Surprisingly, German real estate market is quite intransparent, since prices may (like German dialects) strongly vary even in two neighbor villages. But even the summary statistics is often misleading.

In this short study we demonstrate how one can detect an inconsistency and how it might be explained.

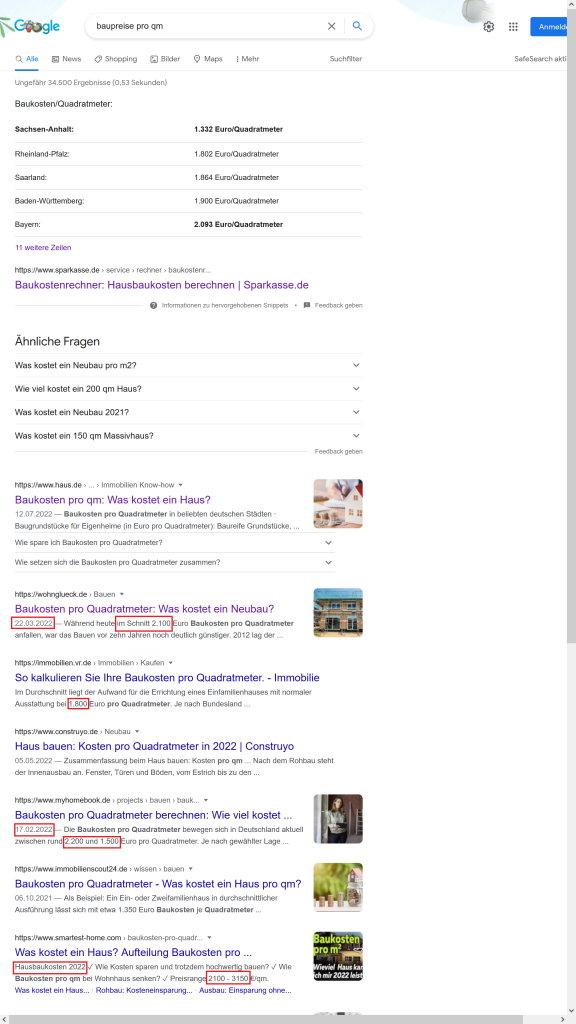

If you are going to build a house in Germany (which is a very non trivial challenge), you will likely start with estimation of construction costs. Let us ask Google (in German, in order to get, so to say, the most native results). Baupreise pro qm means constructions costs per square meter.

Google even provides us with data per Bundesland (Federal State) but, according to Google's summaries, even in Bavaria - the most expensive Bundesland - the prices pro m^2 are about €2000.

We do not blindly trust even Google, this we screen the search results. But they are quite consistent with Google's statistics, note that the results are quite current, not obsolete.

The only problem... these data are a bullshit! How to check it?! Let us google for Kaufpreise pro qm (buy prices per m^2).

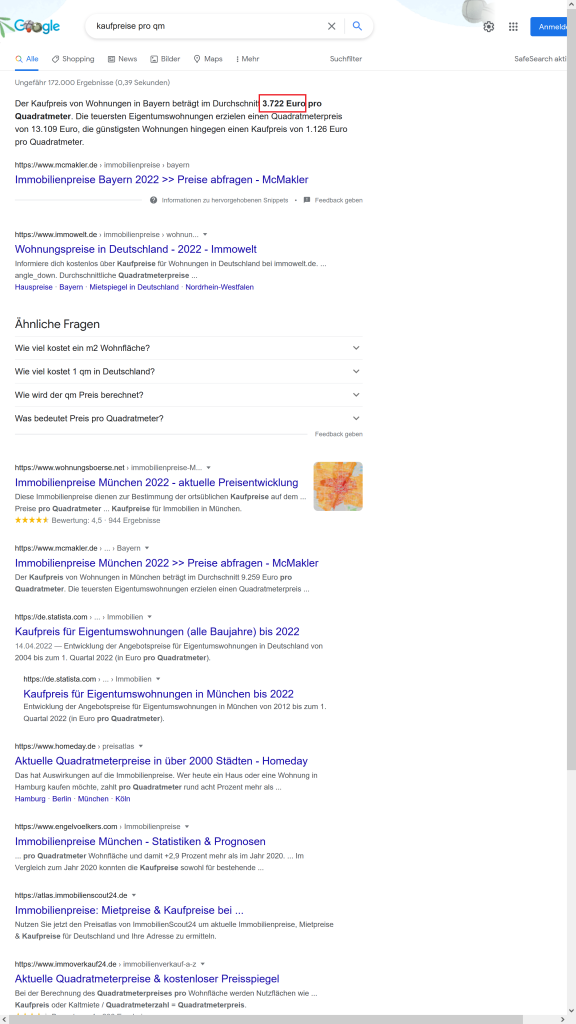

This time Google is (for whatever reason) is not as precise but at least it delivers an average buy price for Bavaria (probably based on my IP-address). We see that it is almost twice of the construction price and this fact shall make us cautious: in a developed economy there cannot be such huge margins. But probably this difference is due to the fact that construction costs do not include land price, whereas buy prices do? Yes, very likely, but (probably with exception of Munich and some other big states) the land is much cheaper relative to construction costs, in particular the German fiscals assume 20% w.r.t. whole price of a real estate object.

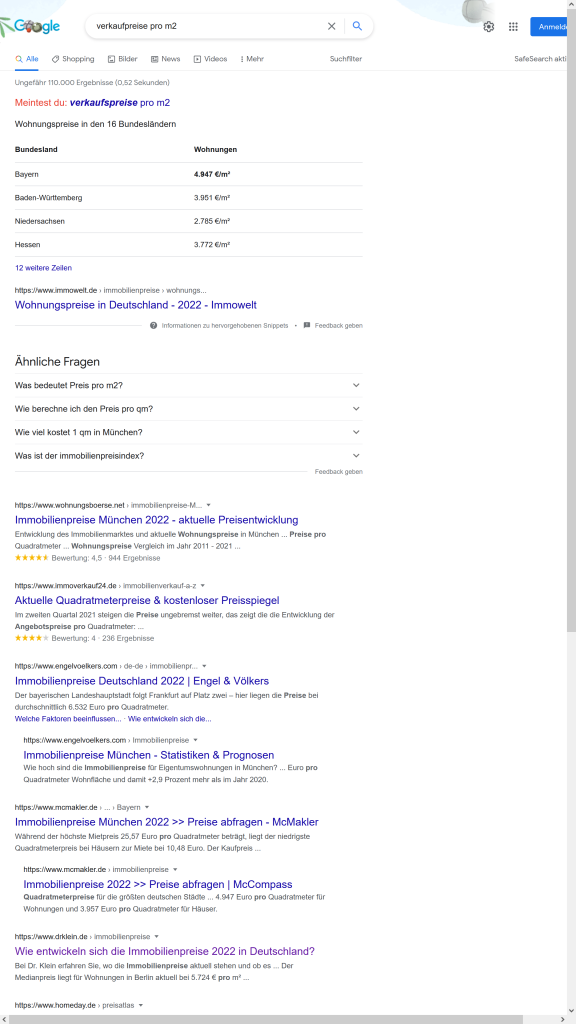

So to dig deeper let us google for verkaufpreis pro m2, i.e. the sale price. Note that in order to get the statistics per Bundesland one (what a serendipity!) needs to make a typo (verkaufpreise instead of verkaufspreise).

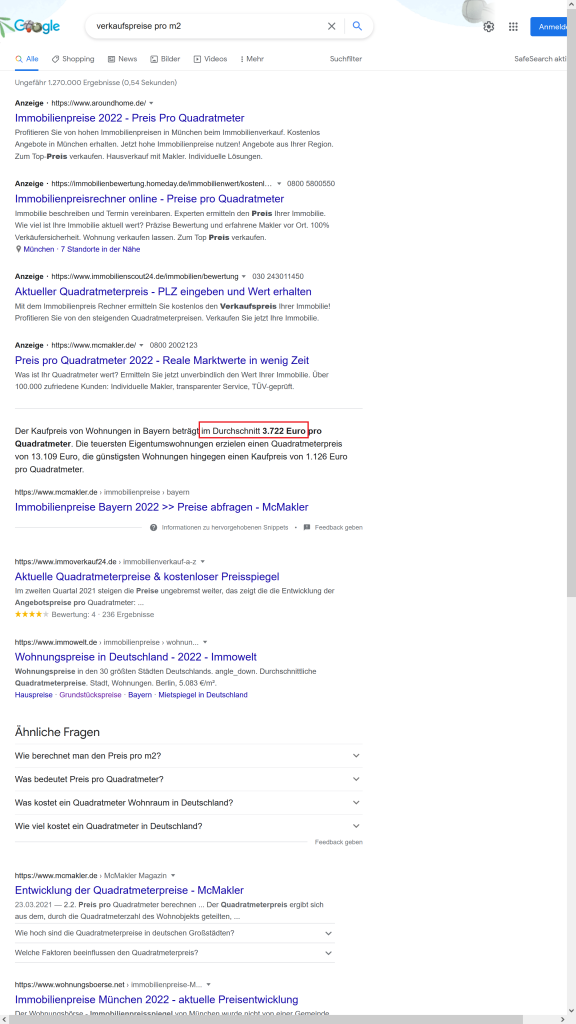

Indeed, if you type the query correctly, you (me) get the summary only for Bavaria ... and this summary is quite different from those from the previous query!

This probably the best proof that LaMDA is not Sentient (at least not yet) but let us get back to our problem.

Such a difference between the constructions and sale prices might be (at least partially) explained by the following factors

- Land - as we have already mentioned, it makes about 20% for an apartment (and about 30%-40% for a one family house)

- Construction prices are often quoted without VAT, whereas sale prices usually include VAT. It makes 19%

- Construction sometimes does not imply a turnkey (in German schlüsselfertig) construction

- Last but not least, constructions companies publicly declare (if they do it at all) the prices [starting] from (Preis ab)

Thus remember: do not trust the statistics unless you have falsified it yourself!

FinViz - an advanced stock screener (both for technical and fundamental traders)