Last weeks Elle was inactive, patiently waiting for an opportunity to buy cheaply. It came with a "common" September correction. Still Elle stays very cautious because this time the October (the most volatile month on average) will definitely be extremely volatile due to President elections in USA.

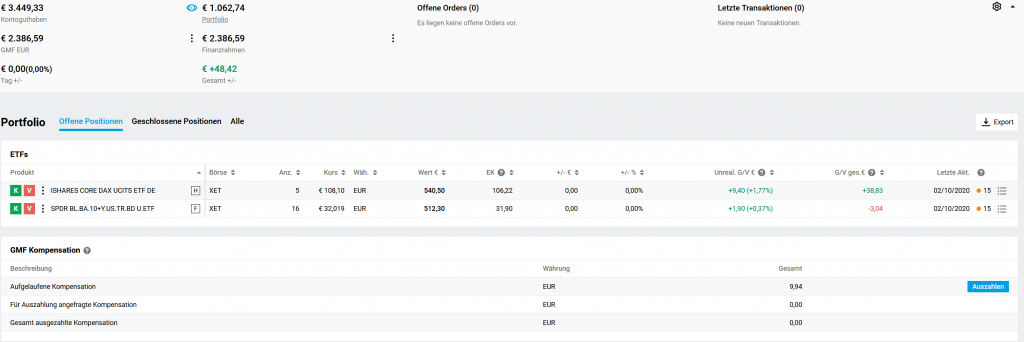

Elle's NAV and current portfolio look as follows:

Note that her wealth exceeded €2500 and she is de-facto imposed to keep a part of it invested, otherwise she will "get" a negative yield of -0.5% p.a. Her current gain is +€48.33, which corresponds the CAGR of 1.216% (by CAGR calculation we do consider €9.94: the compensation for negative interest rate).

For comparison: had we invested all installments in iShares Core DAX UCITS ETF (EXS1, DE0005933931), our gain would be €142,24, corresponding to the CAGR of 2.945%. But also this ETF (although liquid an relatively cheap) is not perfect, one can quickly estimate its tracking error visually. So if we could "buy" the DAX directly, our gain would be €172.55, which corresponds to the CAGR of 3.563%.

Another observation from this: since our savings plan is just about 3 years - i.e. relatively short - the CAGR is pretty sensitive to the small changes in NAV.

Anyway, the expected high volatility in this October gives us hope to make a pretty big gain in NAV, compared to a passive investment in a DAX ETF; stay tuned!

FinViz - an advanced stock screener (both for technical and fundamental traders)