Currently the stocks are expensive and the commodities are cheap (though not all of them). We conduct a lite analysis of investment opportunities and construct a mid-term commodity portfolio for a retail investor with €10000+ capital.

Equity market has grown exuberantly. Now we observe a consolidation and though I am sure the stock market will soon find a reason to fall I find going short too risky for the most of retail investors. Instead, I would suggest to partially take profit in stocks and reallocate capital to commodities. Their advantage is that they always have some value (well, such cases like negative oil prices did happen but they are even more exotic than the negative interest rates). And in terms of prices, most of commodities are currently very cheap, so why not to use this opportunity? However, you should be aware that commodity prices usually trend much stronger than the stock prices thus the commodities are currently rather unsuitable for the trendfollowers. But mean-reversion guys may start building their portfolio. For the sake of concreteness let us assume that a trader has €10000 - €15000 capital.

My favorite commodities are:

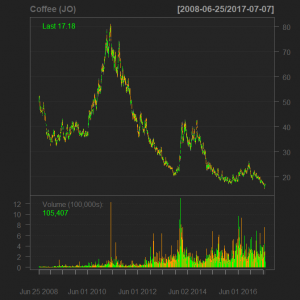

1) Coffee (JO | iPath Dow Jones-UBS Coffee Subindex Total Return ETN | US06739H2976).

|

|

I assume the reсent dip, from which the coffee price has strongly repulsed was the trend reversal. Moreover, the last candle did not break a distinct support level of $17. Though I consider technical analysis with caution, many chartists can go long now. Last but not least I am an espresso lover. So I would invest €1000 now and put aside another €1000 for the next opportunity, if the price continues to fall. Note that if you trade via DeGiro, iPath Dow Jones-UBS Coffee Subindex Total Return ETN belongs to the ETFs / ETNs that can be traded without broker fees.

2) Cocoa (COCO.MI | ETFS COCOA | JE00B2QXZK10).

|

|

Cocoa is also extremely down. However, from technical point of view it is not clear yet whether the level of €1.80 withstands. As a long term investor I would buy for €1000 at current price and forget about it till the next drought or hurricane in Ivory Coast and Ghana.

A speculator can set limit order at €1.80 with take profit at €1.90 and stop loss at €1.75. Due to transaction costs (COCO.MI cannot be trader without commissions by DeGiro) the minimal recommended trade amount is €2000.

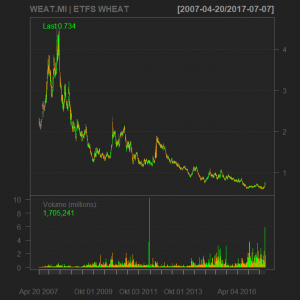

3) Wheat (WEAT.MI | ETFS WHEAT | DE000A0KRJ93).

|

|

Wheat is also extremely cheap and might to be on trend reversal (thank to a cold summer in Russia I made some profit with wheat). However, there are more producers of wheat than of coffee and cocoa and they are on both sides of ocean. That's why I don't count on crop failure so much and will re-enter a €1000 long position again only if the price again falls to €0.65

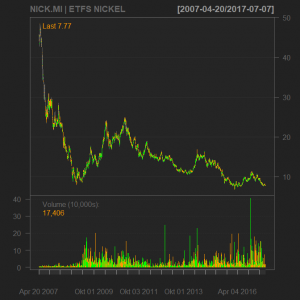

4) Nickel (NICK.MI | ETFS NCIKEL | DE000A0KRJ44).

|

|

Buy at current price for €1000 (if you are very conservative, wait whether it repulses from €7.3) and await the surprises from President Rodrigo Duterte.

5) Zinc short (SZIC.MI | ETFS 1X DAILY SHORT ZINC | JE00B24DKS68).

|

|

Contrary to its brother nickel, zinc grows like a crazy. To be honest, I don't understand the reason behind. May be it is anticipation of zinc rechargeable batteries (that perform better than lithium counterparts but so far cannot be efficiently produced in big quantities). Maybe it is due to the fact that the zinc is necessary for the men's health (beware, though, that the oversupply might be dangerous). Anyway, I likely would not short zinc per se but in the portfolio context it is a good diversification in the sense of market neutrality. Additionally, if you buy an ETFS your risk by going short is limited with your investment amount. So I put €1000 in SZIC.MI

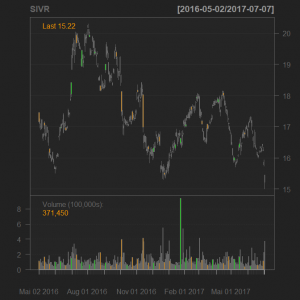

6) Silver (SIVR | ETFS Physical Silver | JE00B1VS3333).

|

|

Silver, the gold of a poor, is a naughty commodity. On one hand it has extremely fallen on the other hand there a distinct signs on the charts that the silver price has a room to drop even deeper. So I reserve €2000 for it and split it in 4 tranches. I have already fixed two of them (and both, in a sense, prematurely). Fortunately, ETFS Physical Silver can be traded via DeGiro without broker fees and moreover, there are several comission-free silver funds. Thus split in many small tranches and buy on dips. Sooner or later it will reverse.

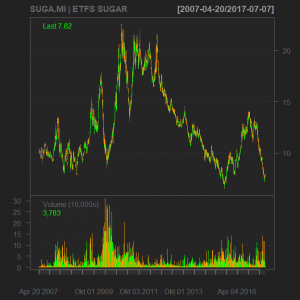

7) Sugar (SUGA.MI | ETFS SUGAR | DE000A0KRJ85).

|

|

Well, I am going to buy but not yet now, since so far it not yet clear whether the trends has reversed or not. And it is risky to invest in sugar in the long term since it is considered to be unhealthy thus a tax (like tobacco excise) can be imposed on it. Additionally, with Coffee and Cocoa I am already heavily invested in tropical agriculture. Thus I keep keeping my eye on sugar and put aside €1000 for it but will not yet invest.

8) Last but definitely not least, its majesty Oil.

It deserves a separate post (which will appear soon) and moreover, it does matter whether to invest in BRENT or WTI. But to put it very briefly, split €3000 in three tranches at set limit order for WTI at $44 for the first tranche.

[sourcecode language="r"]

library('quantmod')

getSymbols('SIVR')

chartSeries(SIVR, subset='last 8 years', TA='addSMA(200)')

chartSeries(SIVR, subset='last 12 months')

getSymbols('JO') #coffee

chartSeries(JO, name='Coffee (JO)')

chartSeries(JO, name='Coffee (JO)', subset='last 3 months')

getSymbols('COCO.MI') #COCOA

chartSeries(COCO.MI, name='COCO.MI | ETFS COCOA')

chartSeries(COCO.MI, name='COCO.MI | ETFS COCOA', subset='last 3 months')

getSymbols('WEAT.MI') #WHEAT

chartSeries(WEAT.MI, name='WEAT.MI | ETFS WHEAT')

chartSeries(WEAT.MI, name='WEAT.MI | ETFS WHEAT', subset='last 3 months')

getSymbols('NICK.MI') #NICKEL

chartSeries(NICK.MI, name='NICK.MI | ETFS NICKEL')

chartSeries(NICK.MI, name='NICK.MI | ETFS NICKEL', subset='last 3 months')

getSymbols('SZIC.MI') #ZINC short

chartSeries(SZIC.MI, name='SZIC.MI | ETFS 1X DAILY SHORT ZINC')

chartSeries(SZIC.MI, name='SZIC.MI | ETFS 1X DAILY SHORT ZINC', subset='last 3 months')

getSymbols('SUGA.MI') #SUGAR

chartSeries(SUGA.MI, name='SUGA.MI | ETFS SUGAR')

chartSeries(SUGA.MI, name='SUGA.MI | ETFS SUGAR', subset='last 6 months')

[/sourcecode]

FinViz - an advanced stock screener (both for technical and fundamental traders)