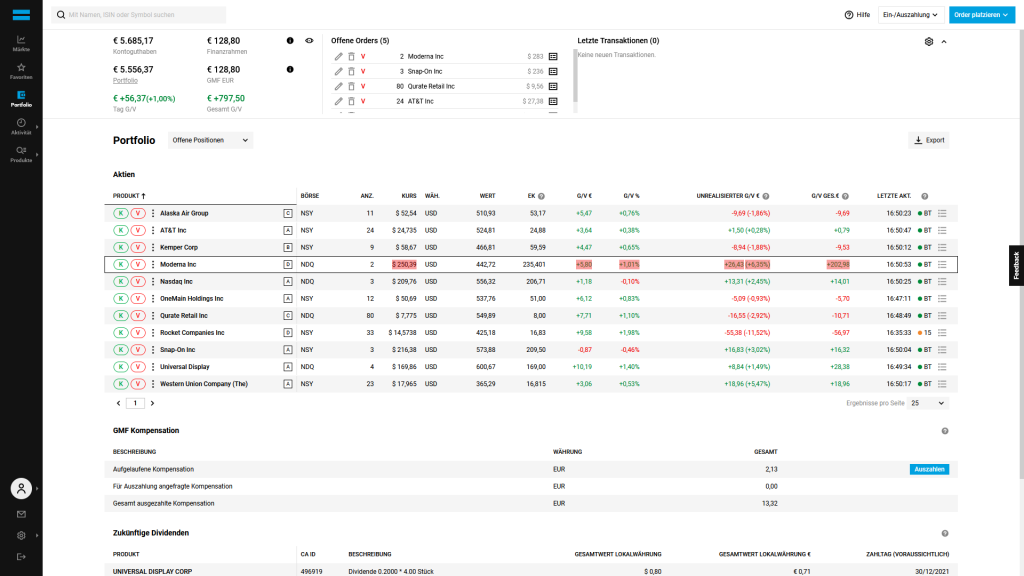

Since we did not report about Elle's progress for more than a year, the readers of letYourMoneyGrow.com might have thought that we have terminated our experiment of growing a 7 (currently 11) years young girl as an investor. Nope, not at all! As a matter of fact we worked hard on creation and test of a deep neural network for the stock (pre)selection. And it did work, our CAGR goal is (over)achieved!

Reminder: Four years ago we have started a long-term social experiment of growing a 7 years old girl as an investor. The original blogpost was written in German because we targeted the German audience (in vain, this nation still lacks the investment culture). Unfortunately, it is impossible to give 100% international recipes. The "national peculiarities" are important: so in Germany it is possible to open a junior depot from the age of 7 and there are some tax advantage for junior accounts. However, it is impossible (not only for juniors) to buy American ETFs due to PRIIPs (probably the most stupid initiative of EU officials). Fortunately, it is still possible to invest in American stocks, which we prefer for the transparency of financial information and availability of historical data; in case European stocks both things are much worse (but still not too bad, so occasionally we buy them as well).

Every month we invest €100 from Elle's Kindergeld (child benefit). Our CAGR (annualized return) target was set to 6% (which roughly corresponds to a long-term historical stock returns). We call our project "18 - 19": as soon as Elle will reach the age of 18, there are shall be 19 thousands Euro.

However, in our quick estimation we calculated vorschüssig (anticipative interest): i.e. as if we had 12*€100=€1200 at the beginning of each year. Let us reproduce this calculation.

| Year | Installment | Total Capital | Annual Gain |

| 1 | 1.200 € | 1.272 € | 72 € |

| 2 | 1.200 € | 2.620 € | 148 € |

| 3 | 1.200 € | 4.050 € | 229 € |

| 4 | 1.200 € | 5.565 € | 315 € |

| 5 | 1.200 € | 7.170 € | 406 € |

| 6 | 1.200 € | 8.873 € | 502 € |

| 7 | 1.200 € | 10.677 € | 604 € |

| 8 | 1.200 € | 12.590 € | 713 € |

| 9 | 1.200 € | 14.617 € | 827 € |

| 10 | 1.200 € | 16.766 € | 949 € |

| 11 | 1.200 € | 19.044 € | 1.078 € |

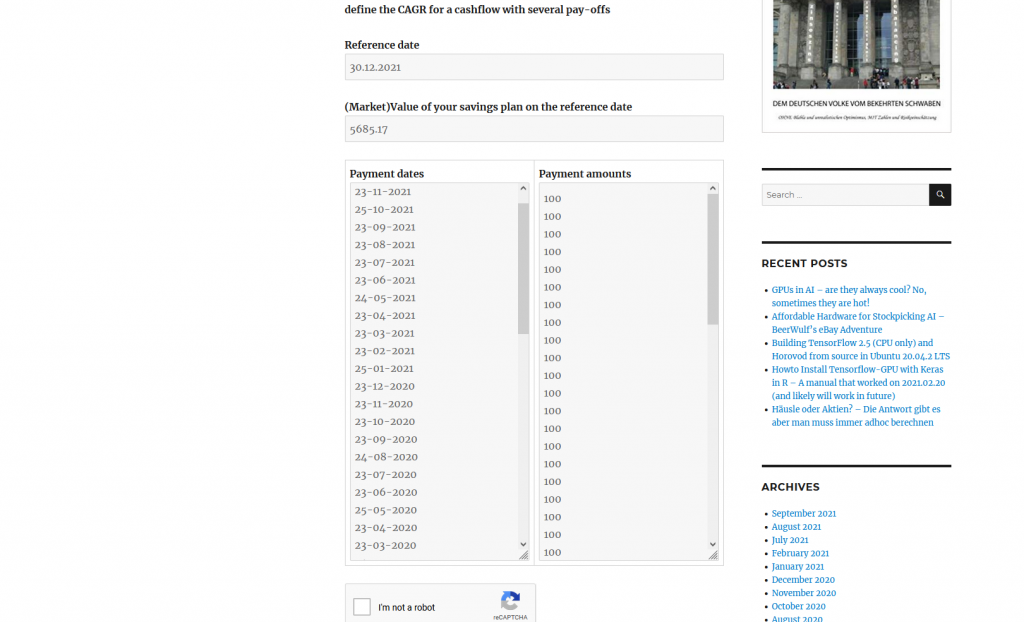

If you calculate the CAGR of this savings plan, you indeed get (about) 6% per annum.

But CAGR is not uniform and if you calculate it for a timespan from the 1th upto the 4th year (where we currently are), you get 9.93% !

And if we accurately calculate everything, we obtain the current CAGR of 7.442%

That's why (in a short term) it is better to take not the CAGR as a milestone but the (absolute) gain. And we see that we indeed overachieved our goal: to the end of the 4th year we expected 72 + 148 + 229 + 315 = 764 and got even 797.50 Euro!

How did we succeed? Well, previously we have reported (here, here and here) about our AI activities.

Now our neural network runs in production. Although we do not (yet) fully trust it but it makes the routine job of screening about 1000 stocks. And as a final step Elle just chooses the most promising. That's why AI + NI: artificial intelligence united (and not contra-posed to) the natural human intelligence!

FinViz - an advanced stock screener (both for technical and fundamental traders)