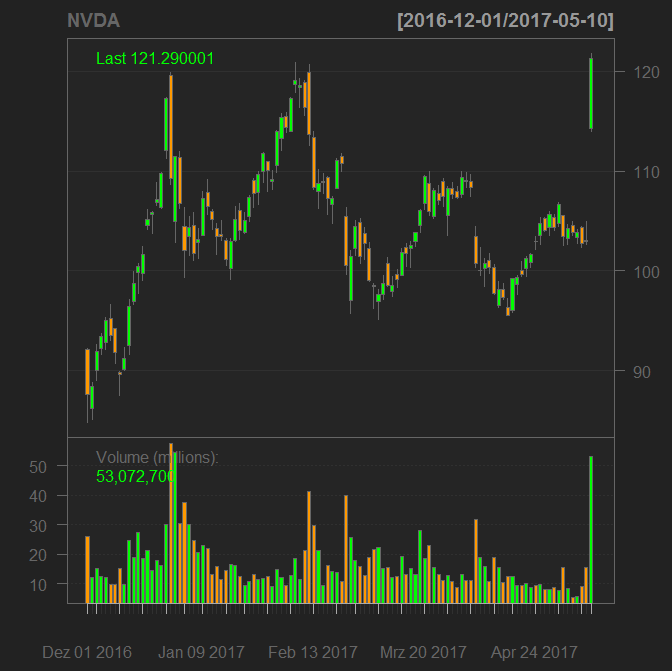

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Tag: NVDA

My PUT Option on NVIDIA – a case study of nearly perfect trading decision

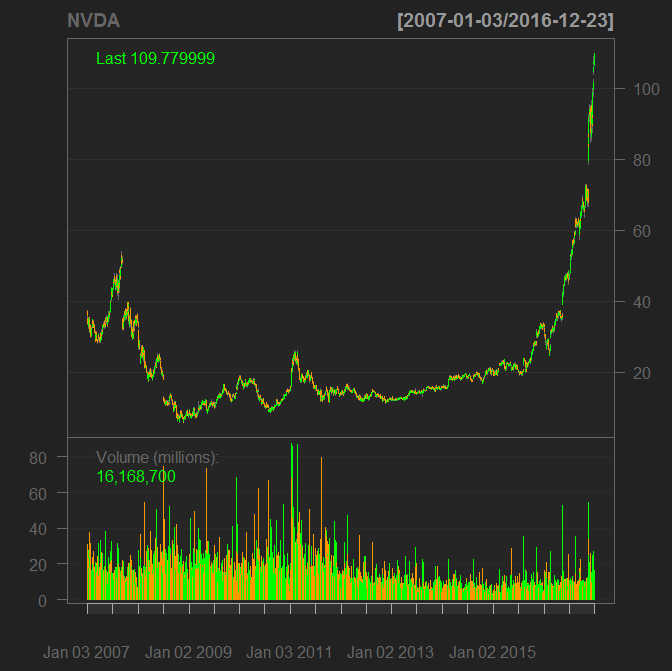

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

Continue reading "My PUT Option on NVIDIA – a case study of nearly perfect trading decision"