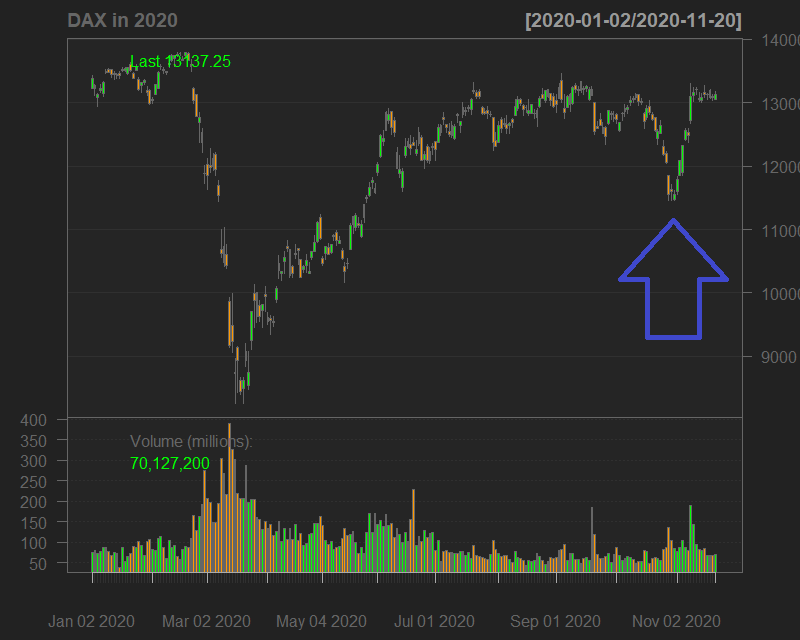

DAX, the German main stock index, fell on the 2nd lockdown in October but quickly recovered in November 2020. Elle made use of this movement, both achieving her target rate of return and beating the DAX.

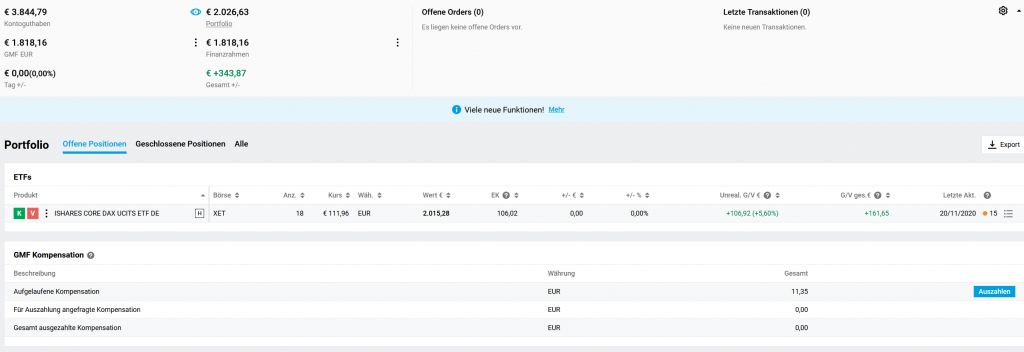

Having learned a bitter lesson from the 1st COVID wave, we patiently held the largest part of our trading capital in bonds (SPPX, IE00BYSZ5V04) and cash. Additionally, we knew that (based on Spain Flu history) the 2nd COVID peak will come, the question was merely how Frau Merkel will react on it, and in turn, how Mr. Market will react on her reaction. Since Frau Merkel (definitely being very intelligent and experienced politician) always reacts as a weathercock on hard issues, it was obvious that she will impose the 2nd lockdown under the pressure of alarmistic mass-media. Given that, we estimated the reaction of Mr. Market by at least -15% and upto -30%. Our estimation turned out to be a bit too pessimistic and that is why we grasped only a part of the market movement. Still it was sufficient to achieve the target CAGR of 6% (the current Elle's CAGR is even 6.4%) as well as to beat a passive investment in DAX, which would bring just €302.65 gain, whereas current Elle's gain is €343.87

FinViz - an advanced stock screener (both for technical and fundamental traders)