As we have previously reported, the year 2018 was not very good for Elle's portfolio, indeed it was bad. But we looked optimistically in future and were right: the portfolio recovers with the market and the opportunities for the active trading arise.

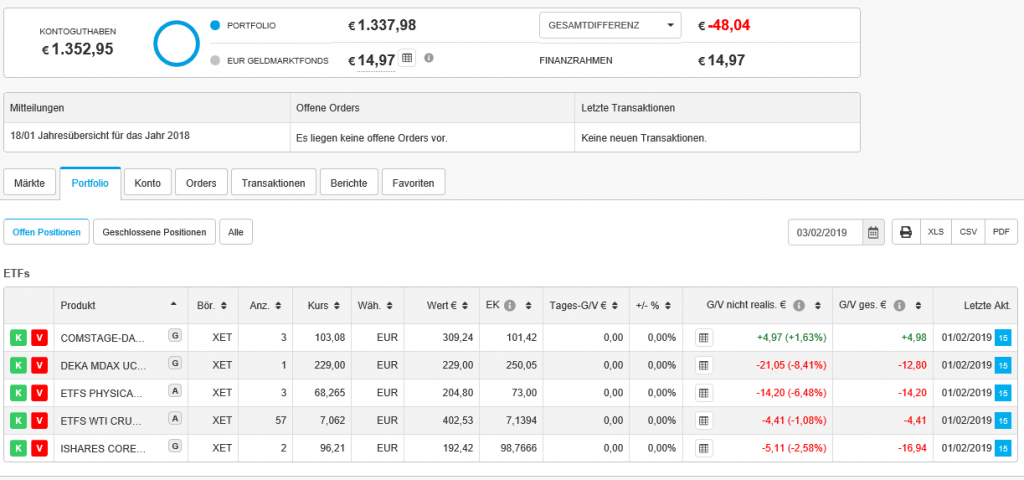

The current Elle's ETF portfolio looks as follows:

As you can readily see, we still have to bear a drawdown but now it is -€48 or -3.4% (against -€166 or -12.7% a month ago).

In particular, the ETC on WTI Oil has quickly recovered. Currently the oil prices stagnate but we expect they will continue recovering. If not, we will try to close the position in ETFS WTI Crude Oil near the breakeven, since we do not want to bear the rollover costs for a long term.

The Physical Platinum ETC remains a long-term investment, the latest local minimum did not turn into the new global one, which (additionally with a slowly growing optimism in automotive) may indicate a turnaround.

Finally, we have invested the last monthly installment in the DAX ETF, since the price still was attractive.

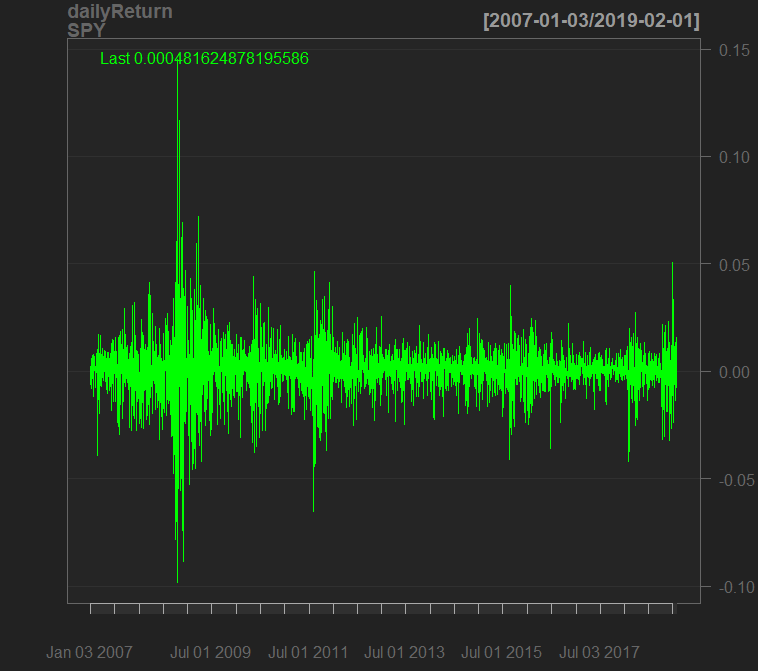

However, we are going to wait until this position gives us some more profit and then to close it, since we need capital for an active trading. There is (so far) no (more) warning signals for the next global crisis: trade war with China seems to be digested by the market (charges against Huawei have not caused a market drop as the arrest of Meng Wanzhou previously did); also the US shutdown hardly impacts the market. On the other hand, the SP500 seems to be in a high-volatility mode, and e.g. a no-deal Brexit-deal may readily trigger the new wave of turbulence.

However, we are going to wait until this position gives us some more profit and then to close it, since we need capital for an active trading. There is (so far) no (more) warning signals for the next global crisis: trade war with China seems to be digested by the market (charges against Huawei have not caused a market drop as the arrest of Meng Wanzhou previously did); also the US shutdown hardly impacts the market. On the other hand, the SP500 seems to be in a high-volatility mode, and e.g. a no-deal Brexit-deal may readily trigger the new wave of turbulence.

In simple words, we expect a flat market in 2019, which would be a good opportunity for an active trading. Shall Elle get started with it? Definitely! Finally, she is already eight years old! 🙂

FinViz - an advanced stock screener (both for technical and fundamental traders)