Options are the simplest non-trivial financial derivatives around. They are part of the curriculum of every university course on Finance for a good reason: They are everywhere! They are traded on regulated exchanges around the world, change hands over the counter between … consenting adults, enhance or "infect" all sorts of contracts as "embedded options", constitute the main ingredient of insurance policies. In their pure form, their annual volume on U.S. Equity Option exchanges alone exceeds 4 billion contracts!

Options are the simplest non-trivial financial derivatives around. They are part of the curriculum of every university course on Finance for a good reason: They are everywhere! They are traded on regulated exchanges around the world, change hands over the counter between … consenting adults, enhance or "infect" all sorts of contracts as "embedded options", constitute the main ingredient of insurance policies. In their pure form, their annual volume on U.S. Equity Option exchanges alone exceeds 4 billion contracts!

This is the first of a series of articles that will show you how to compute the fair value of options within Excel without using expensive third party software. Continue reading "Beyond Black Scholes: European Options without Dividends"

Category: Options

Gas Storage Fair Price | online Calculator

Remarkably, many market players in energy market still cannot calculate the fair value of a gas storage. In particular, many of them rely on perfect foresight. We put online a simple but correct model from QuantLib. Confidence intervals are estimated as well.

NB! This time not for retail investors but for the colleagues from energy industry. Have a look at short introductory video.

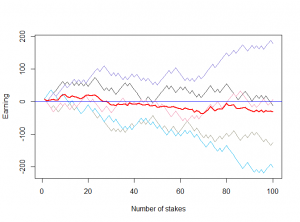

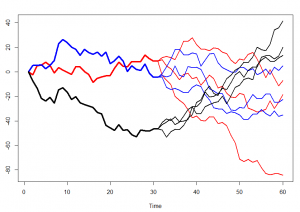

Gas Storage is a relatively complex option to evaluate, esp. if there are non-trivial constraints. Remarkably, many energy companies cannot correctly evaluate even the simplest storage contracts. Moreover, they often resort to a so-called perfect foresight: the price paths are considered random but once the price path is known, it is assumed to be known completely (like at the left-hand sketch).

|

|

| Prefect foresight (unrealistic) | One-step foresight (realistic) |

Continue reading "Gas Storage Fair Price | online Calculator"

Fallen der Optionsscheine: Verlustrisiken verstehen und mit Optionsscheinrechner einschätzen

Eine Umfrage in der Facebook Gruppe "Trading and Education" hat gezeigt, dass man gegen Optionsscheine eine starke Abneigung hat. Hauptgrund war: "die Kurserstellung sei völlig untransparent". Obwohl man von den Optionsscheinen eher Finger weg halten sollte, ab und zu kann sich der Handel damit lohnen. Wir erklären die Risiken der Optionsscheine (Zeitwertverlust, hoher Geld-Brief Spread, Kursmanupulation) und bieten einen Simulator zur Einschätzung der möglichen Gewinne und Verluste an.

Continue reading "Fallen der Optionsscheine: Verlustrisiken verstehen und mit Optionsscheinrechner einschätzen"

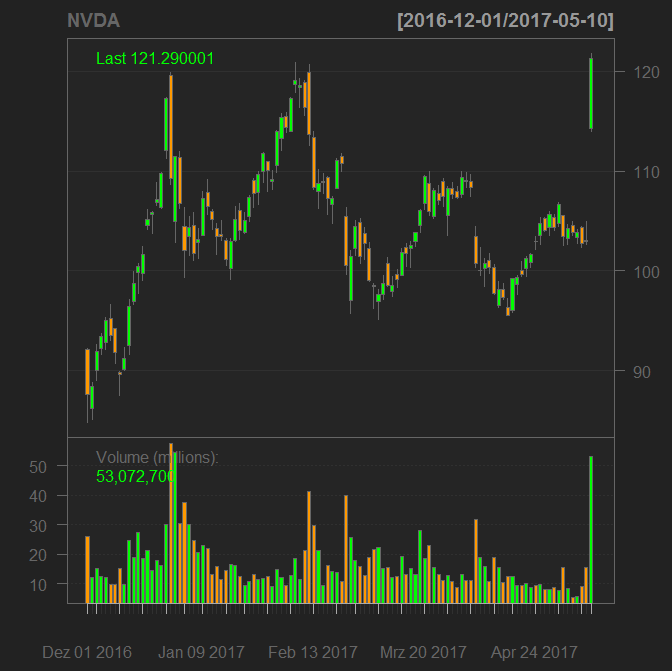

PUT on nVIDIA turned out to be far from perfect trade, but…

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

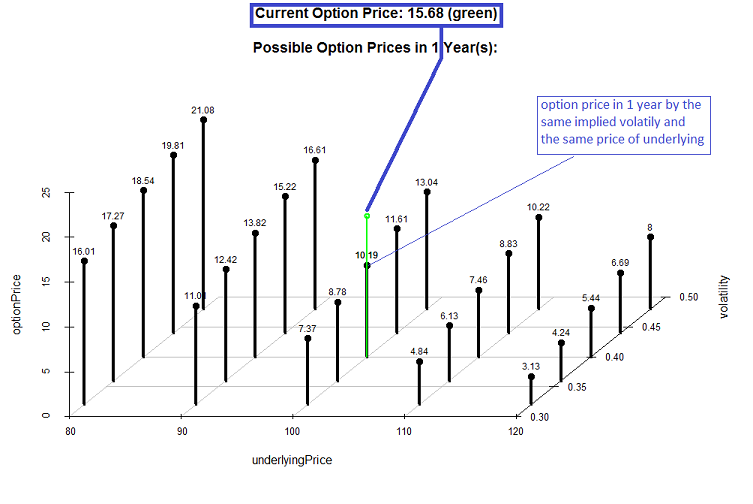

Online Option Calculator – estimate the future value of an option

Many retail investors are unaware that the option price sometimes depends on the (implied) volatility much stronger than on the price of underlying. They also often underestimate the losses of time value. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

Continue reading "Online Option Calculator – estimate the future value of an option"

Continue reading "Online Option Calculator – estimate the future value of an option"