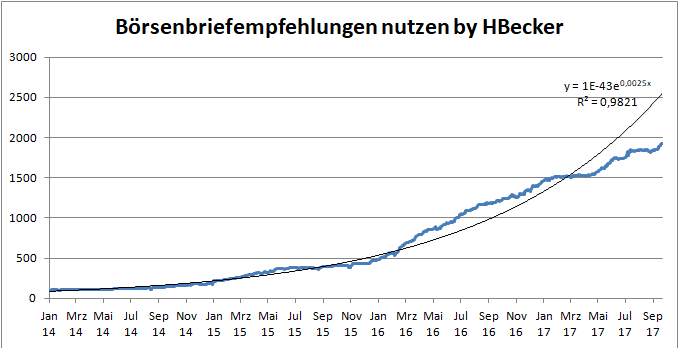

Earlier we analyzed the performance of Einstein, a star trader on Wikifolio who has beaten (and continues to beat) the market. There is one more luminary on Wikifolio - and it is HBecker. Formally, Einstein is Number One in terms of absolute returns (by comparable historical drawdown). However, HBecker has even smoother equity curve and much better hit rate. If you still ask, who is better, the right answer is both are better! We summarize the trading history of HBecker and remind you that Wikifolio is an excellent place to learn from experienced traders but a bad place to invest your money unless you can deeply analyze the risks.

Continue reading "HBecker – another star Trader on Wikifolio"