mw]Shiny, LAMP-stack, Docker (and of course TF/keras) are encouraged to claim their free access to this dashboard (others are also encouraged to request a paid subscription :)). Continue reading "AI Stock Picking Dashboard via mwShiny in Docker behind Apache ReverseProxy"

Category: letYourMoneyGrow

letYourMoneyGrow.com Serves You on Ubuntu 18.04.1 LTS Linux

We have successfully migrated from Ubuntu 16 to Ubuntu 18, assuring stable and secure functioning of letYourMoneyGrow.com for the next several years. We had to disable social login but the users that registered with their social network accounts can use our services as before (they merely need to reset their passwords). Continue reading "letYourMoneyGrow.com Serves You on Ubuntu 18.04.1 LTS Linux"

PropellerAds delivers Bullshit and Malware – avoid it!

By letYourMoneyGrow.com we also want to grow our own money, thus we tried to put Propeller Ads on our pages. But we pursue a win-win collaboration with our readers and never grow our money at their costs. Had Propeller Ads "merely" delivered a bullshit, we would just silently abandon it. But it also supplies malware, thus we feel obliged to apologize to our readers. Fortunately, there is virtually no danger since we promptly removed all PropellerAds content from our website.

Continue reading "PropellerAds delivers Bullshit and Malware – avoid it!"

Market Data Quality – Beware the Splits and Dividends

Recently we made an ex-post analysis of our ETF screening efficiency and detected the price data inconsistency for 4 of 21 ETFs in question. Having a closer look at these ETFs, we explain the causes of inconsistency and emphasize that your trading strategy is only as good as your data (quality controls) are! Continue reading "Market Data Quality – Beware the Splits and Dividends"

letYourMoneyGrow.com Wishes You Happy New Year

Year 2017 was exciting. Markets grew but were very hard, so even Einstein (although he made 30%) says he failed to beat Mr. Market this year. The big question is how 2018 will be, esp. because the market has not seen a correction for a long time. Neither we know the answer but our goal is not to predict the future but rather to help you analyze what may happen. Understanding your own risks and how the numerous rascals may cheat you is essential in trading and investing because there is generally no profit without risk but there are a lot of (idiosyncratic) risks without profit!

We summarize which such risks we have recognized and will continue doing it in 2018.

Continue reading "letYourMoneyGrow.com Wishes You Happy New Year"

QuantLib for Mere Mortals – Insights from QL User Meeting 2017

We have already used QuantLib at letYourMoneyGrow.com several times, in particular to provide a helpful scenario simulator for option traders. QuantLib User Meeting 2017, in which I also took part, provides insights on how to make QuantLib even more accessible for the "mere mortals".

Continue reading "QuantLib for Mere Mortals – Insights from QL User Meeting 2017"

letYourMoneyGrow.com is one year (and one day) old!

One year ago we launched letYourMoneyGrow.com and we already can report some achievements!

1. We have created and keep developing our Quantitative Toolbox. In particular, you will not find suchlike Option Calculator with scenario simulation or mortgage calculator with estimation of the interest rate risk anywhere else.

2. Thanks to Einstein, we disproved the stupid mantra that allegedly "nobody can be better than the market". On the other hand we have shown that many "solid" institutional asset managers and [self-proclaimed] stock market "gurus" cannot beat the market. Thus, only track record matters!

3. We have demonstrated, first of all by the example of IREX, how a quantitative performance analysis can help by investment decisions. At least in case of IREX it was clear that the guy will fail and he recently did!

Our next big goal is to automatize the asset screening as much as possible. Continue reading "letYourMoneyGrow.com is one year (and one day) old!"

Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly

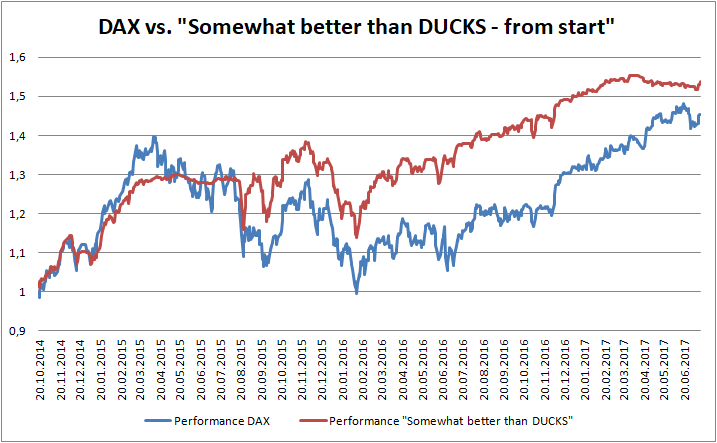

I show by the example of my portfolio "somewhat better than DUCKS" that CAPM alpha is a very non-robust measure of performance as well as that linear regression on an index should be considered very critically.

Recently, one of my facebook contacts has meant that my portfolio "Somewhat better than DUCKS" repeats the DAX with a beta but without alpha. He even did not make an effort to calculate the linear regression before making this statement. However, even if he did, the results would not be comprehensive.

Continue reading "Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly"

R-script for Fixer.io – get FX rates in R for 31 currencies

Even if you are not a Forex trader, it is often necessarily to get currency exchange rates, e.g. if you trade [the options on] foreign stocks. Fixer.io provides daily FX-rates from European Central Bank for 31 currencies via JSON API. We present a script to get data in R.

Continue reading "R-script for Fixer.io – get FX rates in R for 31 currencies"

YaWhore Dance with Yahoo Finance

On 17.04.2017 Yahoo.Finance changed its API, so ichart.finance.yahoo.com is (temporarily?!) unavailable. In particular it means that many R-scripts that rely on quantmod/getSymbols() will not function anymore. We discuss the ways to circumvent the API change of Yahoo.Finance and alternatives to it, esp. Alpha Vantage.

Continue reading "YaWhore Dance with Yahoo Finance"

Continue reading "YaWhore Dance with Yahoo Finance"