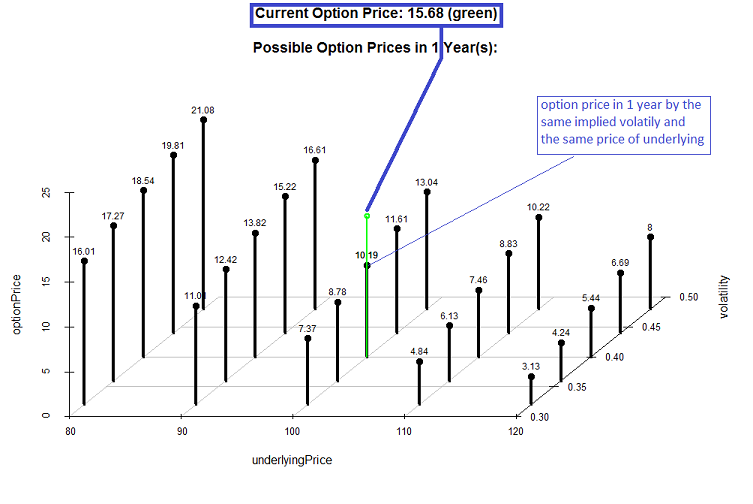

Many retail investors are unaware that the option price sometimes depends on the (implied) volatility much stronger than on the price of underlying. They also often underestimate the losses of time value. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

We support the calculation of American and European CALLs and PUTs. We also take dividends into accounts. Dividends increase the value of a PUT and decrease the value of a CALL option. Note that if you use the implied volatility, the dividend-yield is usually already taken into consideration, so set it to zero. But never neglect it if you calculate with historical volatility, esp. in case of a stock, which is known for its generous dividend payoffs.

We support the calculation of American and European CALLs and PUTs. We also take dividends into accounts. Dividends increase the value of a PUT and decrease the value of a CALL option. Note that if you use the implied volatility, the dividend-yield is usually already taken into consideration, so set it to zero. But never neglect it if you calculate with historical volatility, esp. in case of a stock, which is known for its generous dividend payoffs.

FinViz - an advanced stock screener (both for technical and fundamental traders)