This is a well-known fact that the stock prices are virtually unpredictable. However, stock volatilities can more or less be forecasted! In 2012 Vasily Nekrasov scrutinized about 3000 asset price time series, obtained from yahoo.finance. Approximately in half of cases the volatility was piecewise-stationary and thus predicatable. We put online the technical record from 2012 and start publishing the visualized results

The idea of this study was as follows: first to automatically segment the volatility regimes (volatility clustering is a stylized fact) and then check whether the volatility is piecewise-stationary within the segments. The segmentation was done by means of multiscale and multilevel technique for consistent segmentation of nonstationary time series by Cho and Fryzlewicz (2012).

Note that one did not pursue to predict the time of regime switching. The goal was to check whether, knowing the volatility for this first 30 (60, 90 and 120) days, it is possible to predict the volatility till the next regime switching. In half of cases the answer was positive.

Further technical details can be found in report but likely the practitioners will be reluctant to dwell into relatively complicated math.

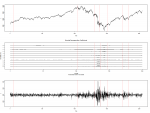

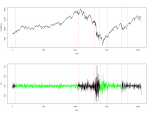

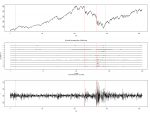

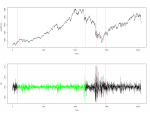

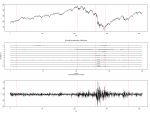

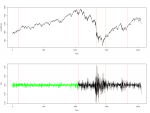

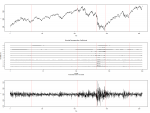

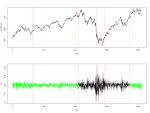

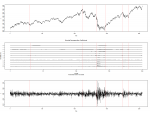

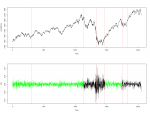

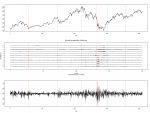

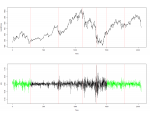

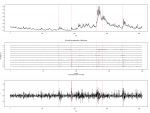

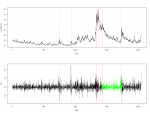

But no problem, they can just have a look at the gallery below. On the left-hand side there are "raw" segmentation results, consisting of daily price time series, wavelet coefficients and the series of daily returns. On the left-hand side there are results of post-processing: the segments with piecewise-stationary (and thus predictable) volatility are colored in green.

Below are the results for Dow Jones Industrial Average (DJI), DAX (GDAXI), S&P 500 (GSPC), Nasdaq (IXIC), TexDAX and VIX. The VIX is the special case since it is the volatility index. But the volatility of volatility also makes sense.

The volatility explosion, which you readily see is the period of the world financial crisis. Interestingly, the volatility regime switching took place before the crisis broke out, this is also clearly visible with naked eye!

Thus, our friends, keep watching the volatility (at least of the most important indices)!

And for those, who do not yet know, what the volatility is, we have prepared a succinct video introduction.

FinViz - an advanced stock screener (both for technical and fundamental traders)