In many countries a mortgage shall be completely redeemed to the end of its duration and may be refinanced anytime. In USA one additionally can foreclose his mortgage by mailing his house-keys to a bank. In Germany is different.

First of all, one may completely refinance a mortgage only after 10 years (otherwise one have to pay Vorfälligkeitsentschädigung - a compensation to a bank for missed interest). But taking a long-term mortgage (20 or 30 years) implies a higher mortgage rate, thus it is not uncommon to take several consequent 10- (or sometimes even 5-) year mortgages. In order to optimize mortgage costs / rate change risk relation one can take several submortgages with different durations. Last but not least there is no requirement to amortize a mortgage completely: normally one refinances the residual debt (Restschuld) with a follow-up mortgage (Anschlussfinanzierung).

In this post we discuss the challenges of mortgage optimization and show how two popular programming languages - R and Python - can help us together

Even though the banks do not allow a completely flexible choice of submortgages but rather usually offer 2 or 3 alternatives, it is not easy to make the optimal choice. Let us start with a concrete example: assuming €300000 loan and monthly installment of €1000 what is better - a (sub)mortgage for 20 years by 1.28% p.a. or for 30 years by 1.58%?! Since the rate difference is "merely" 0.3%, a typical risk averse (as well as financially illiteral and innumerate) German usually prefers the latter. Indeed, the second alternative provides a fixed rate (Zinssicherheit) for 30 years, whereas the first one "only" for 20 years. But let us calculate a break-even forward(20, 10) rate, i.e. let us assume that we take a 20Y mortgage and in 20 years refinance it with a follow-up 10Y mortgage by (so far unknown) rate. It turns out that as far as this rate remains under 3.86%, the 20Y mortgage is preferable!

but remember: a human being has no (indigenous) intuition for the exponential function! If at all, there is such intuition only for the speed and the acceleration

, which helps to hunt animals and drive a car. An the

beat a polynom of any order in long term!

Note however that the forward breakeven mortgage rate also does depend on the credit volume and monthly installment (and not only on yield-to-maturity difference). Indeed, assuming (as before) €300000 loan but reducing the monthly installment to €800 results in the breakeven forward mortgage rate of 2.86%... which is not too improbable in 20 years!

In order to help people make suchlike estimations, we have developed a tool (available both in German and English). However, it does not allow a simultaneous calculation of several submortgages. Neither it provides a stochastic mortgage rate simulation nor a nice visualization of results. Thus we developed a next-generation tool, which does have it all.

But let us first reproduce the above-mentioned example.

import numpy as np

from scipy.optimize import fsolve #https://stackoverflow.com/questions/10652675/solving-an-equation-with-scipys-fsolve

class Zinser:

longDebt = 0.0 #residual debt by the long-term mortgage rate binding

shortDebt = 0.0 #residual debt by the short-term mortgage rate binding

notional = 0.0 #mortgage sum

installment = 0.0 #monthly installment

shortRate = 0.0 #mortgage rate p.a. by the short-term mortgage rate binding

longRate = 0.0 #mortgage rate p.a. by the long-term mortgage rate binding

shortDuration = 0 #short mortgage duration in years

longDuration = 0 #long mortgage duration in years

forwardDebt = 0 #auxiliary variable to iterate, must converge to longDebt

forwardRate = 0 #breakeven forward mortgage rate, i.e. longDebt = shortDebt + restshuldVonAnschlussFinanzierung.

# !NB it depends on all mortgage parameters (on notional and installment as well, and not only on shortRate, longRate and durationDiff as by 'canonical' forward rates)

def __init__(self, notional, installment, shortRate, shortDuration, longRate, longDuration):

self.longDebt = notional

self.shortDebt = notional

self.notional = notional

self.installment = installment

self.shortRate = shortRate

self.longRate = longRate

self.shortDuration = shortDuration

self.longDuration = longDuration

for ml in range(12*longDuration):

self.longDebt -= (installment - self.longDebt * longRate/12) #ToDo: break if the debt becomes negative

for ms in range(12*shortDuration):

self.shortDebt -= (installment - self.shortDebt * shortRate/12)

self.forwardRate = fsolve(self.iterateForwardZins, shortRate)

def iterateForwardZins(self, forwardRate):

self.forwardDebt = self.shortDebt

durationDiff = self.longDuration - self.shortDuration

for ma in range(12*durationDiff):

self.forwardDebt -= (self.installment - self.forwardDebt*forwardRate/12)

#print(self.forwardRate) #for debugging

return self.longDebt - self.forwardDebt

v1 = Zinser(3e5, 800, 0.0128, 20, 0.0158, 30)

v1.forwardRate

Out[15]: array([0.02860649])

v2 = Zinser(3e5, 1000, 0.0128, 20, 0.0158, 30)

v2.forwardRate

Out[21]: array([0.03857974])

In my opinion the advantages of the object-oriented programming in this case are obvious: in order to find the optimal solution we need to deal with many submorgages, which are somewhat complex structures so that is better to keeps them as objects (rather than e.g. as a list of lists). In the sense of OOP Python has a clear advantage over R. But do you know a (proven) Python implementation of a Cox-Ingersoll-Ross (CIR) stochastic process? And such a powerful visualization tool as Shiny (and even if, how about a service like shinyapps.io)?!

Thus our further goal is to integrate R and Python. Fortunately, there is an excellent R-package for this: https://rstudio.github.io/reticulate/

I recommend to install it from GitHub: remotes::install_github("rstudio/reticulate", force = T, ref = '0a516f571721c1219929b3d3f58139fb9206a3bd')

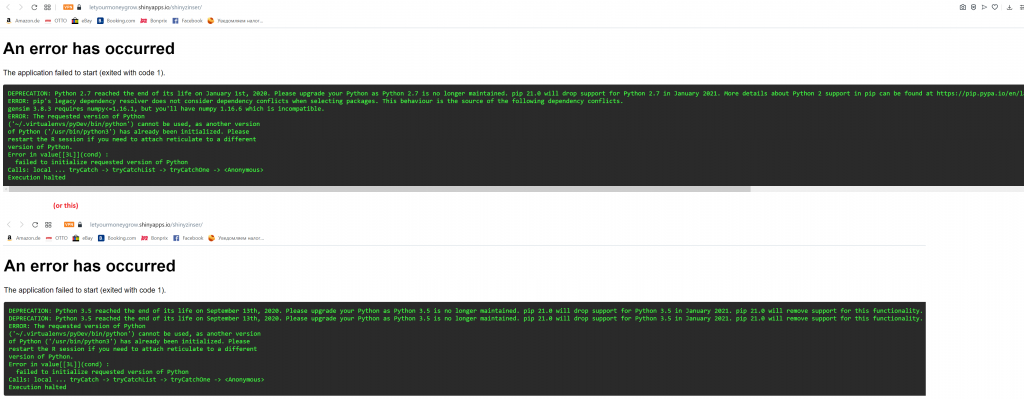

Further we need to configure the virtual Python environment in our shiny app. By some trial and error I came to the following solution for shinyapp.io

library(reticulate)

virtualenv_create('pyDev')

virtualenv_install("pyDev", packages = c('numpy','scipy'))

use_virtualenv("pyDev", required = TRUE)

import('numpy')

source_python('bauFinanzierungForwardZinsRechner.py')

On a local machine one can explicitly specify, which Python interpreter to use:

use_python("C:/Users/vasily/anaconda3/python.exe", required=TRUE)

source_python('bauFinanzierungForwardZinsRechner.py')

That's it, R and Python work together: https://letyourmoneygrow.shinyapps.io/shinyzinser

to have a look on how to render two shiny outputs (we need closures to make use of reactivity concept but this example gives an short and easy explanation).

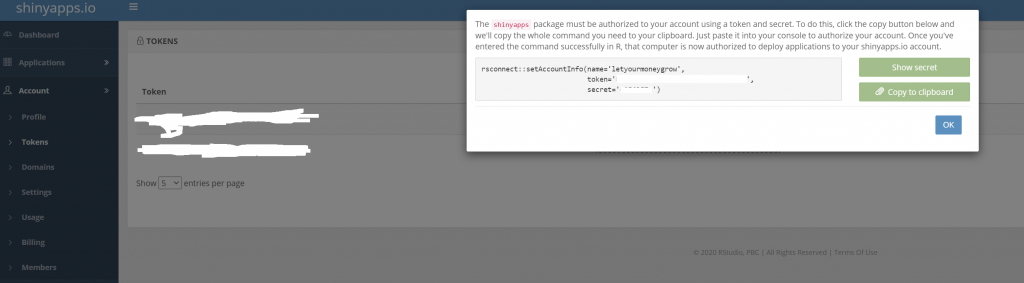

Additionally, it is worth mentioning that an App deployment to shinyapps.io really easy:

1) get your token

2) In your R-Studio set the working dir to app folder and then

> rsconnect::setAccountInfo(name="

> library(rsconnect)

> deployApp()

Preparing to deploy application...

Update application currently deployed at

https://letyourmoneygrow.shinyapps.io/shinyzinser/? [Y/n] y

DONE

Uploading bundle for application: 3357099...DONE

Deploying bundle: xxxxxxxx for application: yyyyyyy ...

Waiting for task: 835446185

building: Parsing manifest

building: Building image: zzzzzzz

building: Fetching packages

building: Installing packages

building: Installing files

building: Pushing image: xxxxxxx

deploying: Starting instances

rollforward: Activating new instances

unstaging: Stopping old instances

Application successfully deployed to https://letyourmoneygrow.shinyapps.io/shinyzinser/

3) If something goes wrong, shinyapp.io provide logs

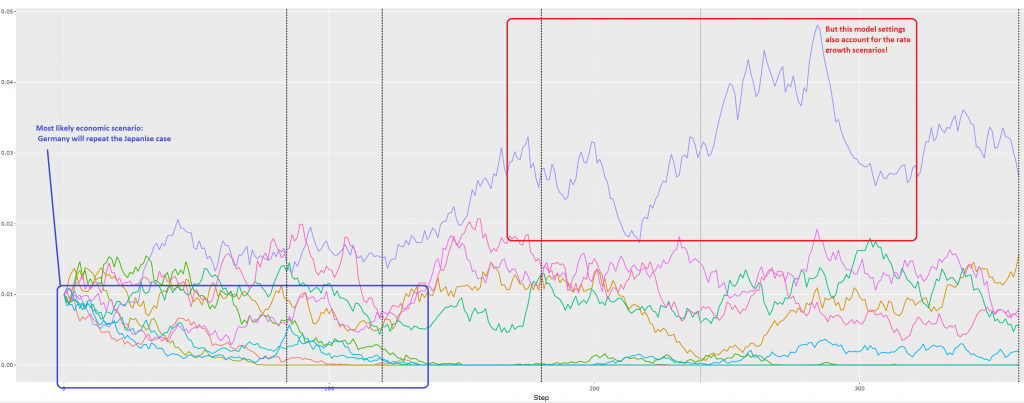

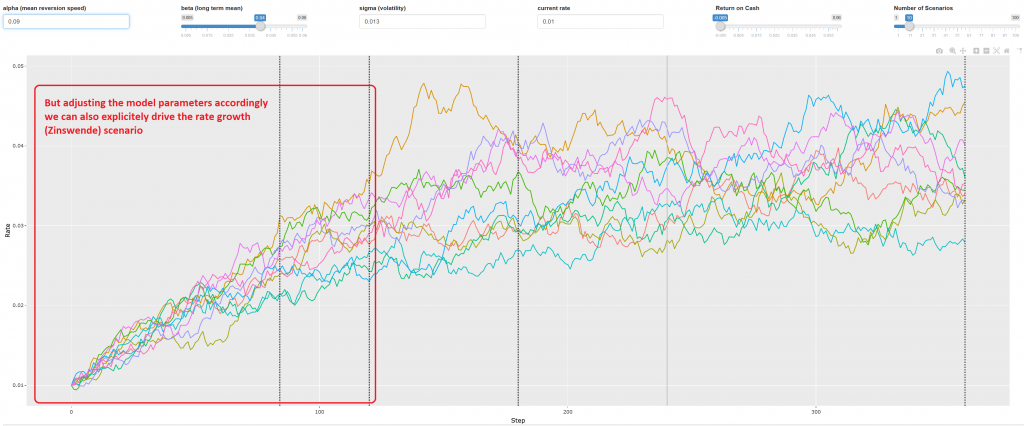

So far so good for technical part, but what about the business usage? Well, I gonna write a separate post on it and so far I would just like to mention that the simulation shows pretty distinctly: (sic! in my case) it is better to take the submortgages with a shorter duration and smaller rate!

Of course the simulation results depend on model assumptions very strongly. But the CIR model is pretty flexible, so I can (and of course do) generate very versatile economic scenarios.

Generally, I worked one day long on this app but it will likely save me about €30000 (over 30 years). A worthy investment, wouldn't you agree? If yes, do not hesitate to contact me!

FinViz - an advanced stock screener (both for technical and fundamental traders)