This time Elle, a 7-year old girl, first bought a physical gold ETC but then quickly sold it and bought an ETF on DAX. Concretely this trade was a bit premature but the portfolio diversification (in particular by means of precious metals) still brought benefits.

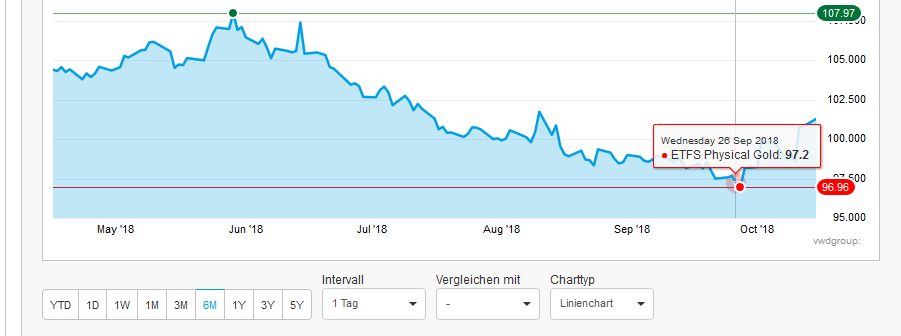

This time Elle has watched the dynamics of gold price and managed to buy the gold at local minimum.

However, she already knows that (contrary to stocks) commodities per se do not create any added value. Thus she decided to sell Gold with 2.3% profit and buy a DAX ETF. (Reminder: once per month she can buy or sell each ETF from this list without broker fees).

We did not keep her from doing it because making 2.3% in few days by trading Gold is really good. But as she asked whether she also should sell her positions in silver and platinum (in order to invest everything in stocks that have recently dropped) we recommended her not to do this. And this was a good advice: stocks continued to decline, whereas gold and silver kept growing.

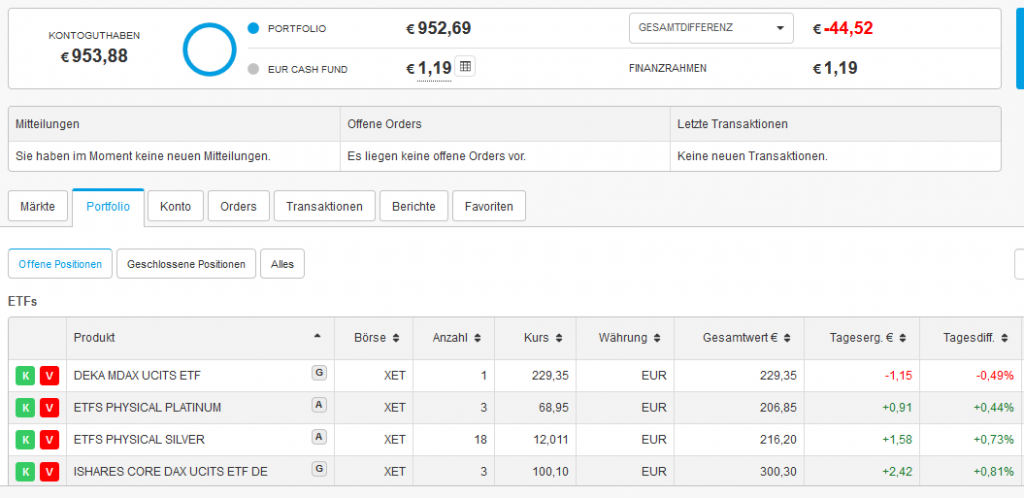

Current Elle's portfolio and its performance are as follows

Although she currently experiences a [temporal] loss of 47.12 EUR (DeGiro shows -44.52 but as we have previously shown it is incorrect due to modality fees and custody costs), it is still significantly better than it would be in case of just purchasing a DAX ETF in the end of each month.

The monthly DAX returns in 2018 were as follows:

2018-01-31 0.0226234333 2018-02-28 -0.0571387828 2018-03-29 -0.0272694790 2018-04-30 0.0426048910 2018-05-31 -0.0005725215 2018-06-29 -0.0237121987 2018-07-31 0.0405899561 2018-08-31 -0.0344727211 2018-09-28 -0.0094895289 2018-10-12 -0.0590297060

(you can check this with the following R-code)

library(quantmod)

getSymbols("^GDAXI", from="2017-12-31", to="2018-10-15")

monRets = monthlyReturn(GDAXI)

print(monRets)

Respectively the loss of a "DAX only" portfolio would be 81.62 EUR, as the following R-code readily tells us

portfolio=0.0

N = length(monRets)

for(m in 1:N)

{

portfolio = portfolio + 100.0*prod(1+monRets[m:N])

}

print(portfolio - 100.0*N)

Note, however, that this concrete case does not mean that we will always avoid a portfolio, which consists 100% of stocks. In our case three factors we important:

1. We started in the beginning of 2018, as stocks we already (very) high.

2. Silver and Platin are priced cheaply from long-term point of view, so currently it makes sense to keep them further.

3. Unfortunately we cannot invest in ETFs on US stocks without broker fees (this is due to PRIIPs, which should have protected a retail European investor but indeed just made things worse).

But there will definitely be periods of low volatility and stable growth: during this time we are going to be 100% in stocks!

FinViz - an advanced stock screener (both for technical and fundamental traders)