Have you ever thought of being a trader?

I mean trading things like stocks, currencies, options or anything else that you can buy and sell almost instantly - typically online - by pressing a button and not illiquid assets, such as houses or antique furniture.

Wouldn’t it be great to get some sense of what real world trading looks like before setting up an account with an online brokerage firm and putting your own money on risk?

I googled around for a "Trading Simulator" and right on the top of the search results came the Investopedia's free Stock Simulator. I clicked on that link and after registering a new free account – only an email was required – I received access to some sort of online game, where I was allocated 100,000 virtual US Dollars that I could spend buying and selling virtual shares of stock.

After recovering from the initial shock of having 100,000 $ to do whatever I want with – I am a dreamer, so something being "virtual" or "real" makes no difference to me – I had to find a way to decide which stocks to buy.

Investopedia came to my aid by allowing me to create a so called "Watch List". So I created one consisting of the tickers MSFT (Microsoft), AAPL (Apple), GOOG (Google) and TWTR (Twitter). I ended up with the screen below, where I could see the "real time" Price, Change, %Change, Volume etc for all stocks in my watch list.

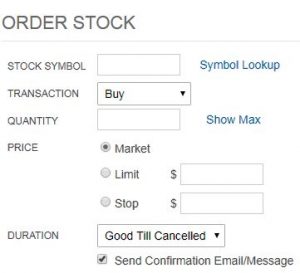

That screen was indeed nice! I could watch the prices blinking as they moved up and down and that made me feel like I was a real trader sitting in front of a trading screen. If I felt it was the right time to buy, I could simply go to the screen shown below and place an order.

Looked terrific and very professional, but then I remembered when I used to go out for beer with some of my trader friends, who casually spoke about "hitting the offer" and "lifting the bid".

One does not need to be a trader to realize that the mechanism of any market exchange is based on the constant availability of two key prices: A low price called "bid" that represents the money a buyer is willing to pay in order to buy the product and a high price called "ask" or "offer" that represents the money a seller requires for selling that product.

At any given moment there will be several ("wannabe") buyers and sellers and therefore several different bids and offers. Collectively the set of all bid and offer quotes is called the "Order Book".

Clearly the most important of all bids is the highest one and conversely the most important of all offers is the lowest one. One accordingly talks of the "top" or "best" bid/offer quotes. This pair of quotes (best bid and best offer) represent the "top" part of the "Order Book".

To make a long story short, I was quite surprised that Investopedia’s screen had no display of these important bid/offer quotes. The displayed price only represents the price at which the last transaction took place. It has no effect on the price I will pay if I place a market order to buy the stock.

One may say that in a liquid market spreads are so low that the current bid will always be just below the quoted traded price so that the approximation is not so bad, particularly since this is a simulated game after all.

Not really!

The main objective of the Trading Simulator is to teach you how to trade. If you talk to real traders, they will tell you that the structure of bid/offer quotes – the Order Book I mentioned above – is paramount to their trading decisions. As a matter of fact, not only the bid/offer quotes, but also their respective sizes provide significant signals as to the direction the market is heading. For example, a big bid size signals big buying appetite indicating a likely price surge. Also the spread between the top bid/ask quotes as well as the spread between successive bid and ask quotes can betray important information with regard to the wider market supply and demand levels.

Things actually turned out to be much uglier! A new problem emerged that made the lack of bid/ask quotes in Investopedia’s Simulator look truly insignificant in comparison!

As I found out, the Price quotation did not refer to the actual last traded price, as one may have initially hoped. According to Investopedia, the quoted price is delayed by around 20 minutes!

This huge time delay actually defeats to some degree the purpose of using the Trading Simulator. Why? Because stock prices move by the flow of news. If Microsoft announces right now a better than expected operating profit, this will obviously have a positive effect on its stock price, but the Investopedia simulator will still display the price as it was 20 minutes ago! So if you follow the news – as you should if you want to ever make money with trading – and you sit in front of your Simulator screen, you would be tempted to place a BUY order, knowing that the price will go up in 20 minutes! Because allowing knowledge of future events is clearly not part of the rules of any realistic trading environment, Investopedia adds an artificial delay of 20 minutes on your BUY order. This delay is sensible given the constraint of the delayed feeds, but it makes the whole Simulator experience less fun, since you are asked to place trade orders based on displayed prices knowing that your orders will be filled on the levels that the displayed prices will attain 20 minutes after you have placed the order!

So, let us go back to the question: Should I use a Trading Simulator to learn how to trade?

The answer is unavoidably yes, but with the precaution that most of free Trading Simulators are not realistic enough. The most important shortcomings are a) delayed market data and b) lack of bid/ask quotes. These shortcomings are not only present in Investopedia’s product but affect most similar products available today, primarily because accessing and distributing true real time data is very expensive. Most trading platforms would supply you with true real time data only if you pay substantial subscription fees.

The good news is that there exists a brand new product that supplies true real time bid/ask quotes plus simulated market orders for free!

I will let you know what this new product is and explain how it works in my next post.

Stay tuned!

FinViz - an advanced stock screener (both for technical and fundamental traders)