Apologists of the passive investment claim: stock ETFs save the costs. Indeed they saved costs as broker fees were high. But now they don't, in fact they increase them! Of course sometimes there is no alternative to an ETF/ETC/ETN, e.g. if you want to invest in commodity market. But if you can buy stocks with low broker fees, you should do it directly.

ETF Apologeten behapten: die Aktien-ETF sparen Kosten. Tatsache ist: die sparten die Kosten, als Brokergebühren noch hoch waren. Aktuell ist es nicht mehr der Fall, langfristig sind die Kosten bei den Aktien-ETF sogar höher als beim Direktkauf. As brokers charged %'s of purchased amount (and additionally, a fixed fee) it was costly to build a diversified stock portfolio directly. Rather, a passive investor should have bought an index ETF. However, currently there are enough very cheap brokers like DeGiro. Moreover, there are even completely free broker Robinhood. Since Robinhood is, so far, not available in Europe, we consider DeGiro in this case study. For European stocks DeGiro charges €2 per stock trade + some infinitesimally small percentage of the purchase sum. American stocks can be traded even cheaper, normally below €1 per trade.

As brokers charged %'s of purchased amount (and additionally, a fixed fee) it was costly to build a diversified stock portfolio directly. Rather, a passive investor should have bought an index ETF. However, currently there are enough very cheap brokers like DeGiro. Moreover, there are even completely free broker Robinhood. Since Robinhood is, so far, not available in Europe, we consider DeGiro in this case study. For European stocks DeGiro charges €2 per stock trade + some infinitesimally small percentage of the purchase sum. American stocks can be traded even cheaper, normally below €1 per trade.

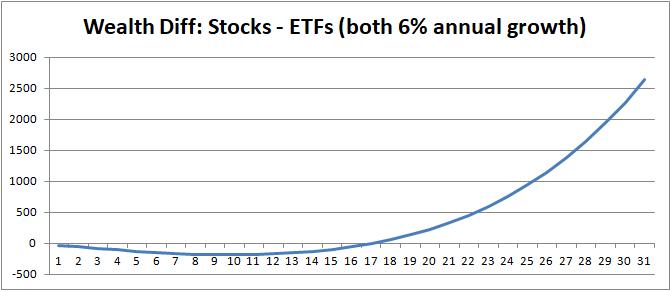

Let us assume that Max Mustermann, a typical German retail investors, saves €2000 annually and invests this money in stocks. Let the portfolio growth be 6% p.a., which approximately corresponds to the DAX mean growth rate in long term. Finally, we assume the ETF Total Expense Ratio of 0.16% (e.g. it is the case for iShares Core DAX UCITS ETF, DE0005933931) and broker fees of €30 p.a. (which is somewhat pessimistic because a well-diversified portfolio does not mean as many stocks as possible). The chart above shows the wealth difference fro year to year by the investment in an ETF vs. a direct investment in stocks. As you readily see, at first an ETF is cheaper and the difference grows in time upto 10th year. But then the result reverses and terminal reversal effect is pretty prominent!

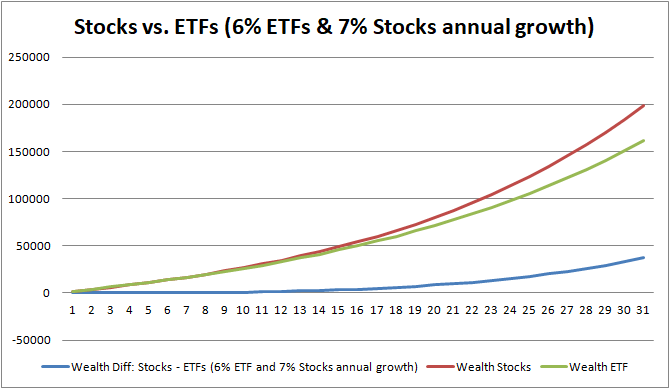

Now let us assume that the ability to select individual stocks gives us 1% extra growth p.a. This assumption is not implausible, indeed even Max Mustermann (if were patient and did his home work properly) can achieve this excess return e.g. by buying stocks with better fundamentals. In this case the difference gets very significant, as the following chart shows.

You are encourage to check by yourself other scenarios with different costs and growth rates. We prepared an Excel sheet for you!

FinViz - an advanced stock screener (both for technical and fundamental traders)