During a high-turbulence market regime it often makes sense to fix the profit quickly. However, Elle's broker DeGiro provides fee-free trades with the following ETFs only once per months. Elle's trading capital is relatively small so far (€2165), thus paying €2 trading fee shall be avoided whenever possible. So I taught her to lock the profit in long position by means of the respective inverse ETF!

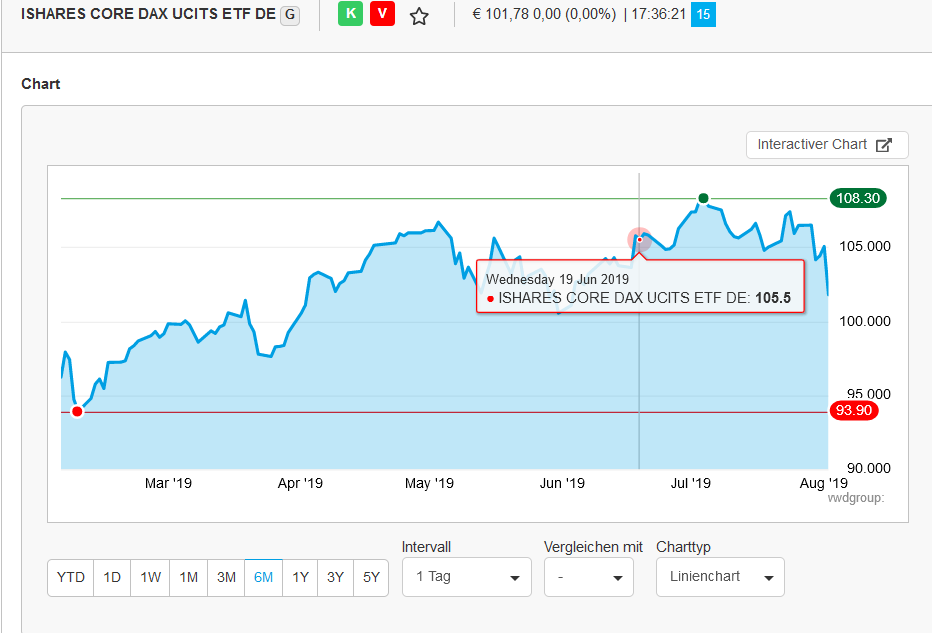

On 19/07/2019 Elle bought 5 entities of ISHS CORE DAX UCITS ETF (EXS1, DE0005933931) at 104,84 EUR (don't be confused by the €105.5 at the screenshot below, €105.5 was the close price on this date).

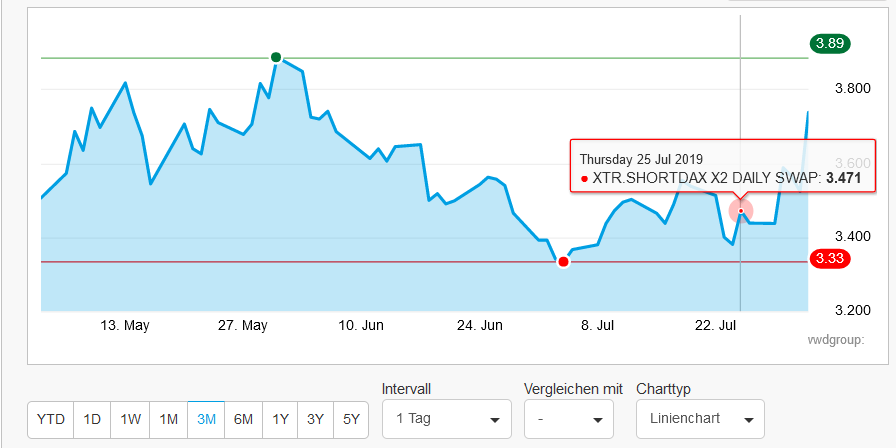

As we expected, the market continued growing but we understood that the growth can be fragile. However, fixing a profit of ca. €15 at price of ca. €2 would be a not so good idea, thus we have instead bought (on 25/07/2019) 75 units of SHORTDAX X2 DAILY SWAP (LU0411075020, DBPD) at 3,352 EUR.

I did not try to elucidate Elle all nuances of the inverse ETFs and told her that she can learn them herself after a couple of years (nowadays Elle is only 8 years old). But I explained her the following principle:

On 25.06.2019 the value of our position in EXS1 was ca. €106*5 = €530. So in order to lock our profit we need to invest ca. €530/2 = €265 in DBPD, which corresponds to 79 units of DBPD (indeed we bought just 75 to avoid overhedging).

Further, as we anticipated, the DAX dropped down. Formally, we should have closed both positions in EXS1 and DBPD to release our (previously fixed) profit. But I suggested Elle not to do it, since I found the DAX level attractive for a long position. And obviously it is better to just keep than close-and-open-again a position. So we sold 75 of DBPD at 3,565 EUR on 01/08/2019, making a 75*(3,565 - 3,352) = €15,975 profit. In relative terms it is 3,565 /3,352 - 1 = 6,35% return on trade or €15,975 / €2165 = 0,74% on portfolio level (this is approximate estimation, since unfortunately DeGiro does not provide the daily history of equity curve).

Unfortunately Trump's tweet pushed the markets to a free fall. However, we were not very upset with this fact, moreover, we even increased our long position in DAX by buying DEKA DAX AUSSCHUETTEND (DE000ETFL060,EL4F): fortunately DeGiro offers several broker-fee free ETFs on DAX.

Note, however, that we are not going to further increase our long DAX position in near future if the market continues falling.

Last (and the least) we have a small long position in copper. We opened it on 30 June 2019, i.e. after the monthly copper futures rollover.

We will double this position if the price reaches (and recoils from) the distinct support level at €20.67

We will double this position if the price reaches (and recoils from) the distinct support level at €20.67

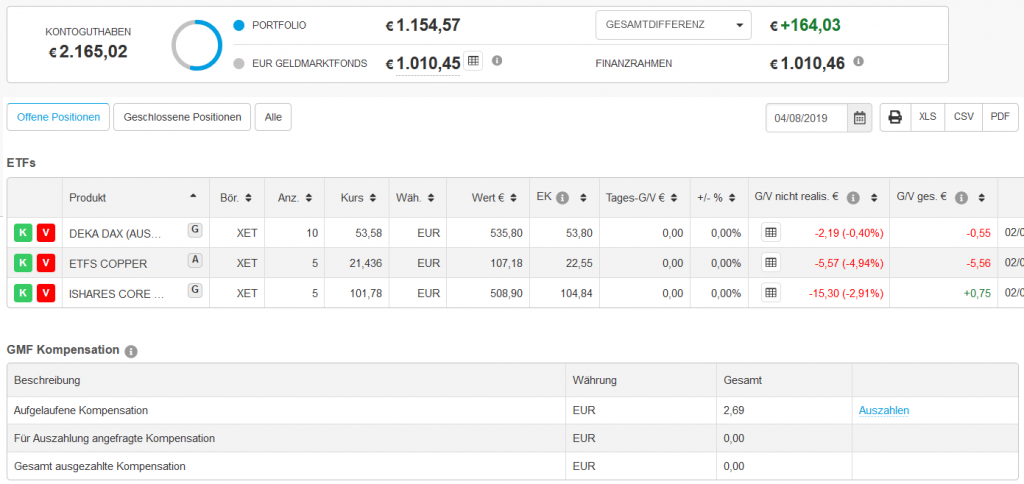

Elle's current depot summary looks as follows:

Note that now DeGiro accumulates the compensation for the negative interest on a special account (GMF) instead of directly transferring it to the cash account.

On the one hand it is good since it alleviates accounting but on the other hand this money stays frozen until paid off to the associated bank account (Girokonto) and then transferred back to depot. The shortcomings of such process (besides a time expenditure) is a challenge in CAGR calculation: as long as there is a partial payoff (Teilauszahlung), the solution of CAGR equation is, in general, not unique.

In order to keep the unicity one shall exclude this partial payoff and back-transfer from bank account to depot from the cashflow table.

By the way, Elle's current CAGR is 10.159%

FinViz - an advanced stock screener (both for technical and fundamental traders)