One month ago we screened all stocks from SP 500 index and suggested busy investors to get rid of information overload and purchase our stock list just for 5 USD. Only a few investors considered our offer, which has brought about 3% return within a month, whereas SP 500 return stagnated around zero.

Our report actually consisted of two lists, so to say a "long short list" and a "short short list". In this post we disclose the first one and discuss its performance. You can still buy the report and see the second list, which contains the best opportunities in our opinion. Although keeping the short list too short may result in an insufficiently diversified portfolio, you should always keep in mind that:

a) Diversification shall be done cleverly and if you do it naively you may even increase the risk of your portfolio.

b) Often it is better to select less but better stocks.

First of all let us look at the performance of SPY in June 2018. As you can readily see, SPY returns stagnated around zero.

Contrary to SP 500, our stock list would bring upto 3% return. We say "upto" because we recommended (and did ourselves so) to invest about 50% of trading capital in stocks due to currently unstable markets. This yielded ca. 1.5%. The stock performance is as follows

| Stock | Price on 29.06.2018 | P/L from 01.06.2016 |

| VIACOM B | 30,05 | 11,70% |

| ADVANCE AUTO PARTS | 135,22 | 5,40% |

| APACHE CORP | 46,63 | 19,50% |

| ALLIANCE DATA SYSTEMS | 232,20 | 9,90% |

| BIOGEN INC. | 289,78 | -2,50% |

| ACUITY BRANDS INC. | 115,28 | -3,10% |

| KIMCO REALTY CORP | 16,91 | 9,30% |

| ALPHABET INC A | 1125,88 | -0,70% |

| CBS CORP. | 56,20 | 10,10% |

| ALEXION PHARMAC. | 124,44 | 4,90% |

| MACYS | 37,30 | 5,00% |

| CIMAREX | 101,42 | 14,80% |

| BEST BUY CO INC | 74,34 | 7,60% |

| PROCTER GAMBLE | 77,90 | 5,70% |

| MOLSON COORS BREWING COMPANY | 67,79 | 9,40% |

| MATTEL | 16,39 | 4,10% |

| GILEAD SCIENCES DL-,001 | 70,70 | 3,50% |

| PG&E | 42,41 | 0,10% |

| CENTURYLINK | 18,59 | 4,40% |

| AT&T INC. | 32,03 | -1,70% |

| WELLS FARGO | 55,43 | 1,50% |

| BRISTOL MEYERS | 55,15 | 3,90% |

| DISNEY (WALT) CO. | 104,62 | 5,30% |

| PPG INDUSTRIES | 103,37 | 0,80% |

| REGENERON PHARMACEUTICALS | 343,78 | 11,30% |

| INVESCO MORTGAGE CAPITAL | 15,81 | -3,50% |

| INTERCONT. EXCHANGE | 73,37 | 1,60% |

| ALASKA AIR | 60,17 | -1,30% |

| THE SOUTHERN COMPANY | 45,93 | 3,50% |

| SNAP INC | 13,07 | 13,50% |

| NASDAQ INC. | 91,09 | -1,30% |

| INTL BUS. MACH. DL-,20 | 139,35 | -1,90% |

| COLGATE PALMOLIV | 64,58 | 2,60% |

| PHILIP MORRIS | 80,48 | 2,30% |

| VENTAS | 56,77 | 3,40% |

| GENERAL MILLS | 43,76 | 2,20% |

| FRANKLIN RESOURCES | 31,95 | -6,30% |

| GOLDMAN SACHS BDC INC. | 20,35 | -1,40% |

| GGP INC. | 20,31 | -0,60% |

| WALGREENS BOOTS ALLIANCE CORP. | 59,45 | -6,00% |

| DUKE ENERGY CORP. (NEW) | 78,60 | 3,00% |

| PPL | 28,44 | 5,20% |

| CINCINNATI FIN. | 66,66 | -5,40% |

| APPLE COMPUTER INC. | 185,16 | -2,50% |

| CARDINAL HEALTH | 48,61 | -7,90% |

| CINTAS | 184,46 | 0,00% |

| APPLIED MATERIALS INC. | 46,12 | -11,60% |

| WHIRLPOOL CORP | 145,72 | 0,80% |

| AMERICAN AIRLINES | 37,82 | -13,40% |

| INTEL CORP. DL-,001 | 49,62 | -12,70% |

| XEROX CORP. REGISTERED SHARES DL 1 | 23,89 | -12,30% |

(Note that we set limit orders for AMERICAN INTERNATIONAL GRP INC at $50 and for ALLERGAN at $145 but they we not triggered, that is why these two stocks are not included in table above).

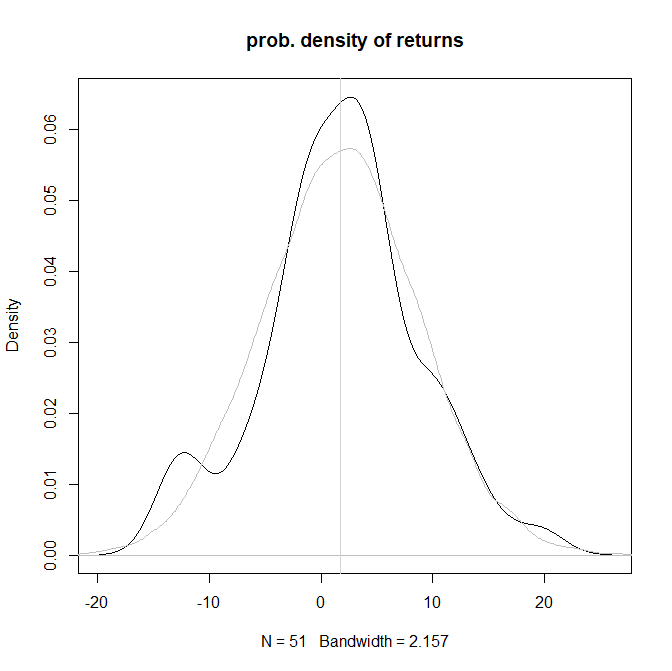

But can this stock picking result be merely a good luck? Well, first of all we see that we cannot reduce the performance to a one or two stocks with a particularly good return. Moreover, the probability density of returns (black) is pretty close to the density of the normal distribution (grey).

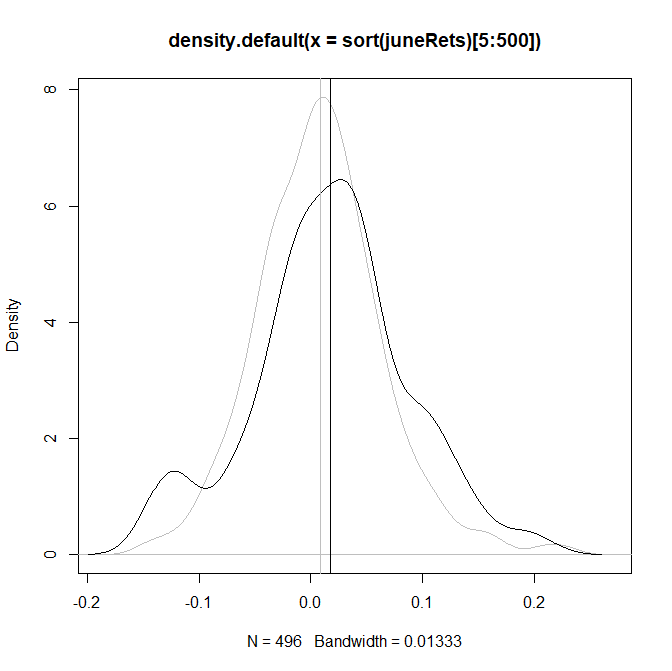

Let's further compare the density of stock returns from our list with the density of returns of all SP500 stocks (5 outliers were removed from both sides).

As you can see, the mean return of our list is higher than that of SP 500.

However, Kolmogorov-Smirnov test gives the p-value = 0.2752 and Welch Two Sample t-test gives the p-value = 0.4904, which means that there is no (sufficient) statistical evidence that the return distributions are really different.

Moreover, even if the statistical tests would show this difference, we would say that one month and one list is not enough to conclude about stock picking power. Still we believe that a careful chart screening and a fastidious stock selection by their fundamentals will bring the excess return in the long run. Stay tuned, the next stock list will follow soon!

FinViz - an advanced stock screener (both for technical and fundamental traders)