Elle, a 7-year old girl, continues to grow her wealth. Recently she has bought a silver ETC and a DAX ETF (the former a little bit prematurely, the latter pretty optimally).

After we bought an ETF on mDAX on 05.07.2018 we still had some free cash and decided to park it to silver. The idea was that it will continue growing after a temporal setback.

And if it doesn't, we will turn this position in a long term investment.  In did not. An option would be to add to the position at €12,5 but we stick to our plan B and from now on consider this position in silver as a long term investment. Thus we will add at ca. €11.87 (and of course we will wait for confirmation this support level).

In did not. An option would be to add to the position at €12,5 but we stick to our plan B and from now on consider this position in silver as a long term investment. Thus we will add at ca. €11.87 (and of course we will wait for confirmation this support level).

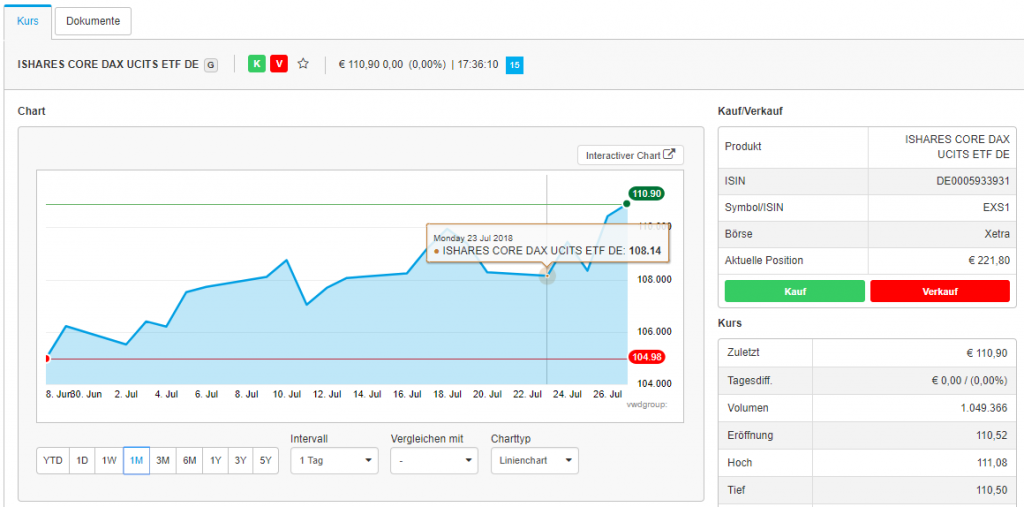

And so far we have (locally optimally) bought a DAX ETF.

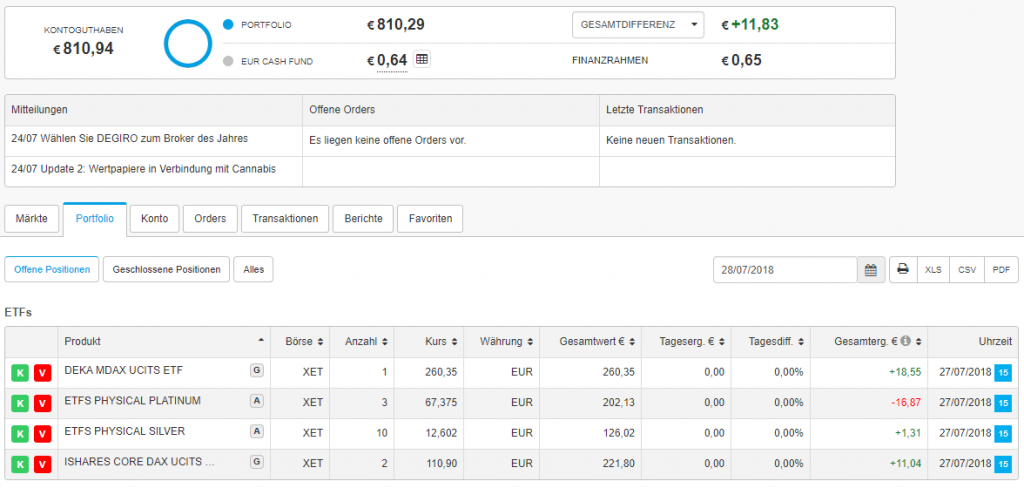

Elles current portfolio looks as follows:

DeGiro report he total gain (GESAMTDIFFERENZ) to be €11,83 but as we have shown in our previous post, due to some accounting nuances it is not exact. The exact gain is thus the difference of current portfolio value (Kontoguthaben = €810,94) and all installments (€801), so it €9,94. Not too much in absolute terms but in terms of CAGR it is still 4.344% p.a., as our CAGR calculator readily tells us.

Note that two month before the CAGR was 8%. This is, however, primarily due to extreme sensitivity of CAGR in a short term (Elle runs her portfolio just from the beginning of 2018). Anyway, the markets seem to calm down and we are quite optimistic w.r.t. our expected end-of-year CAGR.

FinViz - an advanced stock screener (both for technical and fundamental traders)