During a high-turbulence market regime it often makes sense to fix the profit quickly. However, Elle's broker DeGiro provides fee-free trades with the following ETFs only once per months. Elle's trading capital is relatively small so far (€2165), thus paying €2 trading fee shall be avoided whenever possible. So I taught her to lock the profit in long position by means of the respective inverse ETF! Continue reading "JuniorDepot18 – Hedging Profit by a Long-Short Lock-in"

Tag: short

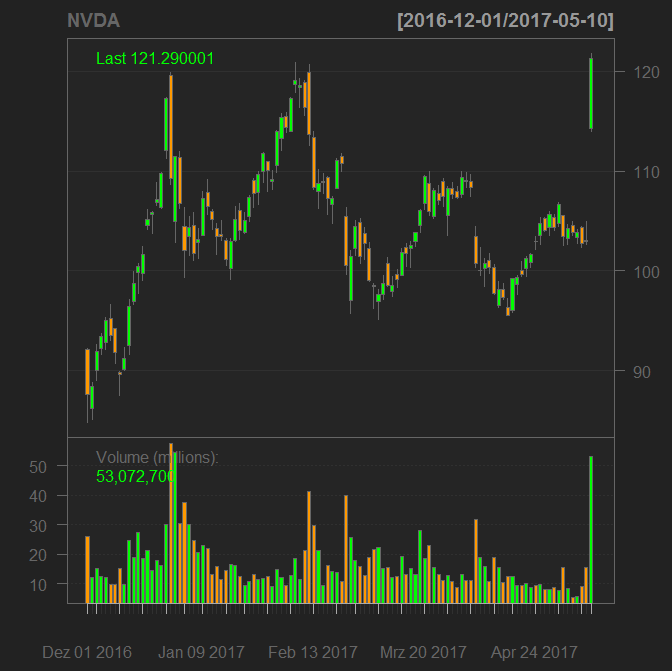

PUT on nVIDIA turned out to be far from perfect trade, but…

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Oil WTI short: why it will likely fall (29.09.2016)

OPEC agrees on oil cut at Algiers meeting ... oil price jumped more than 6% ... a good opportunity to short WTI!

- OPEC members may agree on whatever they want but it is unclear how they will control the agreement and penalize violators.

- As soon as price grows the production of shale oil in USA will be increased.

- The current Brent price is $49.13 and WTI costs $47.69. Respectively, the spread is $1.44, which is pretty narrow (normally it is about $2) so it will likely widen, thus it is better to short WTI, not Brent.

Yes, there we times as the spread was tighter and even negative, but by those times both WTI and Brent tended to fall.

Update 04.10.2016

So far the oil price keeps growing though I was right with shorting WTI, not Brent, since the latter grew more intensively; the spread is now normal, about $2.

Today it was a price dip, so I halved my position with a minimal loss and keep about 1.5% of my trading capital in WTI short.