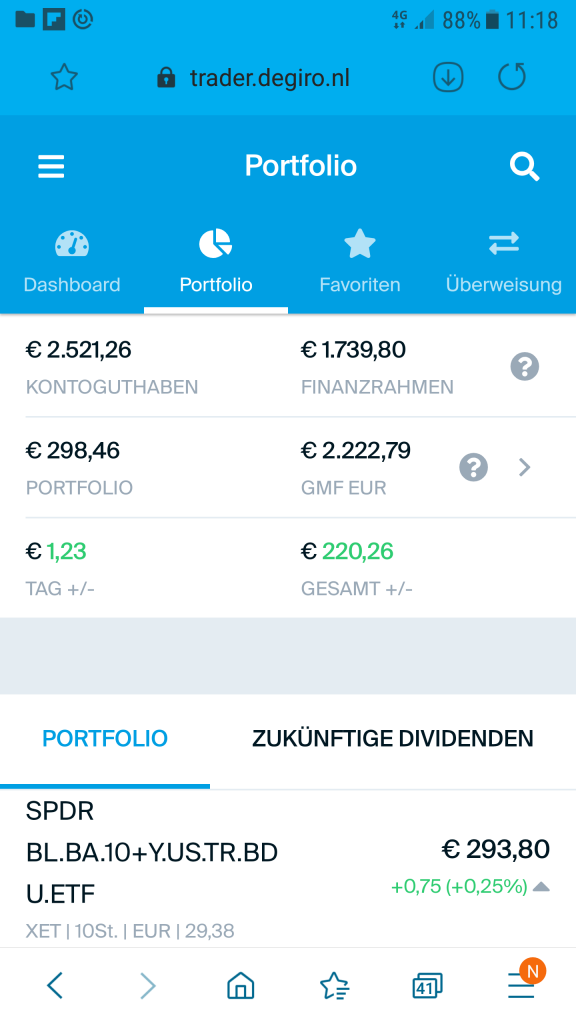

Elle, a nine years old girl, who manages her wealth with our help, has hit (ahead of time) her target for the 2nd year: to earn at least 220 EUR.

In future she has to alter her investing strategy a little bit since on the one hand her broker DeGiro introduces flat-fee trading with American stocks but on the other hand will compensate the negative rates only upto 2500 EUR cash.

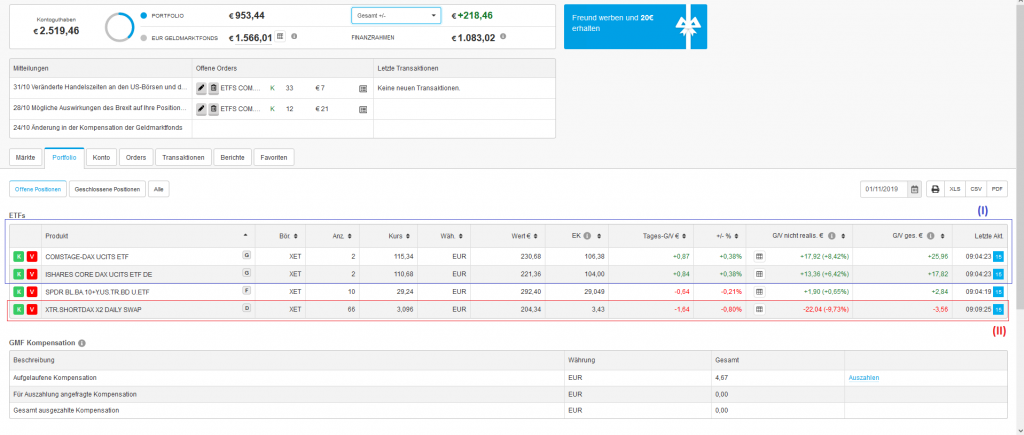

At the beginning of October, as the DAX dipped, we opened two positions in DAX ETFs (I). Then we - as we did before - have locked our profit by means of an inverse-DAX ETF (II).

Unfortunately our fix was a bit premature (but anyway rational since political tension with Brexit and low growth in Euro-Zone still persist).

Unfortunately our fix was a bit premature (but anyway rational since political tension with Brexit and low growth in Euro-Zone still persist).

Additionally we opened a position in a US 10+Y Treasury ETF, making use of both a (short-term?) Euro jump and treasury yield growth. As a result, we made some money and even hit intraday our target for the second year: €220 profit, which corresponds to 6% of the (anticipative) annualized yield.  We closed the positions both in long and short DAX ETFs but unfortunately the treasury ETF fell down a bit, that is why we say that the goal is almost reached.

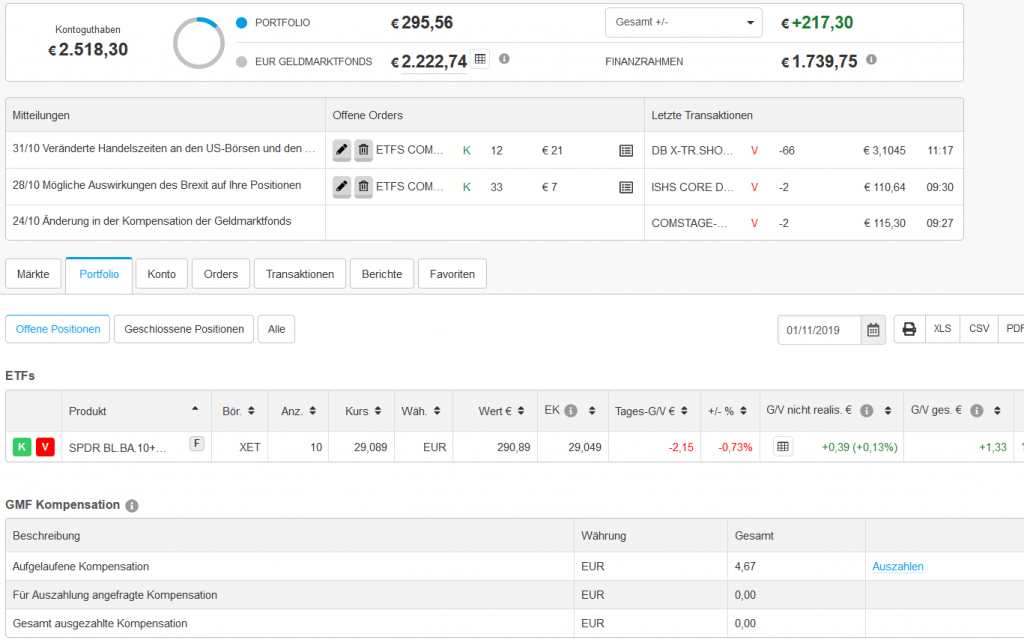

We closed the positions both in long and short DAX ETFs but unfortunately the treasury ETF fell down a bit, that is why we say that the goal is almost reached.

Had we also closed the position in Treasury ETF, we would fix the profit completely. But we did not since in this case Elle's broker DeGiro would charge the negative rate on cash amount, exceeding €2500...

Had we also closed the position in Treasury ETF, we would fix the profit completely. But we did not since in this case Elle's broker DeGiro would charge the negative rate on cash amount, exceeding €2500...

Anyway, we have two months till the end of year and likely will participate in the Christmas rally. Additionally, from March 2020 DeGiro introduces flat fee trading (€2.5/mo) for American stocks. Since Elle's capital has grown, it may be an interesting alternative to the [quasi]-free trading in ETFs. Once we have already done an excellent stockpicking, why not to do it again [and over again :)]?!

FinViz - an advanced stock screener (both for technical and fundamental traders)