In this essay I try to figure out the most fair reward system for a wealth manager. I don't appeal to the notorious utility functions or mathematical optimization models that fail in practice due to the errors of parameter estimation. Rather I rely on best practices and common sense.

Claiming to offer the best reward system for a wealth manager seems to be too ambitious a bit (and it really is). However, what I suggest should be not too far from the global optimum. Anyway, you are highly welcome to discussion and feel free to make an even better suggestion 🙂

So:

1. It is highly recommended to require that the portfolio manager invests a significant amount of his (or her) own wealth in a fund or trading strategy, which he (or she) manages. Otherwise if a portfolio manager has a good luck, he will collect a fat fee... and if he gambles away everything, he loses nothing (customer does). There are uncountably many examples of extremely risky strategies with high management performance fees, e.g. look at this.

Strictly speaking, this requirement is not always technically feasible. Sometimes there are compliance reasons behind, sometimes a portfolio manager can has other risk/reward preference than his customers. However, although it is hardly possible to do something against compliance, it is more or less possible to "bring to a common denominator" the risk/reward preferences of the portfolio manager and his customers. Usually the customers are somewhat more risk-averse, so they might find a suitable fraction of their wealth to be invested in a fund and they keep the rest in cash or treasuries. Of course we made a simplification, assuming that risk [perception] is linear w.r.t. the wealth fraction, invested in a risky fund. But it will likely do for practical purposes. Finally, in his Handbook of hedge funds François-Serge Lhabitant says (likely meaning CAPM): economics is the only branch of science, where one can get the Nobel prize for the linearization.

2. Trading cost shall be born by the customer but they shall be fully documented. An "all-in" management fee (usually about 0.5%-1.5% p.a., which is no small thing in long term) is a common but actually a bad practice, which (being nontransparent) leaves a lot of space for abuse.

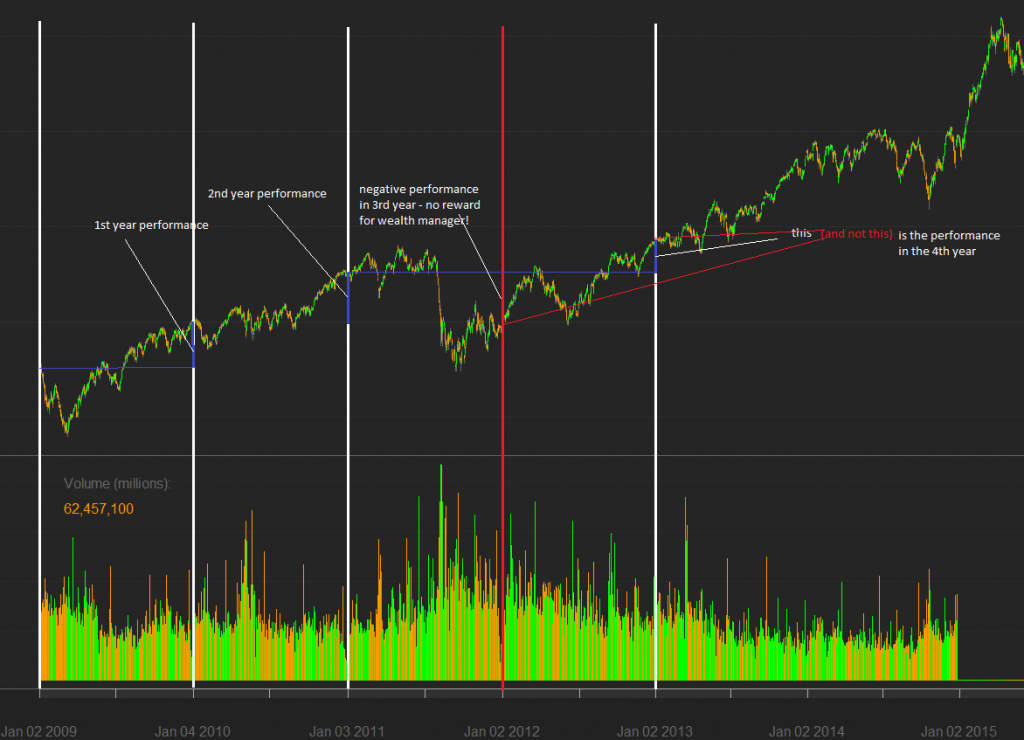

3. Strong high-water mark principle to measure the performance of the portfolio manager.

A high-water mark is the highest peak in value that an investment fund has reached.

But this definition is non-unambiguous. First of all many funds tend to charge the performance fee immediately after a new high was reached (but what if a fund falls down after that)?! Secondly, sometimes they reset the watermark each year.

For one-time investment I propose to take the ends of year (alternatively quarter or month) as the reference dates. A manager will be paid in the end of a period (year, quarter, month) only if the fund price is higher than on all previous reference dates. If it is the case, the performance is calculated as the difference between the current price and the maximum of price on all previous reference dates.

A savings plan can be decomposed to a set of one-time investments.

If savings are made aperiodically then the first reference date is the date on which the saving was made.

4. No benchmark for the calculation of the performance fee.

This might seem strange at first glance. But the nuance is: portfolio management according to the Kelly criterion is the optimal one in many respects. And Kelly-like investor is benchmark-free. Trying to pursue a benchmark a portfolio manager risks to act sub-optimally. In a sense it is currently the case with my wikifolio Somewhat better than DUCKS (whose benchmark is DAX, as its name implies). Trying (and succeeding) to beat the DAX, I still need to keep a big share of wealth in a DAX ETF, otherwise there would be a too high risk of a negative deviation from the benchmark.

Contrary, another wikifolio of mine "Smooth growth faster than bonds" has no benchmark (well, I all the same try to minimize the maximal drawdown and to keep the annual growth rate at least by 4% p.a. but still I have more freedom to strive for the portfolio optimality).

Note that this proposition of course does not mean that the benchmarking is useless. Rather, comparing the fund manager's performance with the performance of a relevant benchmark may help an investor to decide whether to invest in this fund or not. But if decided to invest, don't tie a wealth manager to the benchmark and let him make use of the opportunities that Mr. Market spontaneously provides.

5. And last but not least, which profit share does a portfolio manager deserves?! Probably the most difficult issue. Well, a common range is from 5% to 20%. If I were required to name a single number, I would say 10% is ok. But of course one shall not try to skimp on manager reward in case of an outstanding performance. For instance, if Einstein or HBecker would agree to manage my wealth, I would not hesitate to pay even more than 20% of profit as manager reward.

FinViz - an advanced stock screener (both for technical and fundamental traders)