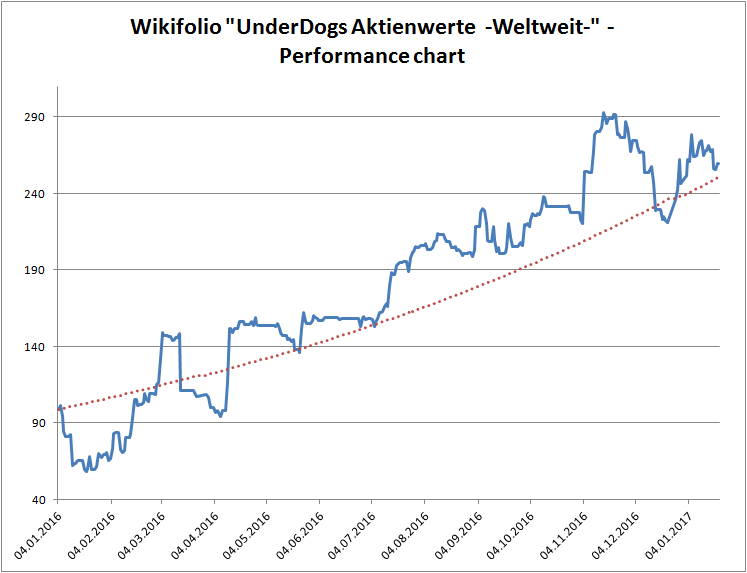

We scrutinize a case of investment strategy, which aggressively bets nearly everything on a few or even on a single stock. Since inception it yielded 160% of return by maximum drawdown of -45.59%. The strategy is popular among retail investors on Wikifolio (distinguished as "Bestseller"). We critically analyze possible risks and rewards.

Category: wikifolio

7 good Wikifolios – Automatic Statistical Performance and Risk Analysis

Wikifolio is a FinTech start-up that lets virtually everybody to become an fund manager. Wikifolio adheres to highest public disclosure standards, in particular current portfolios and complete trading statistics are available in real time. However, wikifolio lacks any statistical and chart analysis. One cannot even add a benchmark like DAX or DJ30 to a wikifolio chart.

We propose a way to increase the value of disclosed information and looking forward for feedback from both Wikifolio trades and investors. We also hope for official feedback from Wikifolio team.

Continue reading "7 good Wikifolios – Automatic Statistical Performance and Risk Analysis"

Einstein – a star trader on Wikifolio, who can beat the market

Summary: In our previous post we reviewed Wikifolio.com, a FinTech project that lets everybody build a proven track record. Today we review the performance of Einstein's portfolio "Platintrader 1000% Leidenschaft" and explain why his performance is a matter of trading mastership, not of just luck.

Continue reading "Einstein – a star trader on Wikifolio, who can beat the market"

Wikifolio – a genuinely social trading and investment FinTech project

Update 30.07.2017: Unfortunately, Wikifolio turned out to be not a genuinely social FinTech but rather yet another attempt to make quick money at costs of retail investors. Here we explain why (in German). But we keep the original post below for historical purposes.

Summary of advantages:

- Wikifolio allows everyone to build a proven track record. If a portfolio meets some simple requirements, an ETF on it can be issued. Technically such ETFs are issued like certificates by Lang & Schwarz and are traded by L&S directly and on the Stuttgart Exchange.

- Wikifolio adheres to maximum disclosure policy: in particular, for every portfolio they provide complete trading history in real time.

- Wikifolio is very suitable for the strategies that imply frequent trading since there is no costs per trade (only bid-ask spread and all-in fee of 0.95% p.a.)

- Wikifolio liberates portfolio management from regulatory cram and lets investors meet the portfolio managers directly (without expensive and dubious middlemen). At the same time the investors do not need to transfer their money directly to portfolio managers, so there is virtually no scam risk.

- Last but not least, numerous successful traders on Wikifolio clearly disprove the mantra that "nobody can beat the market".

Continue reading "Wikifolio – a genuinely social trading and investment FinTech project"