We scrutinize a case of investment strategy, which aggressively bets nearly everything on a few or even on a single stock. Since inception it yielded 160% of return by maximum drawdown of -45.59%. The strategy is popular among retail investors on Wikifolio (distinguished as "Bestseller"). We critically analyze possible risks and rewards.

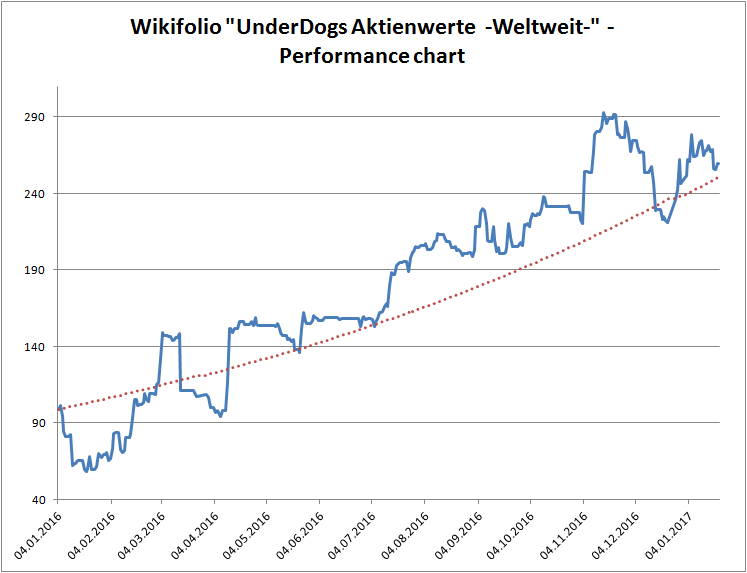

First of all let us look at the performance chart. It may seem to be good and in a sense it is: although a trained eye captures a big drawdown in the beginning, the time to recovery was just about a month and normally the equity chart stays above the trend (red dotted line), which corresponds to the compounded growth of 0.25% per day.

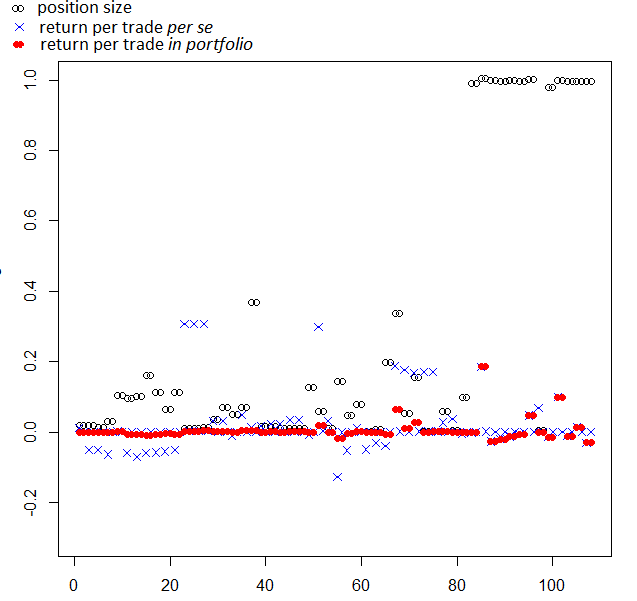

But let us look at at the chart of returns on positions.

You readily see that the portfolio is not diversified. By some trades (upper-right corner) all capital is invested in just one stock! The portfolio manager (Carsten Hasenstab aka work4honor) does not make secret of his approach: he tries to buy a stock, which is (in his opinion) heavily underestimated. As his trade history shows, if he goes wrong (and often it is the case), he closes the position with a relatively small loss. A series of such small losses is not always harmless, you see a sequence of subzero blue crosses coincides in time with the period of the maximum drawdown! But when Mr. Hasenstab is right, he really makes Kasse!

The problem is that sooner or later a black swan will come. And a single stock, in which Mr. Hasenstab invests, will severely drop overnight. In this case the approach to "cut losses quickly" will not work.

Notably, the investors does not recognize this risk: UnderDogs Aktienwerte -Weltweit- is marked as "Bestseller" and "Frequently bought" on wikifolio. But a disillusion and a disappointment may be hard!

Is there a way to improve the strategy?! Oh, yes! First of all, a diversification among at least 5 assets would have helped. Of course it is not an insurance against a market crash but it is very unlikely that something like DieselGate will simultaneously happen with all stocks.

Alternatively, a hedge with a (deeply out of the money) put option may also be helpful.

Anyway, even if I, myself, find UnderDogs Aktienwerte too risky, it does not mean that it is bad. Contrary, I am quite impressed with Mr. Hasenstab's stock picking talent. That's why I am very interested how long it will survive and whether his stock picking ability does not deteriorate in future. If it doesn't, I make no secret that I, myself, will (in a sense) copy Mr. Hasenstab's trades. Of course I will never bet 100% of my capital on a single stock, but to bet a couple of percent is not a bad idea. Concretely: currently UnderDogs Aktienwerte consists mostly of Deutsche Bank (DE0005140008) and GoPro (US38268T1034). The former has already grown 80% from the historical minimum but the latter grew just about 15%. So inspired by Mr. Hasenstab, I will likely increase my GoPro position by one or two percent.

Attachment: Trade history of Wikifolio UnderDogs Aktienwerte

FinViz - an advanced stock screener (both for technical and fundamental traders)