Elle, a 7-year old girl who manages her savings plan with letYourMoneyGrow.com, became more careful after her stockpicking flop with GoPro and readily agrees to invest in an index ETF so far. We explain why we bought an ETF on mDAX this time and review our quarterly performance.

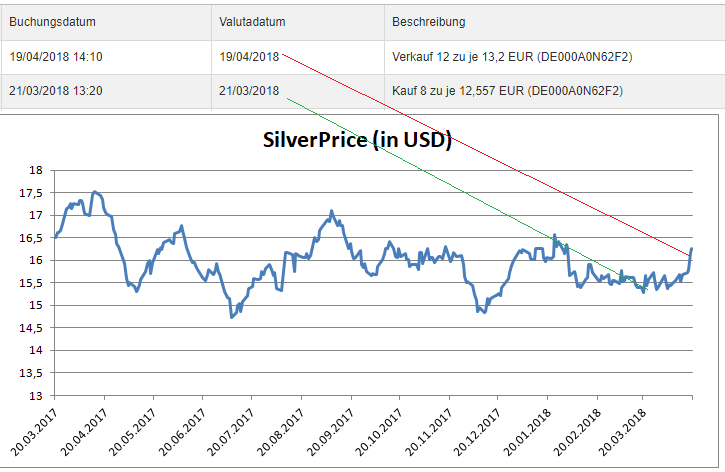

As we have previously reported, Elle's attempt to invest in GoPro was unsuccessful. Fortunately, we managed to partially mitigate the loss, purchasing silver low and selling it high (we got a cash for this deal after triggering a stop loss for GoPro stock).

We sold Silver because, as you can readily see, it swings in a narrow range and was going to reach its upper bound. But first of all we need an extra cash to buy an mDAX-ETF. The problem is: Elle gets €100 each month but the only available mDAX ETF without broker fees (Deka MDAX UCITS ETF, DE000ETFL441, ETR:ELF1) currently costs €252,35

We sold Silver because, as you can readily see, it swings in a narrow range and was going to reach its upper bound. But first of all we need an extra cash to buy an mDAX-ETF. The problem is: Elle gets €100 each month but the only available mDAX ETF without broker fees (Deka MDAX UCITS ETF, DE000ETFL441, ETR:ELF1) currently costs €252,35

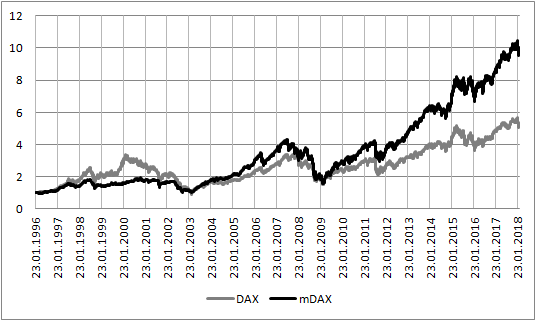

But why we decided for mDAX (and not DAX) this time? Well, first of all Elle already has two DAX-ETFs in her portfolio. Moreover, it is German mid-caps that constitute the competitiveness core of the German economy. The mDAX permanently beats the DAX after stock market recovery in 2009.

This tendency will likely sustain; Vasily Nekrasov explains why in his book Altersarmut verhindern: Eine Praktische Anleitung.

This tendency will likely sustain; Vasily Nekrasov explains why in his book Altersarmut verhindern: Eine Praktische Anleitung.

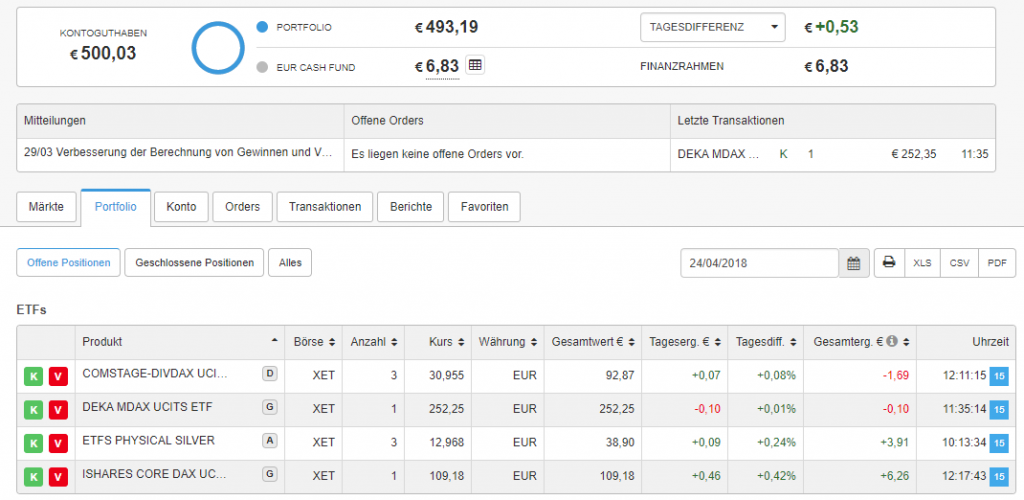

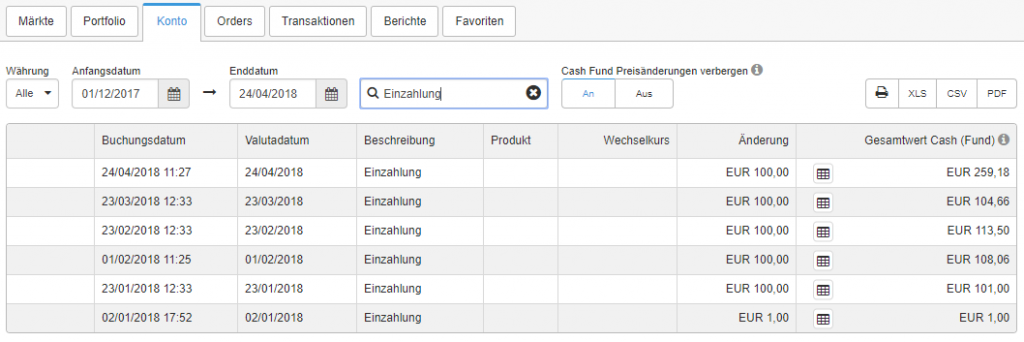

Since we already run the savings plan for a while, let us calculate its CAGR (Compound annual growth rate or Rendite p.a. in German). We do this by means of our Savings Plan Growth Rate Calculator. In order to calculate the CAGR we need the dates and sizes of installments (Einzahlungen) and the portfolio value on current (reference) date. Note that the intermediary portfolio dynamics is fully irrelevant for this calculation (in other words: by calculation of the CAGR for a given date we don't care about the portfolio value before this date... but of course we care about it when e.g. calculate the maximum drawdown or other risk measures).

So Elle's portoflio is currently worth €500.03

and the installments we as follows

and the installments we as follows

We put this data in our Savings Plan Growth Rate Calculator

We put this data in our Savings Plan Growth Rate Calculator

and the CAGR is... -1.32%

Well, it is not completely a breakeven, but in non-annualized term the loss is equal to (501-500.03)/501 = 0.19%, which is really negligible.

The problem is that so far the savings plans runs merely for 4 months (=0.25 years), which is really a short time span, thus the CAGR is so sensitive to the small changes of portfolio value.

As such the result is good because the market are falling since the end of Jan 2018.

Questions, suggestions, ideas from yourside! You are welcome to discuss them in Elle's forum!

FinViz - an advanced stock screener (both for technical and fundamental traders)