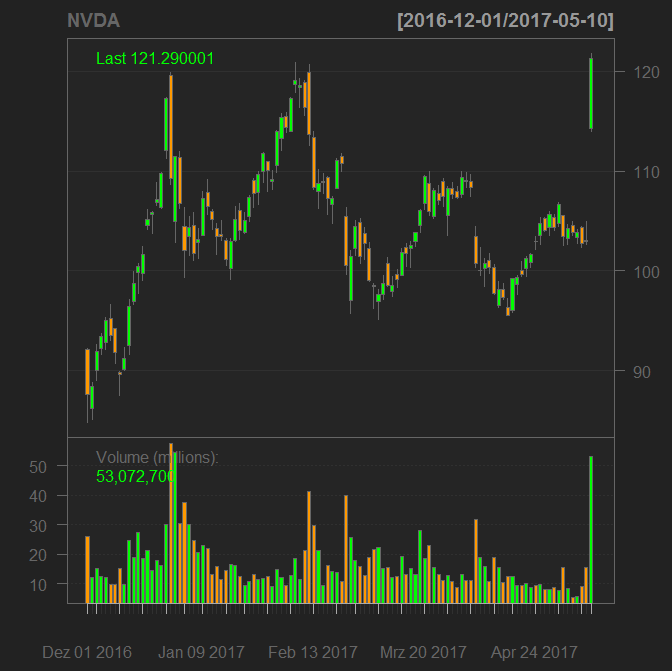

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Tag: put

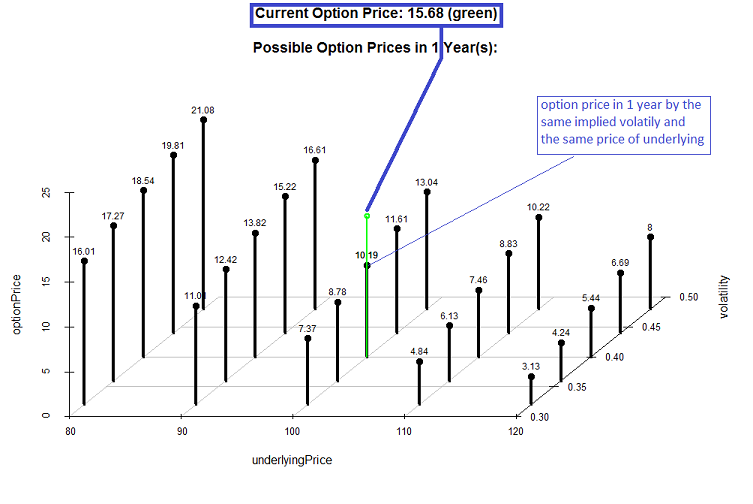

Online Option Calculator – estimate the future value of an option

Many retail investors are unaware that the option price sometimes depends on the (implied) volatility much stronger than on the price of underlying. They also often underestimate the losses of time value. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

Continue reading "Online Option Calculator – estimate the future value of an option"

Continue reading "Online Option Calculator – estimate the future value of an option"

letYourMoneyGrow.com nimmt IndexGarant von SV SparkassenVersicherung unter der Lupe

Aufmerksam darauf gemacht wurde ich durch die Google-Ads hier. Die Werbung versprach attraktive Rendite und dabei keine Verlustrisiken. Das hat meine Forschungsinteresse geweckt. Testergebnis: das Produkt ist innovativ und volle Verlustrisikovermeidung ist möglich. Ob die Rendite aktuell wirklich attraktiv sein wird, ist aber nicht so offensichtlich [UPDATE 20.01.2017 - sie ist nicht attraktiv!].

Aufmerksam darauf gemacht wurde ich durch die Google-Ads hier. Die Werbung versprach attraktive Rendite und dabei keine Verlustrisiken. Das hat meine Forschungsinteresse geweckt. Testergebnis: das Produkt ist innovativ und volle Verlustrisikovermeidung ist möglich. Ob die Rendite aktuell wirklich attraktiv sein wird, ist aber nicht so offensichtlich [UPDATE 20.01.2017 - sie ist nicht attraktiv!].

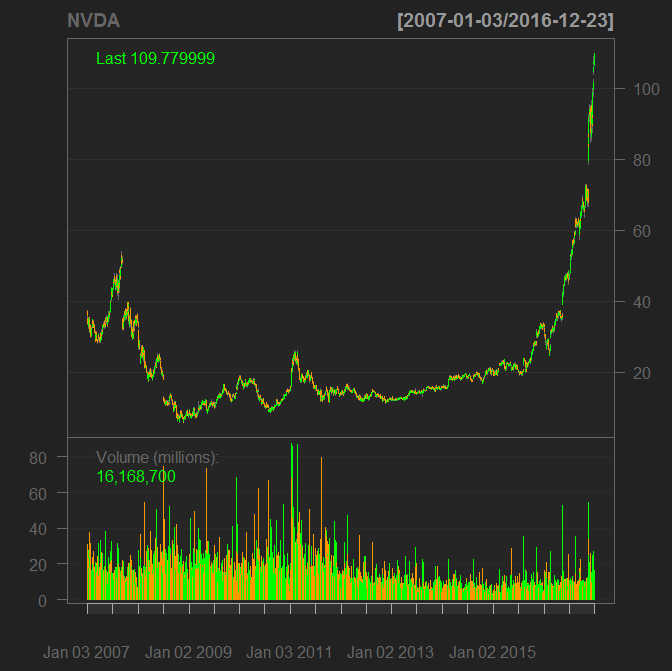

My PUT Option on NVIDIA – a case study of nearly perfect trading decision

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

Continue reading "My PUT Option on NVIDIA – a case study of nearly perfect trading decision"