Having lost the option to invest in ETCs and inverse ETFs, Elle is forced to concentrate on the stockpicking. So far, the result is (a bit) negative but we are quite optimistic for the long run.

Since Elle's broker DeGiro has disabled trading in commodities and inverse ETFs, it is not anymore possible to make use of opportunities in (precious) metals and oil, as well as to lock the profit with short index ETFs. Indeed it is a serious and very annoying limitation, however, it is (so far) not too critical since we have almost 9 years till Elle's Volljährigkeit (majority age). Thus we decided to concentrate on stock picking in the long term.

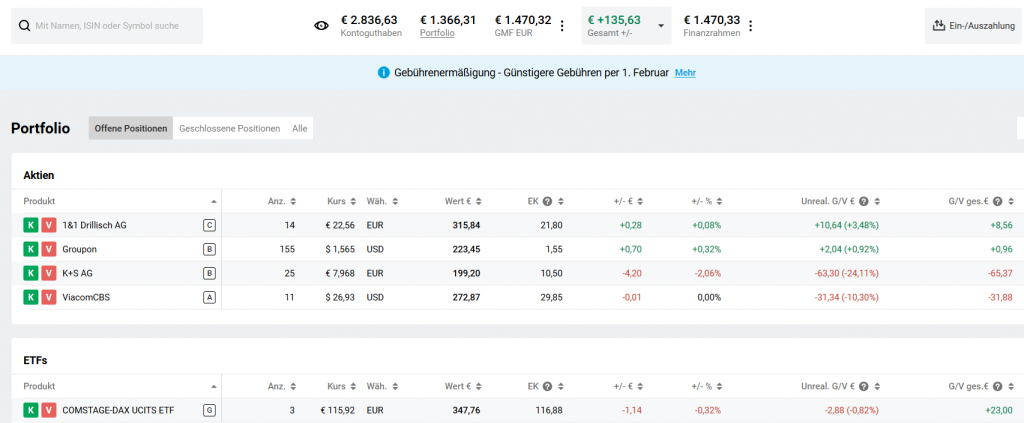

Currently we have the following stocks in our portfolio:

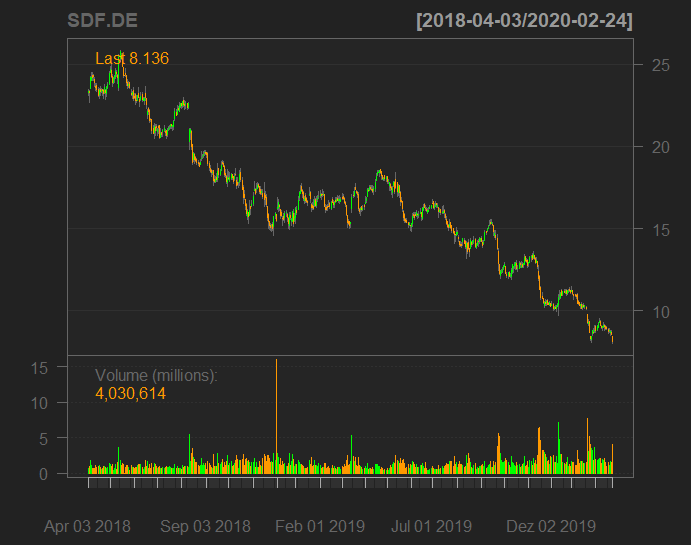

1. K+S (SDF.DE). The market expects that the potash producer will have troubles with serving its debt and fears the increase of equity capital... which normally decrease the price of old stocks. Well, normally, but not always: have a look at Deutsche Bank after the recent capital increase. Additionally, the price/book ratio is about 0.3 (and book values are real). So we continue to keep the stock patiently, however, I used my veto right as Elle wanted to add.

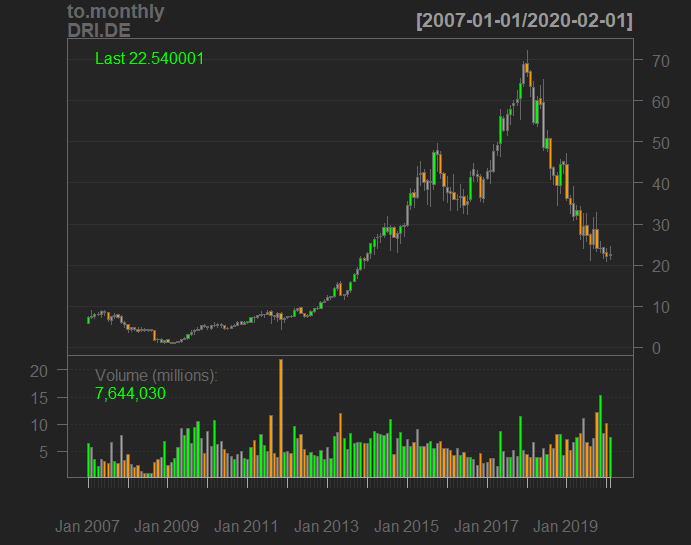

2. 1&1 Drillisch (DRI.DE). This company suffers under exorbitant fees for 5G frequencies, which German government demands (no wonder that the mobile Internet in Germany is often worse than in the 3rd world countries). However, this negative fact seems to be already digested by the market: Drillisch has likely turned around (yesterdays drop is due to common Corona-Virus panic). Additionally, 5G is the future of the telecommunication (we rarely rely on the vision, preferring to rely on the numbers but Drillisch is an exception from the rule... and the numbers are also not bad).

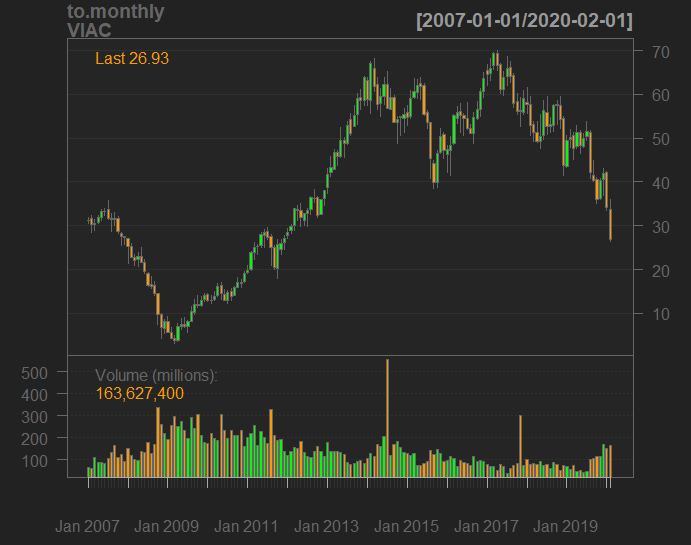

3. ViacomCBS (VIAC). We bought it after the exaggerated market reaction on quarterly report on 20.02.2020. In a sense we have violated the rule not to catch the falling knife (mea culpa: I did not remind it to Elle). Thus the timing was a bit premature, but with P/E = 3.5 (forward P/E = 4.3), the net margin of 20.10% and healthy P/B and debt/equity ratios it shall be no problem. Anyway, we like ViacomCBS much more than e.g. Netflix with forward P/E = 44 (and current P/E = 95)!

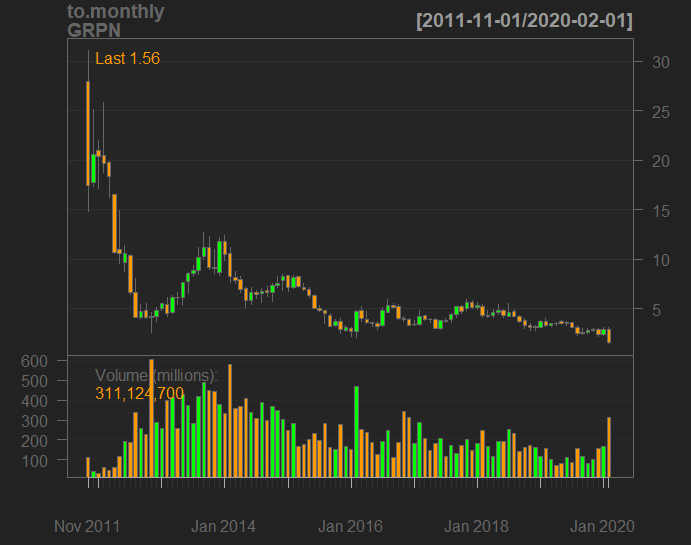

4. Groupon (GRPN). This is mostly (but not purely) a speculative position. According to FinViz Groupon's fundamental data shows that it is quite close to the breakeven frontier.

| Market Cap | 911.23M |

| Income | -25.00M |

| Forward P/E | 22.80 |

| Gross Margin | 53.50% |

| Oper. Margin | 1.30% |

| Profit Margin | -1.00% |

In particular, the gross margin is good, meaning that the net margin can also get positive if Groupon optimizes its business processes (they do). Additionally, the recent drop of -50% is quite grotesque.

BTW, having learnt the lesson with VIAC, we waited till GRPN stabbed in the ground and then bought.

Lust but not least, the complete current snapshot of our portfolio is as follows:

FinViz - an advanced stock screener (both for technical and fundamental traders)