Elle, a 7-year old girl, who learns to manage her wealth had some temporal setbacks but now reaches the CAGR of 8.065%. We recall the trades she has done and explain who one can easily calculate the CAGR of a saving plan.

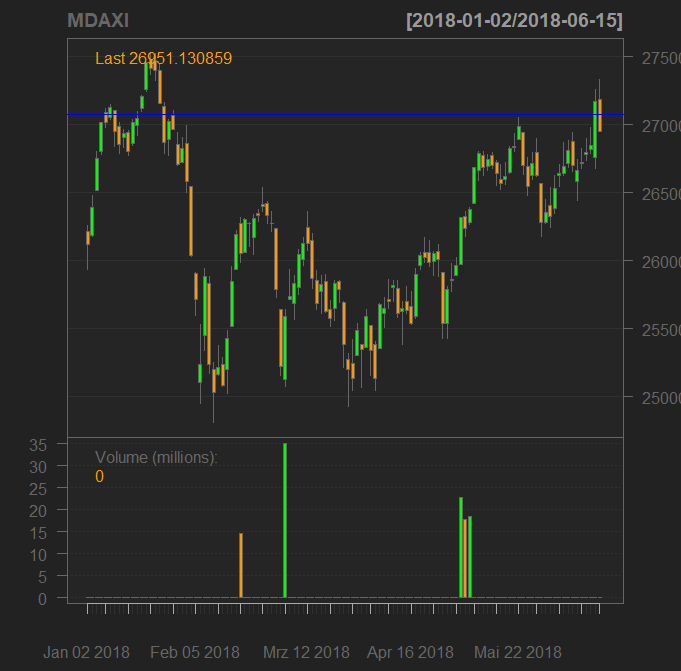

After the recent growth of German stocks Elle noticed that the mDAX reaches the support level at 27070, where she set a take-profit limit order. We approved this decision because although the markets seems to calm down, the trade war tension remains (China strikes back). Moreover, Fed raises the interest rates, which on one hand speaks for a solid economic situation but might also impact the stock prices. As you can readily see the take profit level (triggered on 13/06/2018) was only slightly imperfect 🙂

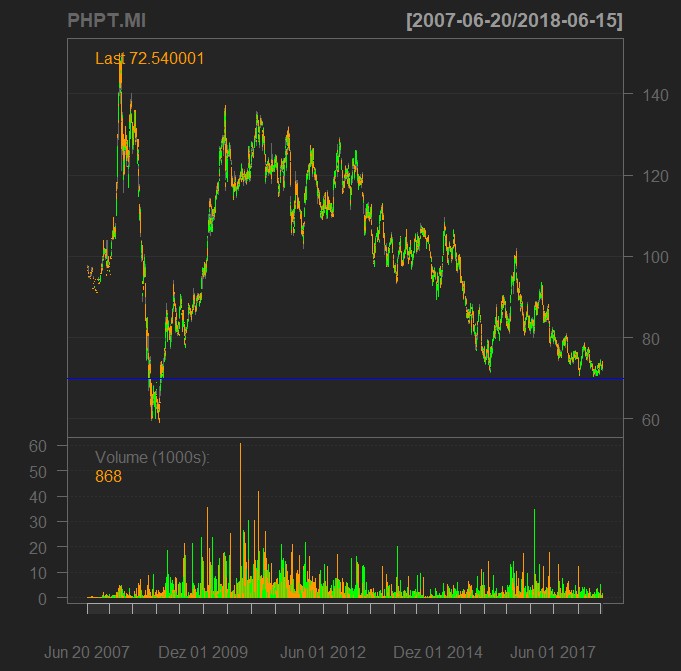

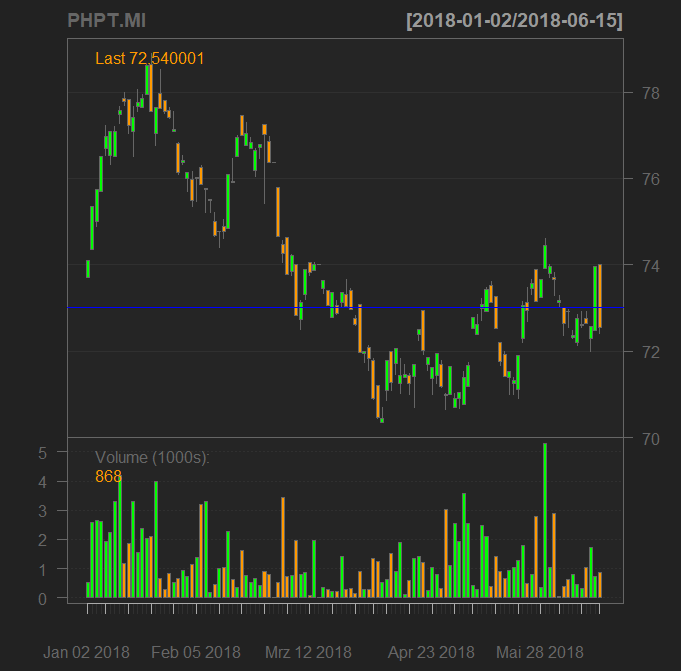

The next step was to buy a physical ETC on platinum. As usual, we chose among those ETCs that can be traded free of charge by DeGiro on Xetra and this is VZLA (DE000A0N62D7).

Although there is a distinct downtrend by platinum we believe it has fell deep enough in order to get started to reverse. Actually it might already do.

Though you shall never forget that about 60% of platinum is used for catalysts in diesel engines (and the reputation of diesels is damaged after the Dieselgate), it is definitely too early to bury this type of motor.

So we used the recent correction (thanks, Fed) and bought at €73.

So we used the recent correction (thanks, Fed) and bought at €73.

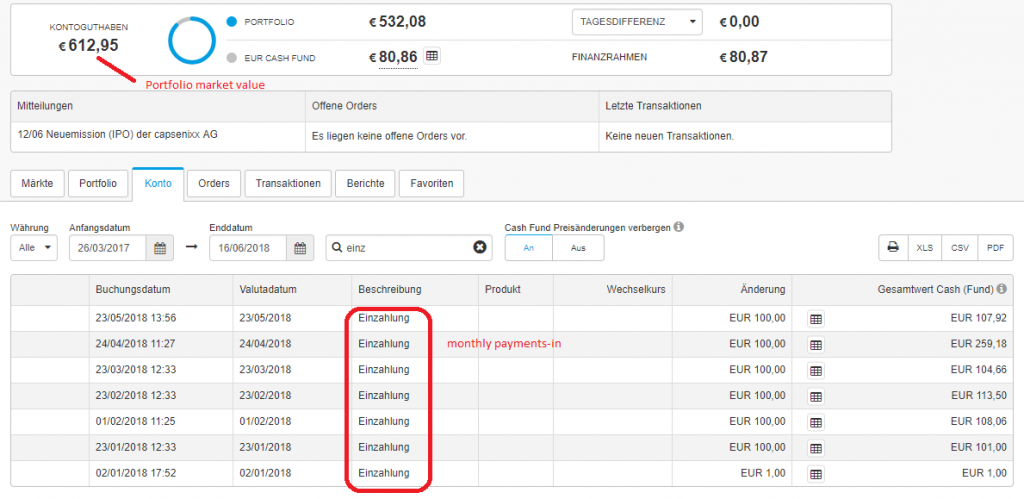

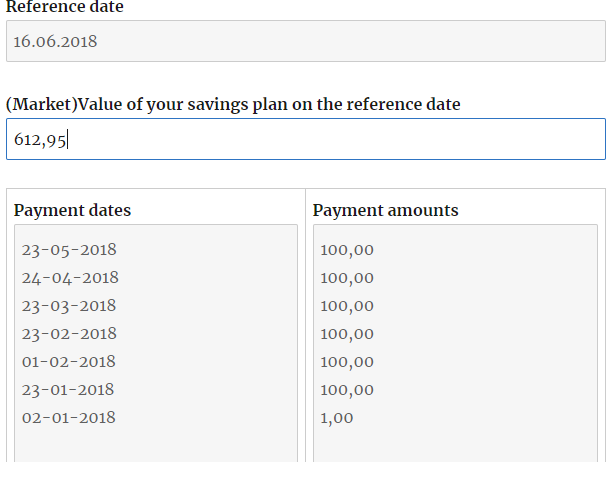

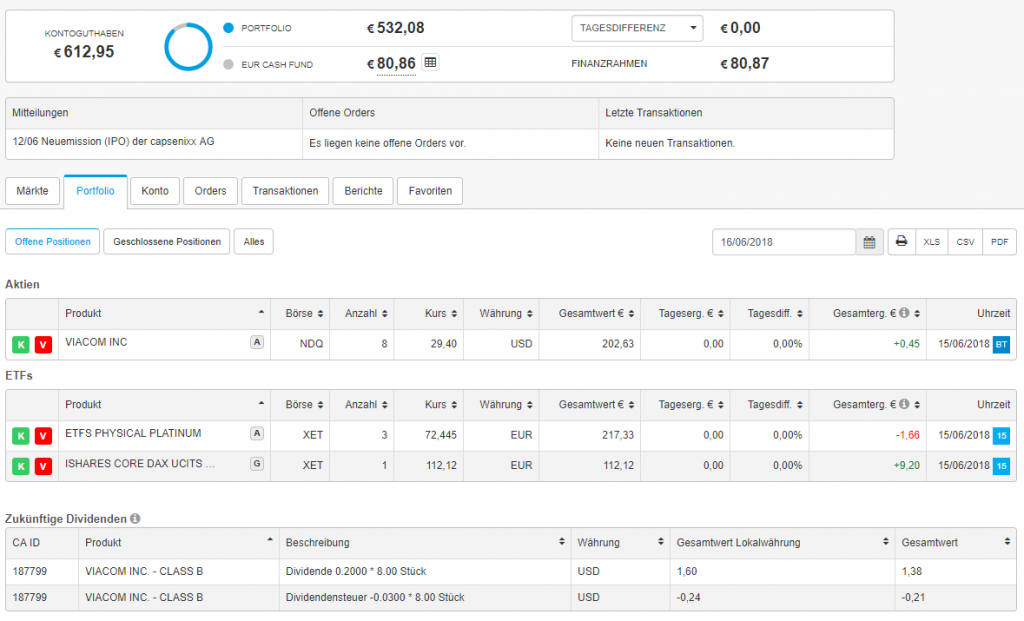

Last but not least we are happy to report that Elle's portfolio has returned to the profitability zone. Before her performance was impacted by the free fall of Viacom, which finally got started to recover. Let us calculate our current compound annual growth rate (CAGR), which is a good performance measure of a savings plan. Note that our trades are completely irrelevant for the calculation of the CAGR. All we need is the monthly installment (payments-in) and the current (market) value of our portfolio. They are as follows:

so we put them in our savings plan CAGR calculator

As usual, here is the portfolio snapshot

FinViz - an advanced stock screener (both for technical and fundamental traders)