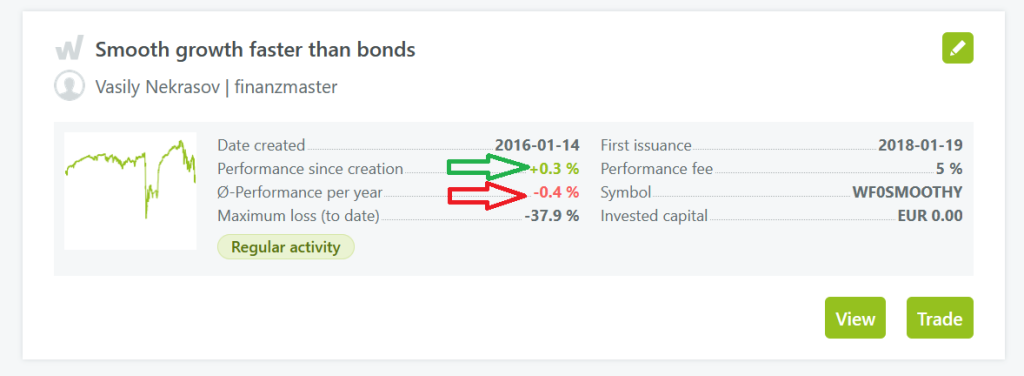

Just had a look at one of my Wikifolios: the overall performance is positive but the annualized one is negative. Sorry guys (and gals): it is impossible, since the total performance is calculated according to , where

is the annual[ized] return, an

is the [fractional] number of years (and the latter is obviously positive). Even if you use the formula of continuous rate

(which you definitely do not understand since it is slightly beyond the school math), it still cannot be so that

is negative but the overall performance is positive.

P.S. a strict reader of this blog will likely note something like this: yes, Wikifolio has calculated a bullshit (like it often does) but what about the performance of your wikifolio per se?! Well, as to smooth growth, yes, it is indeed failed (in part due to technical problems by Wikifolio but this is another story). But as to faster than bonds, it is achieved, have a look at TLT performance for the same period  I even do not mention the European bonds!

I even do not mention the European bonds!

P.P.S.

Despite this (and many other bullshit) I like Wikifolio. I would never trust my money to Wikifolio but for a market researcher it is invaluable. In particular, it helps to disprove the nobody can beat the market mantra .

FinViz - an advanced stock screener (both for technical and fundamental traders)