As we published our recommendation to invest in commodities, we got a remark that we should not neglect the contango effect and rollover costs. So we analyzed them and came to a conclusion that although the costs of futures rolling (and ETF fees) are not negligible, they are also not so important, compared to the recent movements of commodity prices.

There were ten futures for the nearest months

Roll over, roll over.

And the January futures was to expire

Nine!

As is well known, with an exception of the precious metals it is very difficult to track with an investment the commodity spot prices (unless you are ready, like J.M. Keynes to rent a church to use it as a grain storage). Instead, one normally has to invest in futures, which are usually traded with contango: a surcharge to the spot price of the commodity.

Contango is due to the storage costs and the market price of risk. But the closer is a futures contract to expiry, the more its price converges to the spot price. In order to avoid a physical delivery of commodity an investor rolls his position: sells the futures [shortly] before the expiry date and buys the next futures. This causes a systematic loss.

Sometimes the futures prices do fall below the spot price. It is called backwardation. In this case an investor would profit from rolling the futures. However, a backwardation is relatively rare and usually means that the market anticipates a price drop. In particular, the oil was traded with a backwardation shortly before the oil price has (more than) halved due to the shale oil revolution.

So if you speculate with commodities, you usually have to accept the contango effect. In order to strictly analyze it, we would need to have a high-quality database of historical futures prices and to exactly know how the managers of each commodity ETF roll the futures.

But we will do it simpler: just compare the historical prices of a commodity ETF / ETC / ETN with the historical spot prices of the respective commodity. Of course there will also be a management fee and, additionally, an FX-effect, if a fund traded in a currency other than USD. But if we see that all these effects are not critical, we can conclude this inter alia for the rollover effect.

So we did it! The only problem we experienced: surprisingly, it was not so easy to find the downloadable historical commodity spot prices. But thanks to FRED Economic Research we found these data. Let us see what we got

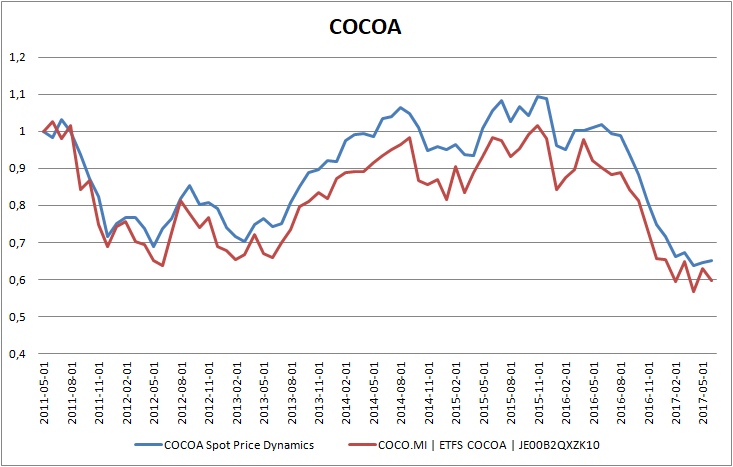

1) Cocoa Spot Price vs. COCO.MI | ETFS COCOA | JE00B2QXZK10

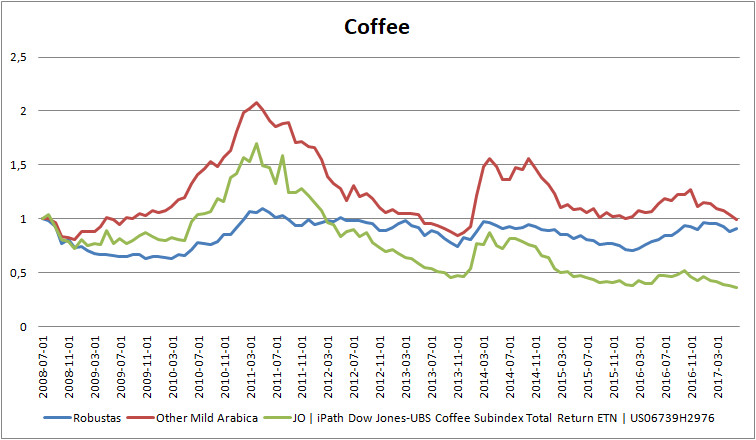

2) Coffee spot price vs. JO | iPath Dow Jones-UBS Coffee Subindex Total Return ETN | US06739H2976

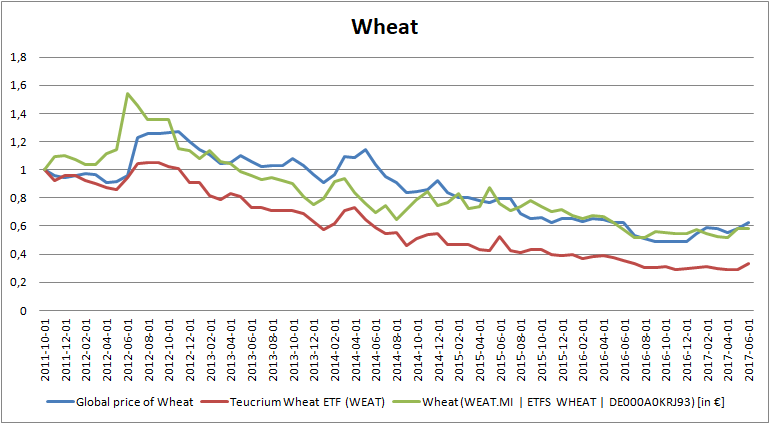

3) Wheat spot price vs. WEAT.MI | ETFS WHEAT | DE000A0KRJ93

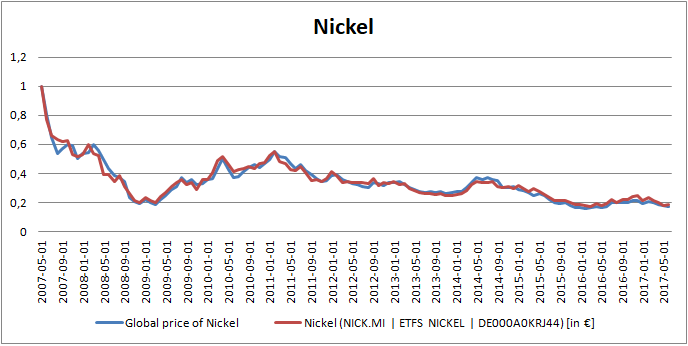

4) Nickel spot price vs. NICK.MI | ETFS NCIKEL | DE000A0KRJ44

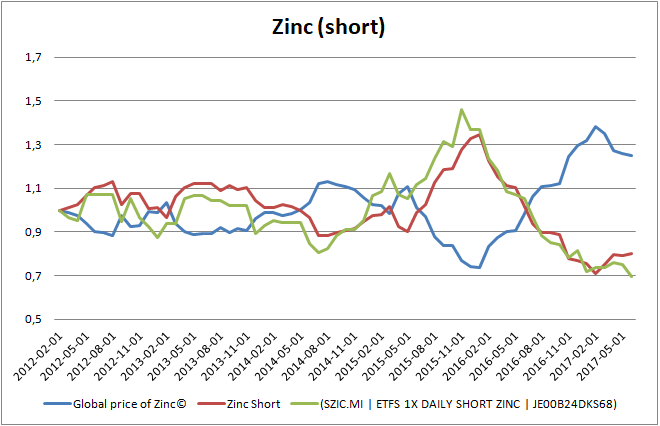

5) Zinc spot short vs. SZIC.MI | ETFS 1X DAILY SHORT ZINC | JE00B24DKS68.

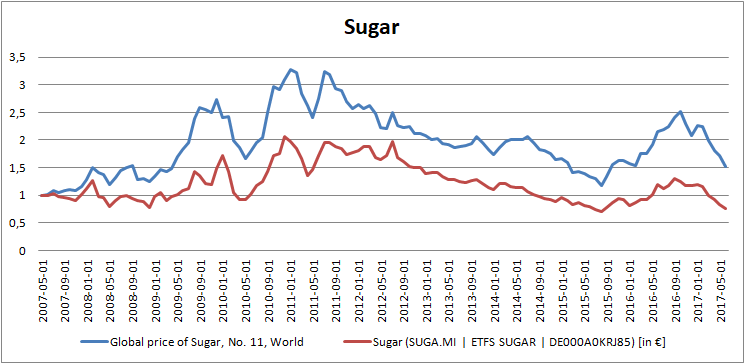

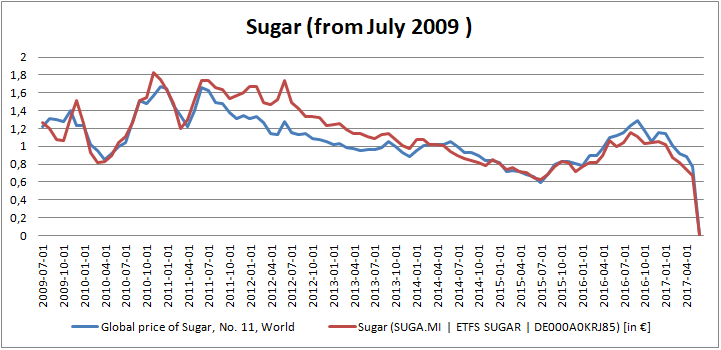

6) Sugar spot price vs. SUGA.MI | ETFS SUGAR | DE000A0KRJ85

As you can readily see, with an exception of coffee and sugar the price of the respective ETF / ETC / ETN closely follows the commodity spot price. Additionally, with sugar the divergence happens relatively far in the past and might be just a data outlier, as the last chart suggest.

As to coffee, it seems that it is very important which sort is meant (and as espresso lover I can confirm that it does matter).

Surprisingly, we have found no data for silver spot price on FRED (although there are many interesting datasets on silver). Anyway, it is easy to physically store the silver bars, so we don't care.

Do you find this post useful and want to read a detailed analysis about oil? You will, if this post gets 1000 likes on LinkedIn or Facebook, so don't spare a click 🙂

FinViz - an advanced stock screener (both for technical and fundamental traders)