Während der Zerozinsenzeit wird immer lauter darüber gesprochen, dass man sein Geld lieber investieren als auf Tagesgeldkonto parken sollte. An sich ist es richtig, aber mit der Auswahl des Vermögensverwalters muss man sehr vorsichtig sein. Der bekehrte Schwabe empfielt: schauen Sie selbst die Performance an, anstatt die Werbung blind zu vertrauen. Erinnern Sie sich immer daran, dass die kostenlosen "Beratungsgespräche" fast immer Verkaufsgespreche sind! Eine Alternative dazu ist die Honorarberatung, jedoch ist ein Honorarberater ohne Track Record nichts Wert! Passive Anlage ist generell keine schlechte Idee, aber selbst der Aufbau eines gut diversifizieren Portfolios ist auch keine triviale Aufgabe.

Während der Zerozinsenzeit wird immer lauter darüber gesprochen, dass man sein Geld lieber investieren als auf Tagesgeldkonto parken sollte. An sich ist es richtig, aber mit der Auswahl des Vermögensverwalters muss man sehr vorsichtig sein. Der bekehrte Schwabe empfielt: schauen Sie selbst die Performance an, anstatt die Werbung blind zu vertrauen. Erinnern Sie sich immer daran, dass die kostenlosen "Beratungsgespräche" fast immer Verkaufsgespreche sind! Eine Alternative dazu ist die Honorarberatung, jedoch ist ein Honorarberater ohne Track Record nichts Wert! Passive Anlage ist generell keine schlechte Idee, aber selbst der Aufbau eines gut diversifizieren Portfolios ist auch keine triviale Aufgabe.

Author: letYourMoneyGrow.com

7 good Wikifolios – Automatic Statistical Performance and Risk Analysis

Wikifolio is a FinTech start-up that lets virtually everybody to become an fund manager. Wikifolio adheres to highest public disclosure standards, in particular current portfolios and complete trading statistics are available in real time. However, wikifolio lacks any statistical and chart analysis. One cannot even add a benchmark like DAX or DJ30 to a wikifolio chart.

We propose a way to increase the value of disclosed information and looking forward for feedback from both Wikifolio trades and investors. We also hope for official feedback from Wikifolio team.

Continue reading "7 good Wikifolios – Automatic Statistical Performance and Risk Analysis"

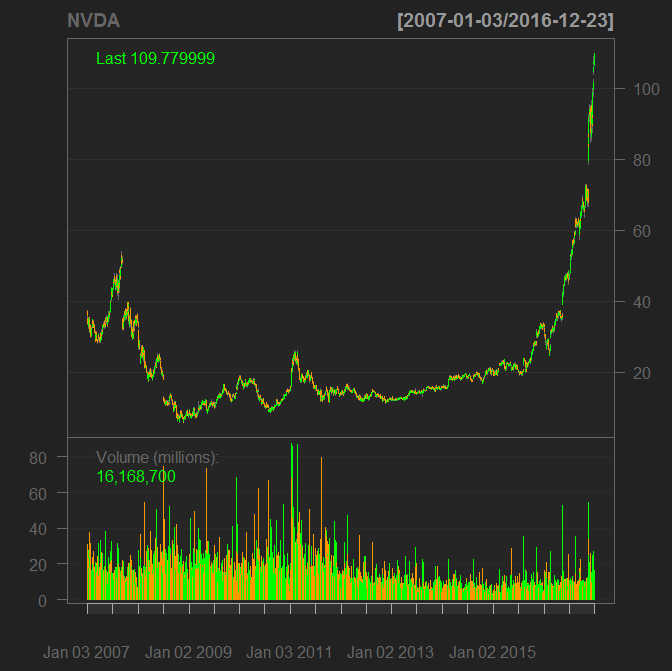

My PUT Option on NVIDIA – a case study of nearly perfect trading decision

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

Continue reading "My PUT Option on NVIDIA – a case study of nearly perfect trading decision"

Why I am skeptical about investing in “global trends”

Investing in a "globaly demanded" product or service seems (at first glance) to be a nice idea. However, it may be (too) dangerous: not all global trends turn into profit and even if they do, you need to get in early since most of global trends (even genuine) turn into bubbles and do burst.

Continue reading "Why I am skeptical about investing in “global trends”"

Pension Savings Calculator for USA based on SSA Actuarial Life Table

Recently we published an essay about the German pension insurance under the title "How the Father State plunders me". As a matter of fact, German pension system is mainly based on a so-called generation solidarity principle: current employers finance current pensioners (and are supposed to be financed by the following generation as they, themselves, retire). It worked well in Bismarck's time but with current longevity and low birthrate the system is not capable anymore! The calculations with German mortality tables shows: were the employers allowed to invest their contributions themselves, they would not be inevitably condemned to the Altersarmut (elderly poverty).

Though Germans have both private pension insurance and Betriebliche Altersvorsorge (similar 401k plans) they are mainly fixed-interest (thus with current rates they even don't cover the inflation). Still they are much more attractive than the compulsory insurance by the state pension fund.

Continue reading "Pension Savings Calculator for USA based on SSA Actuarial Life Table"

Grow your money, Trader – the Anthem of letYourMoneyGrow.com

Let your money grow

Stock mark’t is tough and turbulent

Let your money grow

Your risks by every trade,

Estimate risk-reward and

Let your money grow

Continue reading "Grow your money, Trader – the Anthem of letYourMoneyGrow.com"

Why German real estate market will likely crash

German residential market is booming due to extremely low interest rates and, respectively, very cheap mortgages. But if the rates grow, the market is going to crash! For instance, a current rate for 10 year mortgage without a downpayment is about 2%. A new rural house costs about €300000. A typical borrower can pay about €1000 monthly installment + €5000 extra redemption in the end of year. If the rate jumps to 4%, the house price will drop to €246303, i.e. 17.9% (this is just estimation, however, it is not implausible). And additionally the residual debt refinancing costs will increase by €31762 (this is a precise calculation).

Continue reading "Why German real estate market will likely crash"

Warum Sie äußerst vorsichtig beim Immobilienkauf sein müssen

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).

Continue reading "Warum Sie äußerst vorsichtig beim Immobilienkauf sein müssen"

Anti-Asimov’s Three Laws of Robo-Advisory

- Falsely affirm that nobody can beat the market

- Substitute the idea of wealth maximization with the idea of cutting-off the management fees.

- Don't disclose anything about the underling portfolio optimization model and avoid showing possible future portfolio dynamics.

Continue reading "Anti-Asimov’s Three Laws of Robo-Advisory"