Remarkably, many market players in energy market still cannot calculate the fair value of a gas storage. In particular, many of them rely on perfect foresight. We put online a simple but correct model from QuantLib. Confidence intervals are estimated as well.

NB! This time not for retail investors but for the colleagues from energy industry. Have a look at short introductory video.

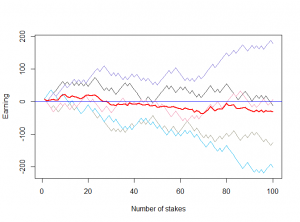

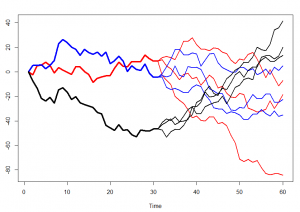

Gas Storage is a relatively complex option to evaluate, esp. if there are non-trivial constraints. Remarkably, many energy companies cannot correctly evaluate even the simplest storage contracts. Moreover, they often resort to a so-called perfect foresight: the price paths are considered random but once the price path is known, it is assumed to be known completely (like at the left-hand sketch).

|

|

| Prefect foresight (unrealistic) | One-step foresight (realistic) |

Continue reading "Gas Storage Fair Price | online Calculator"