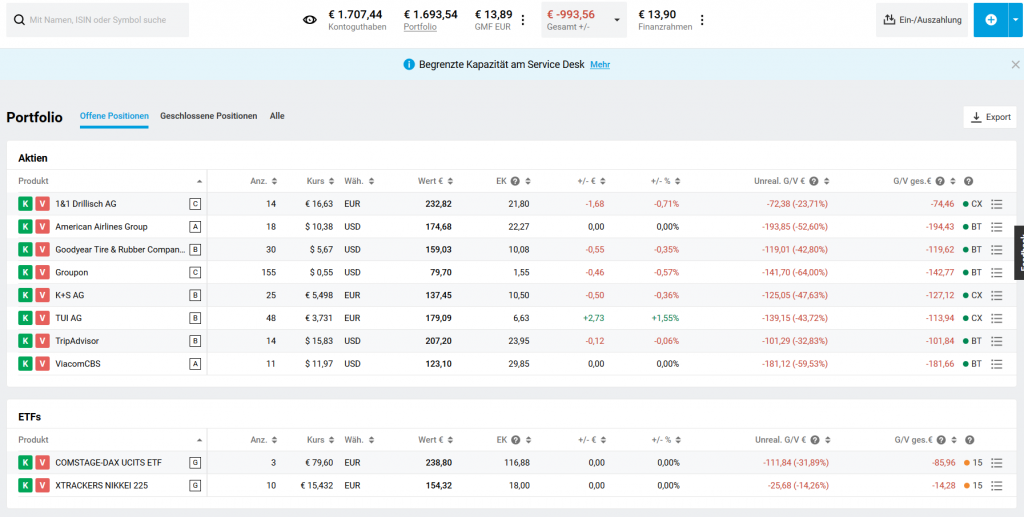

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

The market reaction on COVID-19 was really amazing. Little did I understand the total no-reaction, as the decease brought out in China and even less the market crash, as it turned out to the pandemia. Ironically, we had enough cash but just invested it prematurely... too prematurely.

It is mostly my fault, since I expected a quick recovery a-la Brexit or even Trump case.

Unfortunately, we even cannot dynamically update Elle's portfolio. Since we are sensitive to trading fees, we cannot afford trading frequently. So I, myself, did exit AAL stock on a spike but for Elle, given relatively high trading fees, the optimal decision (by the time of this spike) was to stay and hope that AAL will continue recovering.

Anyway, lesson learnt (both by me and Elle) but there is no use crying over spilt milk. Instead, we are quite happy that the crash occurred in the beginning (rather than in the end) of our savings plan.

The DAX is about 40% down (and so is our portfolio). Not all stocks in our portfolio will recover (e.g. we do not exclude the bankruptcy of Groupon but still do not sell it because if it does recover, it can grow 10 times).

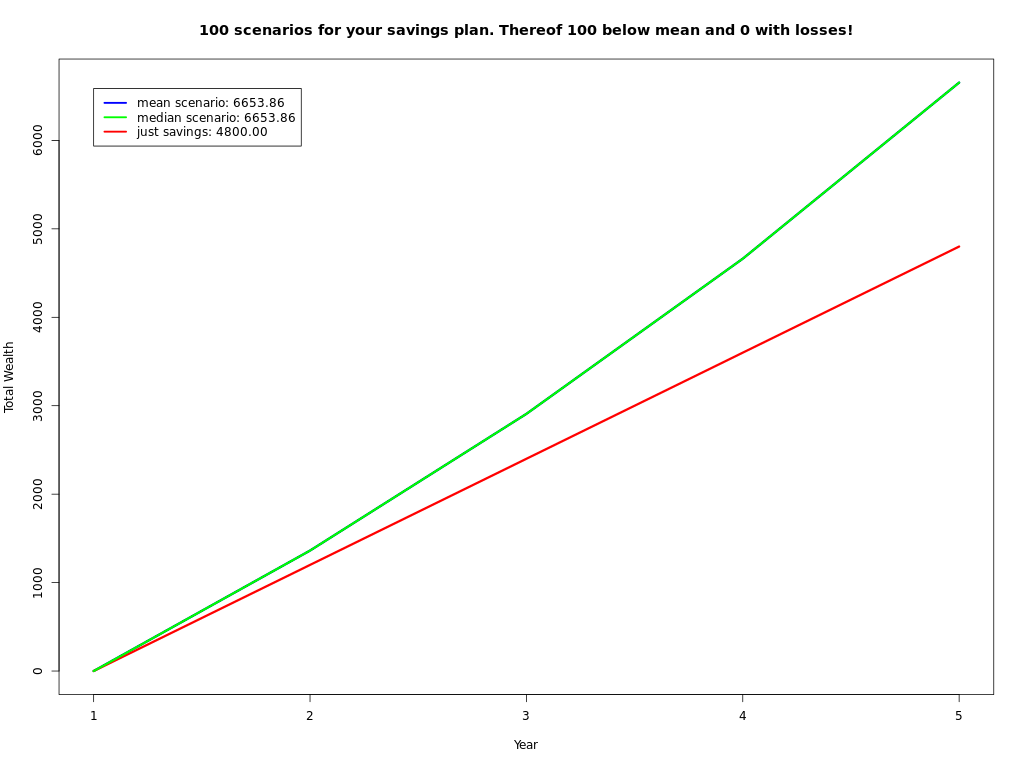

Assuming that the recovery of the market (i.e. DAX) will take 4 years (as it did by the Great Depression), we get an implied DAX growth rate of 13.5%

Indeed , so we will likely gain about €1850, as our savings plan simulator tells us.

In this sense we do not even need the stockpicking for this time span, we can just bluntly invest our monthly installment in a (M)DAX ETF.

Stay optimistic, stay tuned!

FinViz - an advanced stock screener (both for technical and fundamental traders)