Elle, a 7-year old girl, confronted a hard choice this time: both German stocks and precious metals were relatively cheap. Finally, she decided to increase the position in silver, although before she has already bought a silver ETC a little bit prematurely. Continue reading "JuniorDepot9 – Buying Silver ETC again"

Tag: MonteCarlo

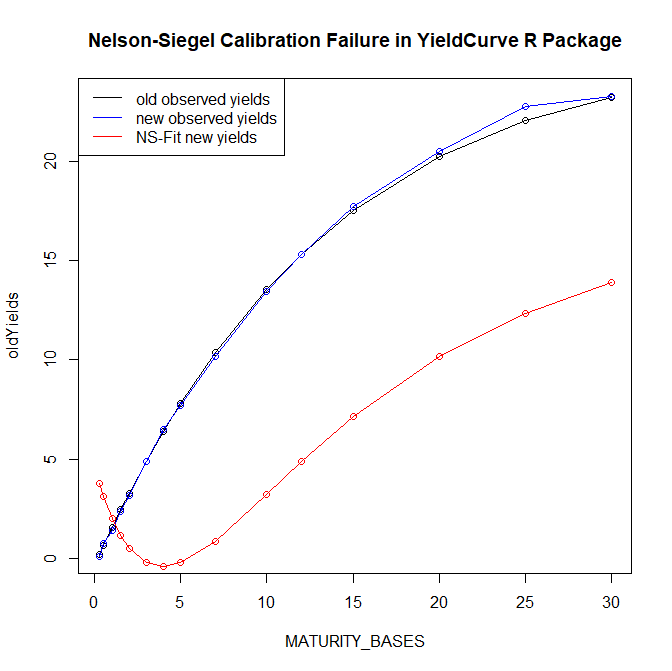

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do

In our previous post on Nelson-Siegel model we have shown some pitfalls of it. In this follow-up we will discuss how to circumvent them and how machine learning and artificial intelligence can[not] help. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do"

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I

The Nelson-Siegel-[Svensson] Model is a common approach to fit a yield curve. Its popularity might be explained with economic interpretability of its parameters but most likely it is because the European Central Bank uses it. However, what may do for ECB will not necessarily work in all cases: the model parameters are sometimes extremely unstable and fail to converge. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

Portfolio Simulator – estimate the expected risk and return of your investments

Our simulator allows you to simulate 100 future scenarios of your portfolios, estimate the expected risk, return and correlations, helping you to improve the diversification of your portfolios. The simulator projects the historical returns in future and is completely model-free (in particular, we don't make an unrealistic assumption of Normally-distributed returns). Though the past doesn't capture all possible future scenarios, it provides a good idea of possible outcomes.

Continue reading "Portfolio Simulator – estimate the expected risk and return of your investments"

A simple scenario simulator for Vanguard optimal portfolio

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

Continue reading "A simple scenario simulator for Vanguard optimal portfolio"

Mystery and misery of the martingale betting system: why it will not make you rich

Summary:

- The martingale strategy asymptotically implies infinite capital or infinitely divisible stake. In reality you have a limited capital and there is a lower (in casino also an upper) bound of the stake.

- In a fair game (with 50/50 chance of profit and loss) the probability of profit after a series of losses is still 50% (because the outcomes of bets or trades are independent from each other).

- Typically, if you win then your profits are moderate but if you lose, the losses are severe (you can lose your capital just after a small series of unlucky bets).

- If you make pretty many bets, you might make a good profit but the probability to make profit at all decreases with the number of bets. Losses stays severe.

Binary Options: you may earn in a short term but eventually you WILL lose

Summary:

- Gambling with binary options you either lose 100% or earn about 90% of your stake. The win lose/ratio of 90/100 = 0.9 is worse than by the European roulette (36/37 = 0.973) and even by American roulette (36/38 = 0.947).

- A trade takes just a couple of minutes, which allows (and implicitly encourages) you to commit a lot of trades. Due to the law of large numbers and negative odds, the more you trade, the more you lose.

- Don't trust numerous "success stories" in Internet. Virtually all of them are fake and they are just a marketing trick of brokers or those who earn with brokers' affiliate programs.

Continue reading "Binary Options: you may earn in a short term but eventually you WILL lose"