A common belief: adding extra asset to a portfolio will automatically reduce the portfolio risk. We provide a counter-example resorting only to the simplest algebra and explain why this erroneous belief is so common.

Month: February 2017

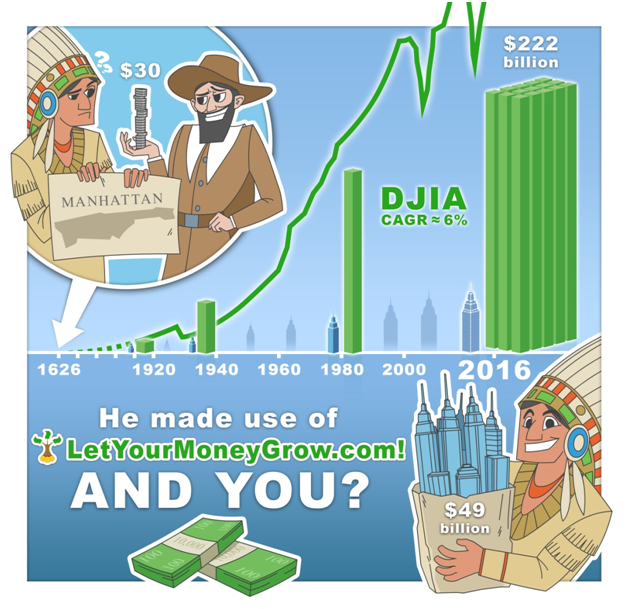

Numeracy for Traders – Lesson 2 – Exponentiation, polynomials, logarithms and the power of compound returns

After this lesson you will understand how to compute the compound return, discount factors and the CAGR (compound annual growth rate: nominal and inflation adjusted). You will also learn about the continuously compounded (exponential) interest and logarithmic returns. Finally, you will be able to calculate the effective rate of interest of a credit or of a savings scheme.

After this lesson you will understand how to compute the compound return, discount factors and the CAGR (compound annual growth rate: nominal and inflation adjusted). You will also learn about the continuously compounded (exponential) interest and logarithmic returns. Finally, you will be able to calculate the effective rate of interest of a credit or of a savings scheme.