Wirecard is a German company, which provides e-payment solutions. It grew very rapidly but the fall was even quicker. This case perfectly demonstrates the advantages of diversification and money management.

Wirecard AG grew rapidly during recent years and replaced Commerzbank in the DAX a couple of years ago. (Apropos, Commerzbank is another pictorial case of equity capital elimination). But then it was subjected to short selling attacks. BaFin (the German SEC) investigated but the results were not very clear.

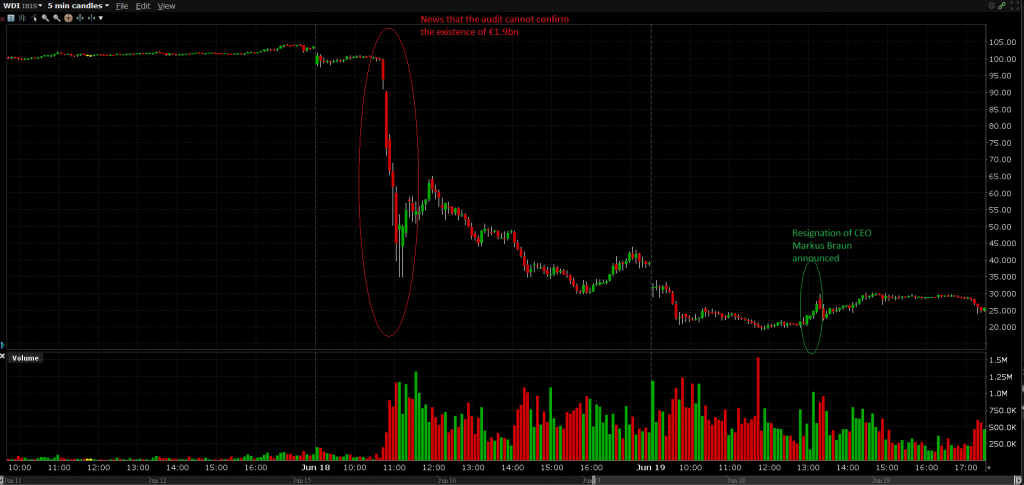

A scandal seemed to gradually fade out till the Wirecard auditors announced that they have no confirmation of existence of €1.9bn. The stock fell upto 70% (interestingly that possibly missing €1.9bn wiped out €8bn of the market capitalization).

By the time, the situation is still to be cleared but anyway - even if one finds this €1.9bn - the stock will not completely recover quickly.

Indeed this case is not unique. One shall recall e.g. the Volkswagen Dieselgate or BP deepwater oil spill. But the amplitude of the drawdown (upto 70% on the 1st day within 30 min and upto 50% on the next day) is really unique for a DAX stock.

What this example tells us? Well, probably the main message is that the diversification will not save you from a macroeconomic crash but will protect you from suchlike idiosyncratic events. Interestingly that Kelly criterion (which asymptotically beats any other money management strategy) often overweights the positions ... unless you model the extreme events properly (but then the numerical instability comes into play). But anyway, probably no model would have suggested such a big drop. However, everything is possible on the market!

update 22.06.2020

The show goes on! €1.9bn are not found during the last weekend (and probably do not exist).

WDI halves again!

update 25.06.2020

Wirecard filed for bankruptcy! [Almost] nobody believed it but it did happen! At first one was afraid that the banks will call back the credits (but it would mean a big loss for the banks themselves). Anyway, ING, LBBW and Commerzbank may suffer now.

Wirecard stock (and bonds) turned to junk

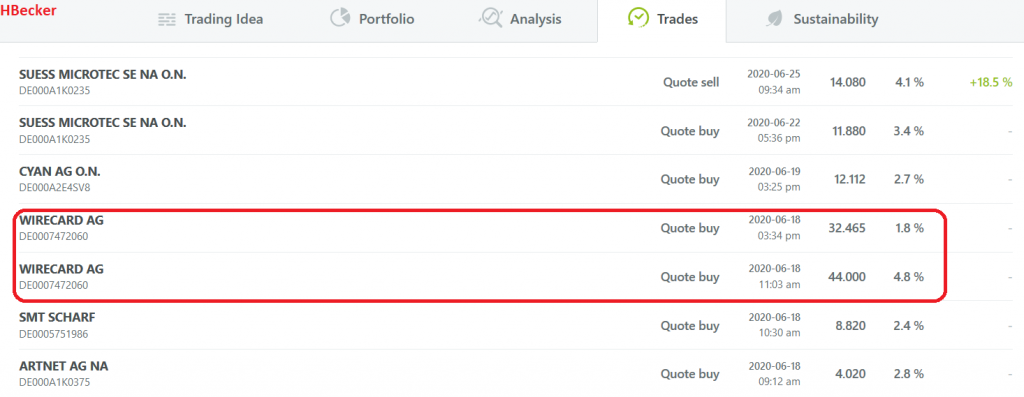

Interestingly that HBecker, who was always a Paragon of Risk Management, invested (and almost surely lost) 5.6% of his capital in WDI!

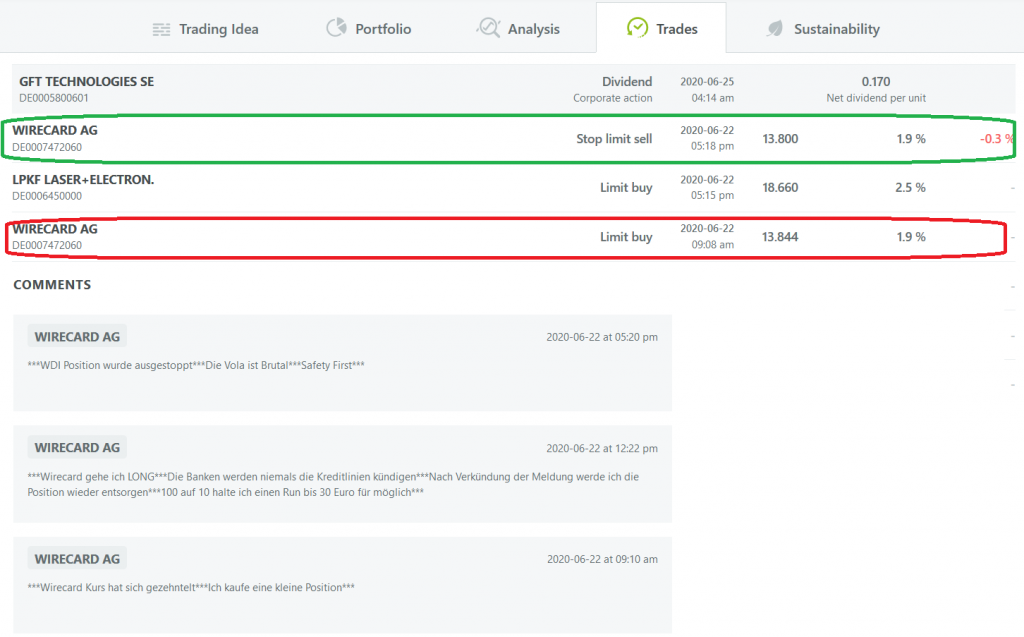

Oppositely, his archrival Einstein decided for ***safety first*** and was totally right!

FinViz - an advanced stock screener (both for technical and fundamental traders)