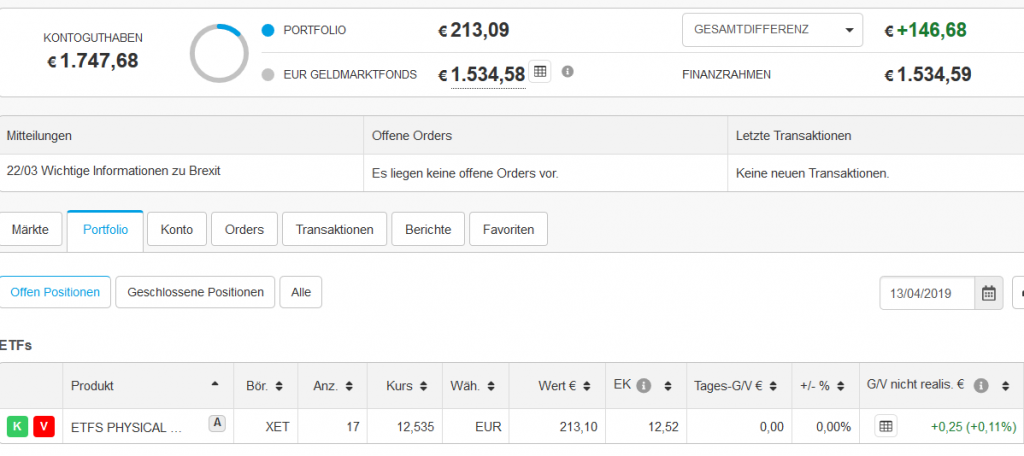

Elle got started with her savings plan in Jan 2018 with a monthly installment of €100. Now she has sufficient trading capital, so that (taking broker fees into account) the stock picking may make sense. She tried to make her hands dirty with stock selection and earned €139,53 gain or 8.6% return in less than a month! The CAGR of her savings plan is currently 13.75%

Our broker DeGiro offers more than 200 ETFs, which can be traded without broker fees once per months. As long as Elle's capital was tiny, ETFs were the only way to actively manage her portfolio. But DeGiro offers pretty good prices for trading with (European) stocks: ca. €2.5 per trade.

And we have already shown before that in the long term the ETFs (even those free of broker fee) are more costly than pure stocks.

So we picked the following stocks: Schaeffler AG, Kloeckner AG and TUI AG.

The selection was based both on chart and fundamental analysis. By means of the former we intended to squeeze a bit of excess returns from the market and the latter would let us turn a speculation into investment if there were no rapid price growth... but there was! 🙂

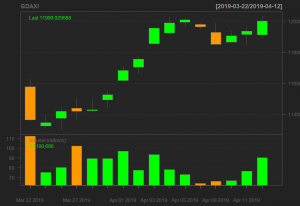

Note that if we would instead trade a DAX ETF then (even by a nearly perfect intraday timing) we would yield just 12000/11400 - 1.0 = 5.3% (instead of 8.3% reached with single stocks).

But we do not allow an euphoria to obsess us and calmly analyze our trades ex post. Let us summarize them

| Stock | Amount | BuyPrice | SellPrice | BrokerFees | Profit | Return |

| SHA | 77 | 7,112 | 7,78 | 4,3 | 47,136 | 8,61% |

| KCO | 77 | 6,44 | 7,175 | 4,27 | 52,325 | 10,55% |

| TUI | 50 | 8,25 | 8,88 | 4,23 | 27,27 | 6,61% |

The best trade is obviously KCO. However, we earned €52.33 and paid €4.27 broker fees. So let us calculate the implied break-even probability to win.

To do this let us assume that we would close the trade if the loss reached €-55.33 (as we mentioned before we would not do it, rather we would turn this trade into investment, but still let us assume it for a while). The broker fees are to be paid in either case, so we can write an equation for a break-even trade (i.e. a trade with a zero expectation) as follows

So we need

in order to be breakeven. This is though feasible but still a pretty ambitious number, e.g. Einstein (the best trader on Wikifolio) has a hitrate of ca. 57%!

If you do the same calculation for TUI, you will likely think that it was not a worthy trade. And generally you will be right, however, look at the DAX chart: we closed the position in TUI since we fear that the DAX might repel from the resistance level of 12000 (and entice the whole German market).

Anyway, we are happy that this speculation was so successful that we have beaten our target CAGR of 6% but we remain modest and generally will stay stuck to ETFs and ETCs until we grow Elle's capital so high that we can really neglect the broker fees.

So far we mostly stay in cash and hold a small position in VZLC (a silver ETC), stay tuned!

FinViz - an advanced stock screener (both for technical and fundamental traders)