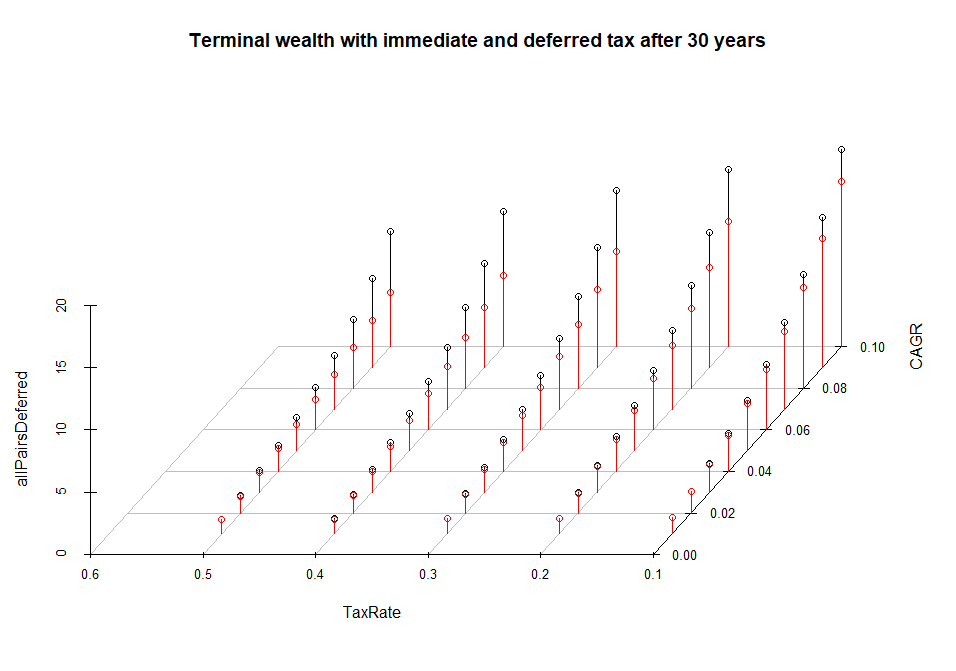

Many investment funds and financial services that want your money argue with a deferred capital yield tax. For instance, in Germany if you trade by yourself, you immediately pay the capital returns tax [Kapitalertragsteuer] (unless the net result of your previous trades is negative). But if you invest in a fund, you don't pay the tax on returns until you sell your share (you still pay a tax on dividends).

We show that though, in general, an investor profits from tax deferral, one should not exaggerate its effect. Moreover, due to annual tax-exempt amounts [Jahresfreibetrag], an immediate taxation can be better than a deferred one.

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Skip to content