A pig will find the dirt (Russian proverb). The market will find reasons to grow. To fall as well. It is worth documenting (and periodically recalling) what happened on 9/11/2000 (as well as shortly before and after this date).

In the end of October the German market was not in the mood, upset by the 2nd (partial) lockdown. However, after a healthy DAX correction, the greed got started to dominate again. On November the 9th two really(?) good news arrived: first the preliminary victory of Joe Biden, followed by 90% efficiency of Pfizer/BioNtech vaccine.

PFE jumped +15%, however, quickly lost the lion's share of its growth on the fact that the vaccine shall be kept at -70°C (which makes it less practical) and the news that the competitor MODERNA has an even more efficient vaccine.

Even more spectacular was the growth of real estate and travel stocks, like Kimco Reality and Frankfurter Airport.

Contrary to PFE, these stocks still retain their growth, i.e. so far the market refuses to realize the fact, that even if the vaccine can be produced in huge amount, the number of doctors is insufficient to serve the critical mass of gluteus maximus.

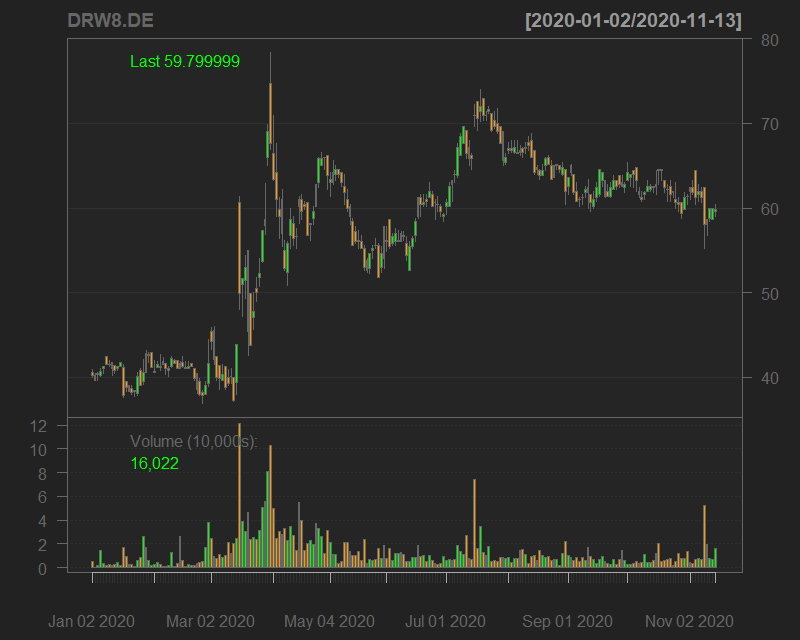

Accordingly, the direct Covid-Winner stocks (like face mask producer Draegerwerk) has dropped.

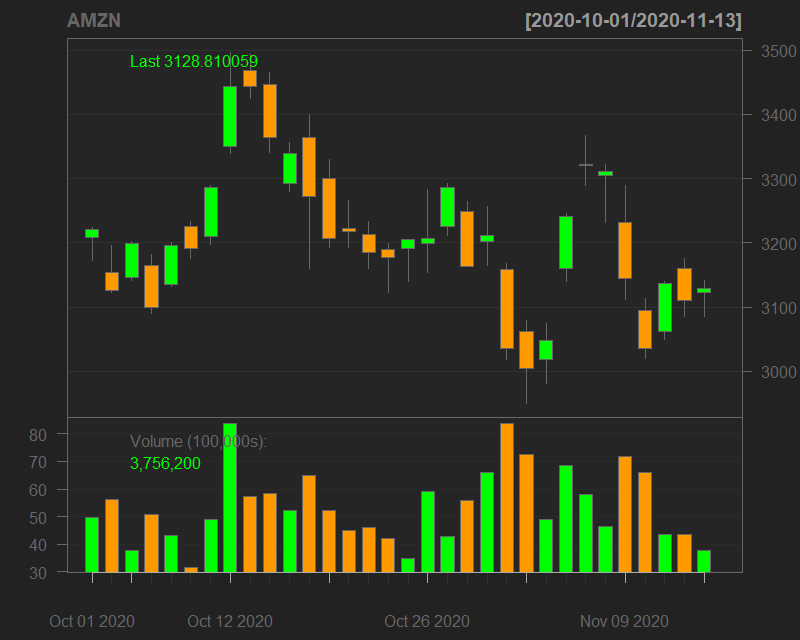

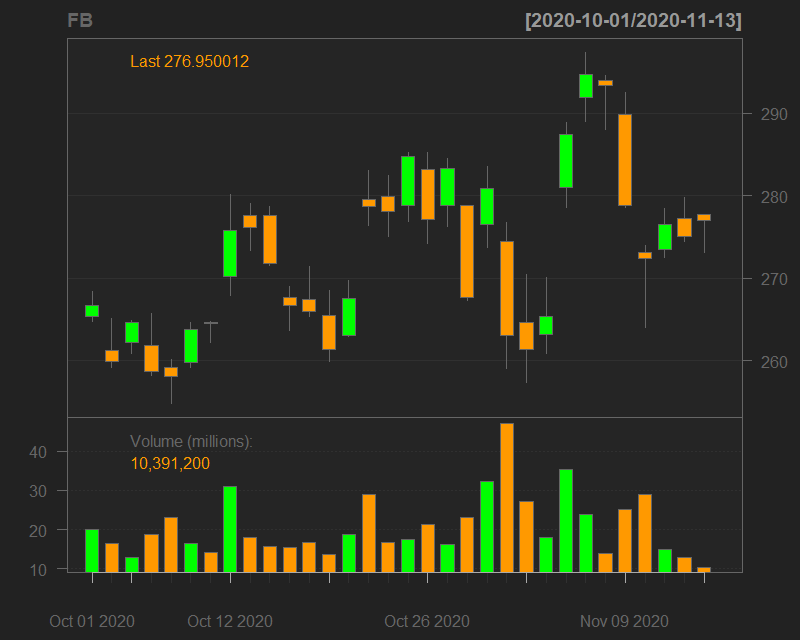

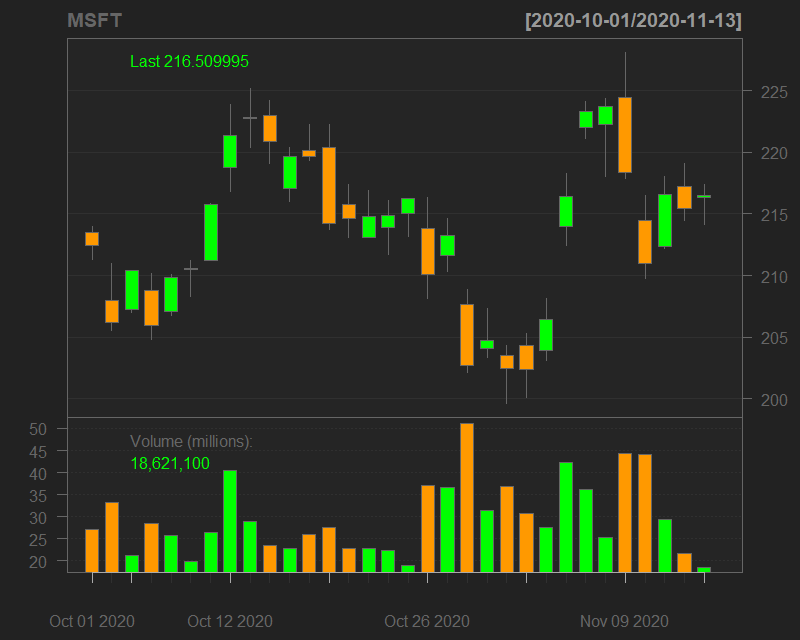

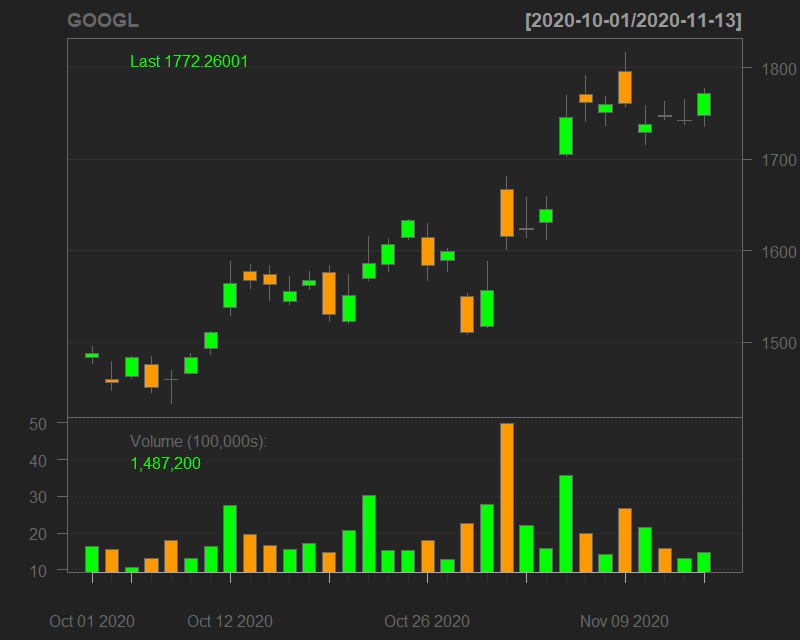

Remarkably, the FAMG stocks also did, which shows that the capital is pretty liquid (can readily flow from on market segment to another).

|

|

|

|

So what I, myself, do? Well, sold KIM with 30% profit (FRA was unfotunatelly sold a couple of days before), patiently keep watching PFE ... and bought the Austrian Post, since Austria announced strict lockdown (which, by the way, is completely ignored by ATX so far).

FinViz - an advanced stock screener (both for technical and fundamental traders)