On 10.02.2022 DeGiro notified Elle that her Depot is going to be closed due to inability to run a bank account for an underage person.

This is a very illustrative case of the operational risk.

Previously, we have (a)periodically reported about the deterioration of DeGiro broker. However, those cases were rather due to the stupidity of European financial regulators rather than to DeGiro itself.

But the terminal problem (both in the sense "last" and "which terminates business with DeGiro") is due to DeGiro's inability to run the banks accounts for juniors (although many financial institutions in Germany do). Actually, it is DeGiro's inability to think strategically in long term: a junior customer will sometimes become senior and since s/he got started with stock market very early, there is a good chance that s/he will be a valuable customer. Actually, Elle has likely already generated an above-average margin for DeGiro... But something like this was indeed to expect from DeGiro after it has merged with Flatex (which also first was a revolutionary broker but ended up in deterioration).

Sehr geehrte Elle

mit diesem Schreiben bringen wir offiziell unsere Entscheidung zum Ausdruck, die Beziehung in Übereinstimmung mit der Kundenvereinbarung für das Konto mit dem Benutzernamen ... zu beenden. Leider können wir keine Gemeinschaftskonten mehr anbieten, die einen minderjährigen Kontoinhaber beinhalten. Dies liegt daran, dass die flatexDEGIRO Bank AG nicht in der Lage ist, Minderjährigen ein Bankkonto zur Verfügung zu stellen, was für das Fühen eines DEGIRO Kontos erforderlich ist.

Mit diesem Schreiben bringen wir offiziell unsere Entscheidung zum Ausdruck, die Geschäftsbeziehung gemäß der Kundenvereinbarung zu beenden. Ihr DEGIRO-Konto wird daher am Sonntag, den 15. Mai 2022, geschlossen.

Rückerstattung von Barguthaben

Leider können wir Ihnen auch die derzeitige Lösung für die Aufbewahrung Ihres nicht investierten Barguthabens nicht mehr anbieten. Aus diesem Grund werden wir Ihnen bis Donnerstag, den 24. Februar 2022, das verbleibende Barguthaben auf Ihr persönliches Bankkonto auszahlen. Dies bedeutet auch, dass alle Guthaben in Fremdwährungen automatisch in die Basiswährung umgewandelt und auf Ihr persönliches Bankkonto ausgezahlt werden. Außerdem werden alle offenen unbefristeten Orders gelöscht.

Bitte beachten Sie, dass es möglich ist, Ihre Wertpapierpositionen bis zum Beendigungsdatum am 15. Mai 2022 zu halten, um eine Übertragung Ihrer Wertpapiere oder die Schließung der Positionen zu ermöglichen.

Schließen aller offenen Positionen

Bitte beachten Sie, dass Sie sicherstellen müssen, dass Ihr DEGIRO-Konto bis zum 15. Mai 2022 keinen positiven Saldo in Fremdwährungen oder Finanzinstrumenten aufweist. Falls Ihr Konto zum Kündigungstermin noch einen positiven Saldo aufweist, dann werden wir diese Positionen gemäß der Kundenvereinbarung schließen.

Sobald alle Positionen in Fremdwährungen und Finanzinstrumenten geschlossen und alle Ihre Verpflichtungen gegenüber DEGIRO und seinen Verwahrstellen erfüllt sind, überweisen wir den resultierenden Betrag auf Ihr persönliches Bankkonto. Sollten wir feststellen, dass nach der Beendigung des Kundenvertrags weitere Kosten oder Verluste im Zusammenhang mit Transaktionen oder Positionen auf Ihrem Konto entstanden sind, können Sie dafür haftbar gemacht werden, und wir können daher den verbleibenden Saldo ganz oder teilweise einbehalten, bis alle Ihre Verpflichtungen gegenüber DEGIRO erfüllt sind.

Entschädigung

Da wir wissen, dass dies keine wünschenswerte Situation für Sie ist, werden wir Sie für alle Gebühren entschädigen, die Ihnen im Zusammenhang mit der Schließung Ihrer Positionen, die Sie heute in Ihrem Portfolio halten, entstehen, um die Schließung Ihres Kontos voranzutreiben. Auch wenn Sie sich dafür entscheiden, Ihr Portfolio zu einem anderen Broker zu übertragen, werden wir Ihnen die dafür üblichen Übertragsgebühren nicht in Rechnung stellen. Bitte beachten Sie, dass wir nur Übertragsanträge bearbeiten, die mindestens 14 Tage vor der gesetzten Frist (15. Mai 2022) bei uns eingehen. Alle Anträge, die nach diesem Datum bei uns eingehen, werden nicht bearbeitet.

Bitte beachten Sie, dass die Rückerstattung von Transaktions- und Übertragsgebühren nur für die Positionen gilt, welche sich derzeit in Ihrem Portfolio befinden. Wir entschuldigen uns für etwaige Unannehmlichkeiten, die Ihnen durch diese Entscheidung entstehen.

Sollten Sie weitere Fragen haben, zögern Sie bitte nicht, sich mit unserem Service Desk in Verbindung zu setzen.

Mit freundlichen Grüßen,

DEGIRO

Anyway, the life goes on but before we go further with our experiment, we have to learn from this case. An this is a good case to illustrate the operational risk.

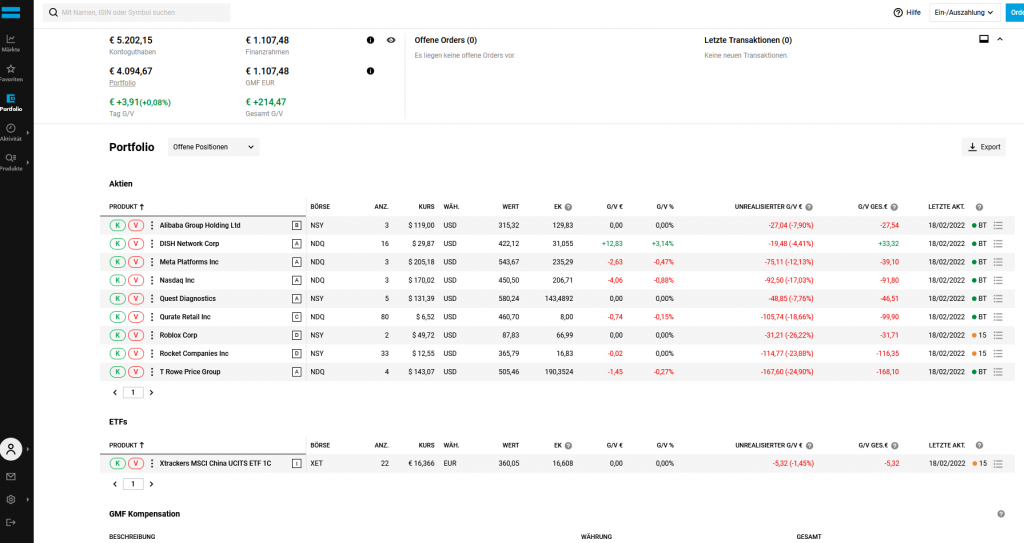

Although our current portfolio is affected by the market correction (about -10%), we did not worry about it per se. First of all we have about 20% of wealth in cash, which would give us an opportunity in case of a panic sellout. Secondly, all stocks (except the Roblox) are very solid fundamentally thus the recovery and further growth is (most likely) just a matter of time.

However, the depot termination makes this matter of time critical. The cash will be transferred back to Elle's bank account on 24.02.2022 thus there is a risk to miss the sellout while opening a new depot by another broker will take a time. As to positions in stocks, they will be closed on 15.05.2022. This is actually less critical and will only cause some excess broker fees (DeGiro promises not to take fees if depot is transferred to another broker... but they would better refrain from taking broker fees by position closing, since to transfer a depot is more complicated than to close all positions and transfer the cash).

And last but not least what happens happens for the best. In a recent past we have regretted that we have no zero-commission brokers in Germany. Now there are many of them so we got a good opportunity to try them!

FinViz - an advanced stock screener (both for technical and fundamental traders)