Donald Trump's victory on 09.11.2016 was likely as surprising for markets as Brexit was. However, the expected (and factual) aftermath was completely different. This case is good to learn when you should urgently sell and when not To be true, I was well-prepared to Brexit but I was hardly able to prepare my portfolio to the Triumph case. I rightly guessed that the gold may jump (analogous to the Brexit case). On the other hand the gold was on a strong downtrend and also might have dropped even stronger if Hillary had won. Also contrary to Brexit, the DAX was not so close to its recent maximum, so a partial selling-off on previous day would make little sense in terms of risk-reward. Last but not least, though I believed that the German stocks will fall if Trump wins, I attributed it exclusively to the anti-Trump hysteria in German media. Finally, Trump is a republican and a businessman with liberal economy attitude, in this sense the market would rather grow.

To be true, I was well-prepared to Brexit but I was hardly able to prepare my portfolio to the Triumph case. I rightly guessed that the gold may jump (analogous to the Brexit case). On the other hand the gold was on a strong downtrend and also might have dropped even stronger if Hillary had won. Also contrary to Brexit, the DAX was not so close to its recent maximum, so a partial selling-off on previous day would make little sense in terms of risk-reward. Last but not least, though I believed that the German stocks will fall if Trump wins, I attributed it exclusively to the anti-Trump hysteria in German media. Finally, Trump is a republican and a businessman with liberal economy attitude, in this sense the market would rather grow.

Thus on 08.11.2016 I did nothing with my portfolio Somewhat better than DUCKS and did sold about one third of another portfolio "Smooth growth faster than bonds" (keyword is smooth, so I rather miss an excess profit than get into a drawdown). On 09.11.2016 at 8:00 (begin of pre-market) many German stocks fell about 5%. But instead of selling in panic I calmly evaluated the situation. OK, thought I, the automotive is down and according to the news the market is afraid of protectionism. Well, both Daimler and BMW are additionally in a strong down-trend, so keep them out. On the other hand for some stocks (like Infinion, Gerry Weber and K+S) there are no political threats, so I buy them. In order to get cash, I sold Bayer and Novartis. These positions were lossy for a long time and I just waited for an opportunity to close them. Interestingly, these stocks grew as everything fell, so I made use of it.

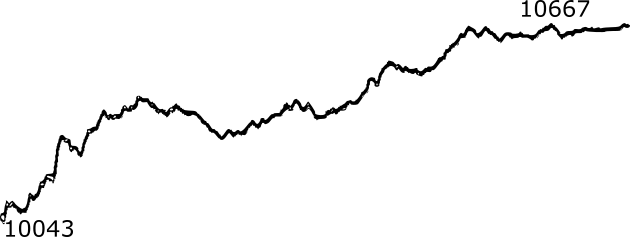

As expected, an economic view has quickly overridden an anti-Trump hysteria and the market has even closed with profit, which I partially took in "Smooth growth faster than bonds". Since I expect a moderate correction next day (those, who made a good profit today might take it tomorrow), I also sold about 10% of Somewhat better than DUCKS. In midterm I expect the market will continue to grow.

P.S.

The election result is not just about markets. First of all it is about democracy. In this sense my highest respect to American people that have not allowed the establishment to manipulate their opinions. Yes, Donald Trump is a contradictory personality but the elites should sometimes get their asses kicked, since a contradictory president is not as worse as a rotten political system.

FinViz - an advanced stock screener (both for technical and fundamental traders)