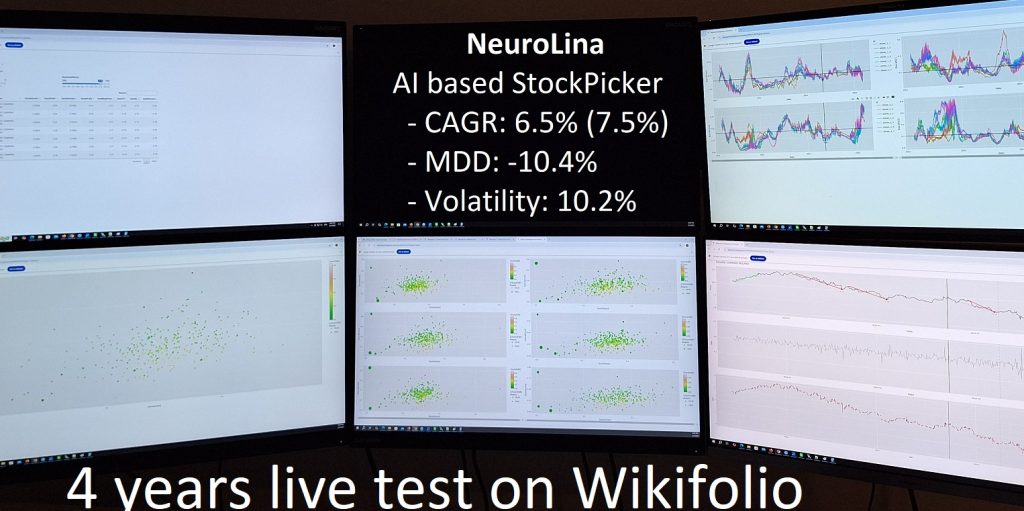

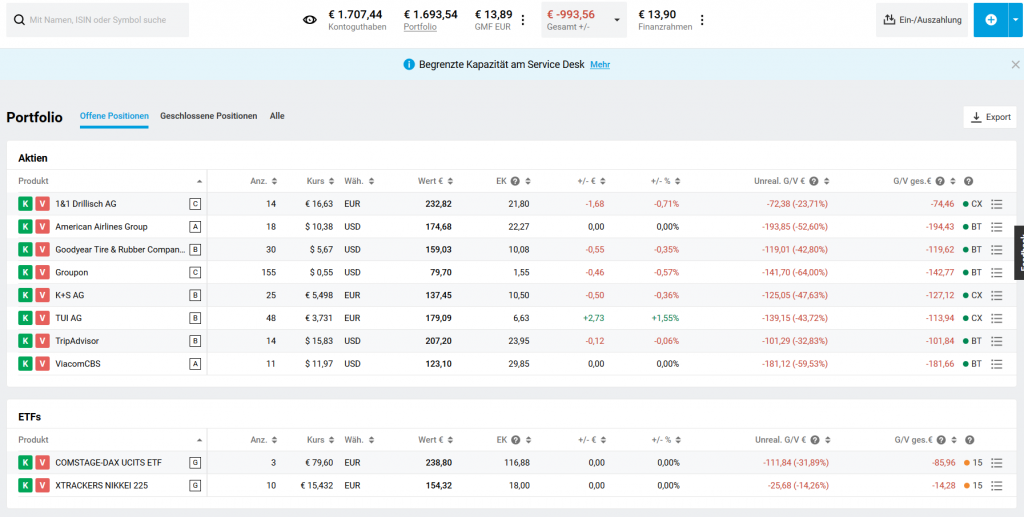

After 4 years of a live test of my AI-based stock picker Neurolina on a 3rd party service I publish (and close) NeuroLina Wikifolio and summarize the performance.

Continue reading "AI Stockpicker NeuroLina – 4 Years of Live Test on Wikifolio"

Category: AmericanStocks

Bye-bye Software AG and BBBY

Today - on 24.04.2023 - Software AG stock jumped +50% due to a takeover offer from private equity firm Silver Lake, whereas Bed Bath & Beyond filed for bankruptcy. Continue reading "Bye-bye Software AG and BBBY"

JuniorDepot29 – (Over)archieving the Financial Plan (thanks to AI and NI)

Since we did not report about Elle's progress for more than a year, the readers of letYourMoneyGrow.com might have thought that we have terminated our experiment of growing a 7 (currently 11) years young girl as an investor. Nope, not at all! As a matter of fact we worked hard on creation and test of a deep neural network for the stock (pre)selection. And it did work, our CAGR goal is (over)achieved!

Continue reading "JuniorDepot29 – (Over)archieving the Financial Plan (thanks to AI and NI)"

Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality

A pig will find the dirt (Russian proverb). The market will find reasons to grow. To fall as well. It is worth documenting (and periodically recalling) what happened on 9/11/2000 (as well as shortly before and after this date).

In the end of October the German market was not in the mood, upset by the 2nd (partial) lockdown. However, after a healthy DAX correction, the greed got started to dominate again. On November the 9th two really(?) good news arrived: first the preliminary victory of Joe Biden, followed by 90% efficiency of Pfizer/BioNtech vaccine.

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

JuniorDepot25 – Profitable Again

Elle's depot turned back to profitability thanks to recent exuberant market growth. We closed most of our positions and await a drop after a pretty groundless euphoria. Continue reading "JuniorDepot25 – Profitable Again"

JuniorDepot24 – A Gradual Recovery

Elle's timing during the Corona-Crisis was premature and lead to a significant drawdown. However, her depot recovers gradually. We accumulate cash, awaiting the 2nd wave of COVID-19. Continue reading "JuniorDepot24 – A Gradual Recovery"

JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

MATtel Stock – Barbie Reaches Puberty and Draws a DoubleF*uck Chart Pattern

Mattel, a company that owns Barbie brand, currently experiences bad times and suffers losses. However, this may be irrelevant for tactical traders, esp. those who rely exclusively on technical analysis. But now they shall be strongly disappointed too: MAT stock has drawn a pattern, which can be named doubleF*ck.

Continue reading "MATtel Stock – Barbie Reaches Puberty and Draws a DoubleF*uck Chart Pattern"

PCA, Autoencoders and the Feasibility of Stockpicking

The idea that the stock picking makes less and less sense since the markets are more and more driven by the macroeconomic factors is quite popular.

Especially right now, as the markets are falling (like on todays FEd decision to increase the rates), this idea may seem to be plausible. However, we show that in the long term the stocks do show enough of individuality. Continue reading "PCA, Autoencoders and the Feasibility of Stockpicking"

Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al.

On November 13, 2018 the shares of EQT Corporation (NYSE:EQT) fell down by 46%. Yet, as Montley Fool reported, it was just a spinoff of the midstream assets into a separate public company, Equitrans Midstream Corp... FinViz and eoddata.com has completely failed to depict this event properly. Yahoo.Finance and AlphaVantage coped with it but only to some extent. We discuss the problems, caused by such events and sketch some ways to mitigate them. Continue reading "Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al."